The Cboe Volatility Index, or VIX, rocketed over 40% in trading Monday to its highest level since last August. The index, which is up 6% in Tuesday trading, is often referred to as the S&P 500’s “fear gauge” because it tends to spike during periods of worry and uncertainty in the market.

“Today’s volatile market reaction with investors fleeing risk in favor of safe haven assets such as U.S. Treasuries exemplifies the uncertainty associated to the viral outbreak,” said Charlie Ripley, a senior investment strategist at Allianz Investment Management, in an email Monday.

Stock indices opened down roughly 3% on Monday from where they finished last week, losing more than 3% of their value within minutes of the opening bell. The losses were generally expected, with Dow futures down more than 800 points earlier in the day following reports that the coronavirus outbreak had deteriorated considerably in China and was starting to more rapidly spread a variety of other areas like Italy, Iran, South Korea and beyond.

Coiled or compressed volatility is often a harbinger of a larger stock decline, and this time is no exception, as stocks have tanked in the last few days.

“The VIX follows some very specific patterns that show compression,” Henrich said last year on CNBC’s “Trading Nation.” “If you look back to, let’s say, the last few years, we’ve seen a large compression pattern from 2016 to 2017.”

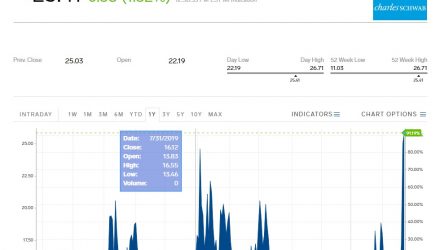

Investors looking to use ETFs to trade the VIX over the short term can look at the iPath Series B S&P 500 VIX Short Term Futures ETN (NYSEArca: VXX) which is up 4% on Tuesday, or the ProShares VIX Short-Term Futures ETF (NYSEArca: VIXY), which also advanced 4%, while the CBOE Volatility Index. Potential investors should keep in mind that VIX-related exchange traded products track VIX futures and not the spot price.

In the event that volatility does start to compress, investing in stocks once again using time-tested ETFs like the SPDR S&P 500 ETF Trust (SPY), the SPDR Dow Jones Industrial Average ETF (DIA), and the Invesco QQQ Trust (QQQ) is one simple way to play the long side.

For more market trends, visit ETF Trends.