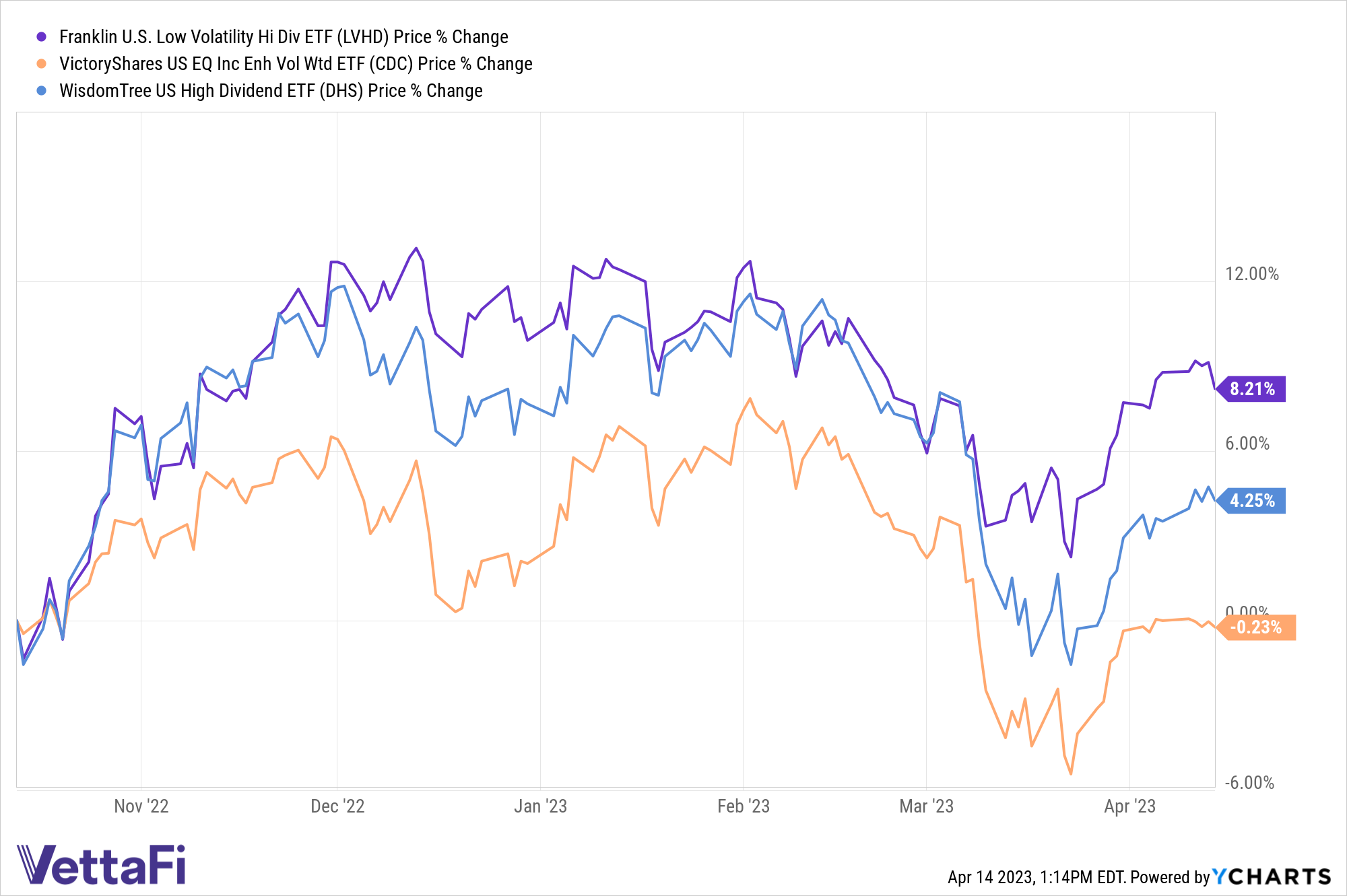

With earnings set to be a big indicator as to whether the U.S. economy has entered a recession or not in the coming weeks, investors may be looking to prepare for an economic contraction. ETFs already have certain tax benefits that make them stand out, and they can also be a great wrapper for low volatility income stocks that can provide equity-like returns with less volatility and lower drawdowns in strategies like the Franklin U.S. Low Volatility High Dividend Index ETF (LVHD).

