By Michael A. Gayed, CFA

- The Vanguard Information Technology ETF is a great way to get exposure to a number of high-quality, high-flying names.

- Some may be concerned about higher valuations, but tech is well within a historical range.

- From a technical perspective, VGT looks ready to continue momentum.

The stock market is filled with individuals who know the price of everything, but the value of nothing. – Philip Fisher

When taking a look at the Vanguard Information Technology ETF (VGT), there is a lot to like at the moment, and I think we’re breaking out to new highs throughout 2020.

As I mentioned in the Lead-Lag report last week, it will obviously come with risk. But the opportunity is there for the taking. Taking a look at the breakdown of the holding from a sector perspective, you have a number of high-margin sectors that are benefiting from the generational shift to technology.

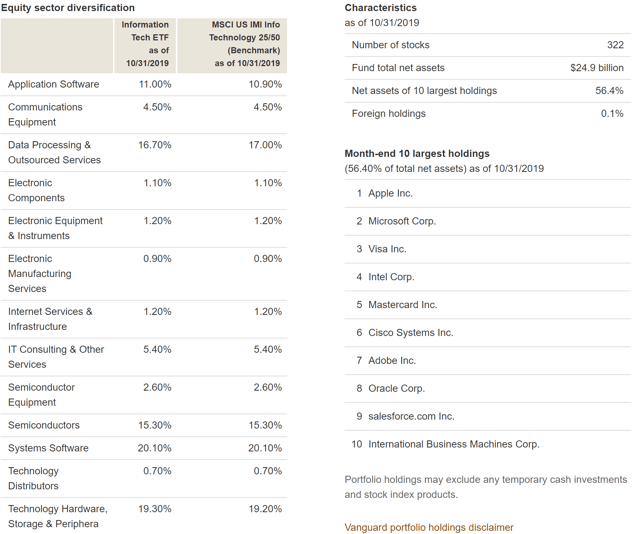

According to the Vanguard website, the top sectors by weight are Systems Software (20.1%), Technology Hardware, Storage & Peripherals (19.3%), Data Processing & Outsourced Services (16.7%), Semiconductors (15.3%) and Application Software (11%).

That is pretty diversified across the technology industry, and definitely deserves attention for your portfolio. A look at the top 10 holdings has a number of names that are attractive, bellweathers of technology with strong economic moats surrounding.

Making up about 56.4% of the portfolio are Apple (AAPL), Microsoft (MSFT), Visa (V), Intel (INTC), Mastercard (MA), Cisco Systems (CSCO), Adobe (ADBE), Oracle (ORCL), Salesforce.com (CRM), and International Business Machines (IBM). Those names alone give you exposure to a number of mature, dividend-paying tech companies alongside some higher-growth, high-beta names, which is the type of portfolio I would recommend at this late-stage bull market run.

High Valuation? Not to worry

Many will cite the concern with valuation at these levels, which is sitting around 25.5 P/E.