“Ukraine’s glory has not yet died, nor her freedom,” begins the beleaguered Eastern European country’s national anthem. It goes on to promise that Ukraine’s “enemies will perish, like dew in the morning sun, and we too shall rule, brothers, in our own land.”

These words are being challenged like never before in the 30+ years since Ukraine gained its independence following the collapse of the Soviet Union. I join millions of others around the world in hoping that the Ukrainian people can continue to “rule their own land” following a resolution to this crisis.

Here at U.S. Global Investors, we believe that government policies are a precursor to change, and President Vladimir Putin’s brazen, unprovoked decision to invade a sovereign nation is no exception.

In response, we have sold all of our Russia-listed stocks, leaving only positions in oil producers Lukoil and a very small position in Raspadskaya, a coal producer. U.S. sanctions have so far targeted Russia’s financial sector, not its energy sector, which is still incredibly important to Western Europe.

Our withdrawal came early and was well timed, as Russian stocks had their worst one-day selloff on record last week. The dollar-denominated RTS Index fell around 40% on Thursday alone, and deeper losses are expected with the addition of new sanctions over the weekend.

Meanwhile, the Russian ruble has crashed to an all-time low, making it worth less than $0.01, and ratings agencies are raising the possibility of Russian equities being downgraded to junk status.

You may wonder when we’ll feel comfortable enough to dip our toes in the Russian market again. The simplest and most honest answer is that it’s too early to tell. The situation is highly volatile and changing by the hour.

Putin has never been a friend to the West, but he has obliterated any doubt that he’s a threat to the rule of law and his neighbors’ right to exist. Therefore, it may be decided that we can’t invest in Russia again until the Kremlin is under new management, one way or another. Which is a shame because we’ve always liked Russian stocks for their cheap valuation and attractive dividends.

Having said that, Putin signed a law last year that effectively resets his term limits to zero, allowing him to potentially remain in office until 2036. A lot can happen in 14 years.

Playing The Long Game… With Gold

If we look at how Russia has been positioning its central bank reserves over the past decade, it becomes clear that Putin has been planning this invasion for some time.

In 2010, gold represented only 7.4% of Russia’s official reserves. By the end of the 2010s, this share had grown to 23.4%. Over the same period, the country significantly reduced its holdings of U.S. dollars and debt, and in January 2021, it announced that it held more gold than greenbacks for the first time ever.

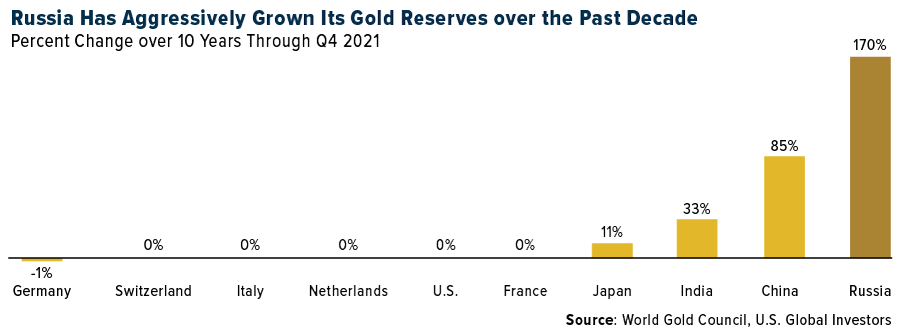

As you can see below, no other major gold holding country has come close to expanding its reserves as aggressively as Russia has.

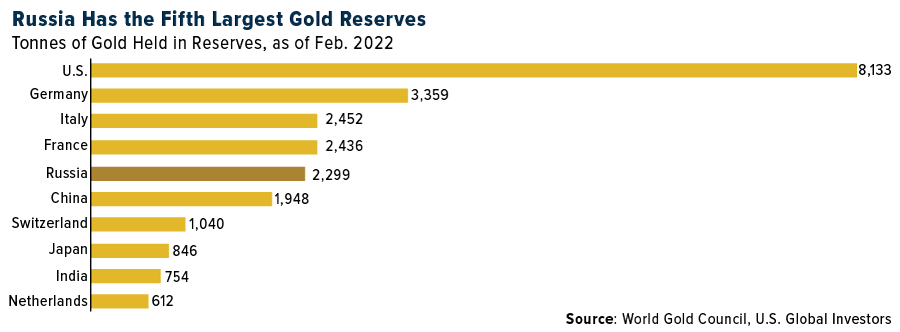

As a result, Russia now has the fifth largest official gold hoard of any central bank, with holdings currently standing at over 2,298 tonnes, according to the World Gold Council (WGC). At today’s prices, that comes out to about $145 billion, or around 10% of Russia’s gross domestic product (GDP).

This should help the country weather the raft of economic sanctions imposed by the U.S. and its allies, as the central bank may be forced to sell its gold to make payments.

Gold Is No One’s Liability

I’m reminded, in fact, of Germany’s use of gold in its preparations for what eventually became World War II. The country ransacked Europe’s central banks to acquire hundreds of millions of dollars of the yellow metal, which helped finance Hitler’s ambitions. (The U.K. famously managed to keep its gold out of the Nazis’ hands by transporting it to Canada in a daring mission known as Operation Fish.)

Some might think this reflects poorly on gold, but remember, the metal is completely apolitical. It’s no one’s liability. It belongs to everyone.

The same goes for Bitcoin. Millions in Bitcoin donations have been sent to Ukraine in support of its armed forces. At the same time, Russia is reportedly using cryptocurrencies, which could include Bitcoin, to bypass certain sanctions.

I believe these are compelling reasons to own gold, Bitcoin and other alternative assets.

For more on gold and Bitcoin, watch my interview with Kitco News by clicking here!

Originally published by U.S. Global Investors on February 28, 2022.

For more news, information, and strategy, visit ETF Trends.

The RTS Index is a capitalization-weighted composite index calculated based on prices of the most liquid Russian stocks of the largest and dynamically developing Russian issuers with economic activities related to the main sectors of the Russian economy presented on the Exchange.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 12/31/2021: Lukoil PJSC.