Definitions of recession vary, but according to at least one, the National Bureau of Economic Research (NBER), the U.S. is not currently in a recession. With GDP expected to dip starting 2023 according to Comerica Bank’s chief economist, for example, due to negative U.S. inventory and trade deficits, and retail sales particularly down in February, the expected recession this year may be getting closer.

See more: “This Low-Vol ETF Is Signaling a Buy Amid Market Volatility”

Earnings season will have a big impact on the debate around recession this year, with the key point being whether weaker profits lead to layoffs, but the picture doesn’t look ideal, already, as analysts expect that profits fell nearly seven percent on an annualized basis according to FactSet.

That puts together a strong case for investing in low-volatility income rather than more vulnerable equities, a focus of a recent piece of research from Franklin Templeton. According to Franklin Templeton’s analysis, bank lending has and is continuing to tighten across multiple sectors — a key indicator that recession is on the way, as earnings growth already slowed last quarter, too.

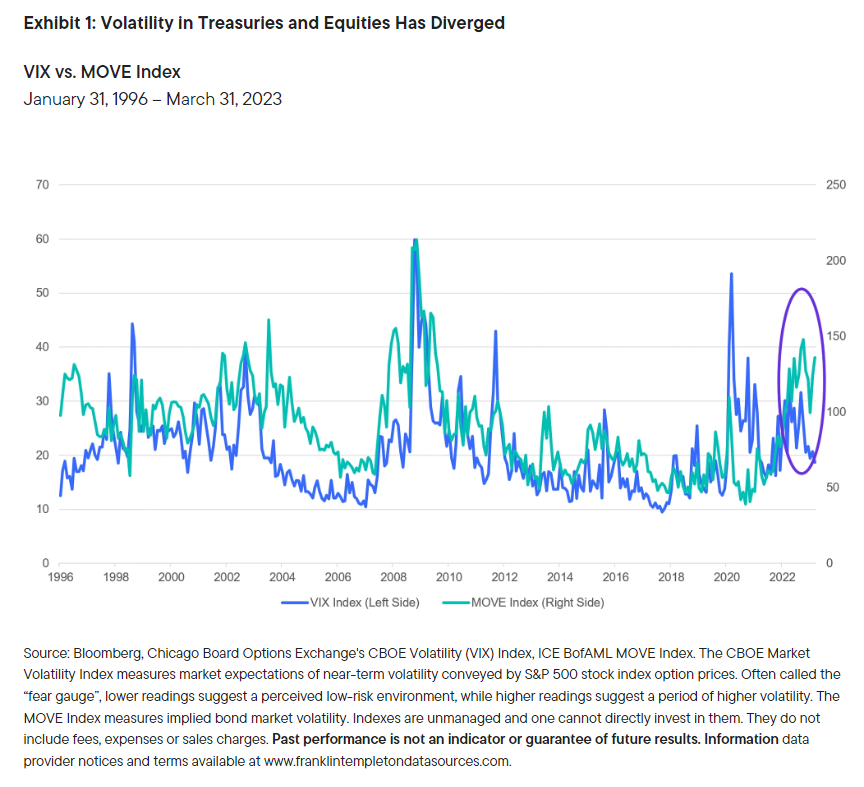

Treasury and equity volatility normally coincide, according to analysts, but have recently diverged — suggesting that one of the two is missing something. While the MOVE index aims to measure implied bond market volatility, the VIX, of course, measures equities volatility — and the former is much higher than the latter. For Franklin Templeton’s analysts, all of this points to low volatility, high-dividend stocks that can perform in downturns.

LVHD tracks the QS Low Volatility High Dividend Index and charges 27 basis points, adding more than $100 million in net inflows over the last month. LVHD picks about 50 to 100 U.S. all-cap stocks and weights them based on factors like profitability, high dividends, and low price and earnings volatility. LVHD has also offered its investors a 3.26 annual dividend yield, as well.

A recession seems more likely than not this year, whether caused by higher interest rates persisting or from slowing earnings, or some other factor. For those who want to avoid a possible volatility upswing when a recession hits, a set of defensive stocks in a low volatility income-focused ETF like LVHD could be worth considering.

For more news, information, and analysis, visit the Volatility Resource Channel.

VettaFi is an independent publisher and takes responsibility for our edit staff, research, and postings. Franklin Templeton is not affiliated with VettaFi and was not involved in drafting this article. The opinions and forecasts expressed are solely those of VettaFi and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.