By Karen Veraa, CFA

- As rates have risen in 2022, short-term Treasury yields are at the highest levels in more than 15 years.

- With attractive yields available in short-term bond markets, investors looking to step up from idle cash may consider using ETFs to add income and keep pace with inflation.

- For investors looking to have their investments adjust with interest rate hikes, Treasury floating rate notes may be a potential solution.

Short-term yields rising

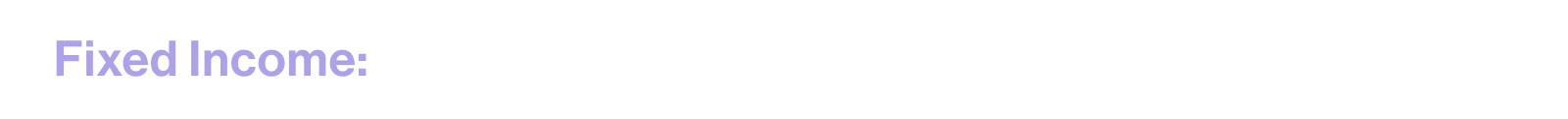

2-year US treasury historical yields

Source: Bloomberg.

Performance data represents past performance and does not guarantee future results.

Chart description: Chart showing 2-year Treasury note yields from 2002 to September 30, 2022.

Central bank rate hikes have roiled financial markets in 2022, but the volatility in interest rates has also created opportunity for investors. As rates have risen in 2022, many short-term bond markets are paying their highest yields in more than 15 years. Investors seeking to generate income from idle funds may find short-term bond ETFs are an attractive option.

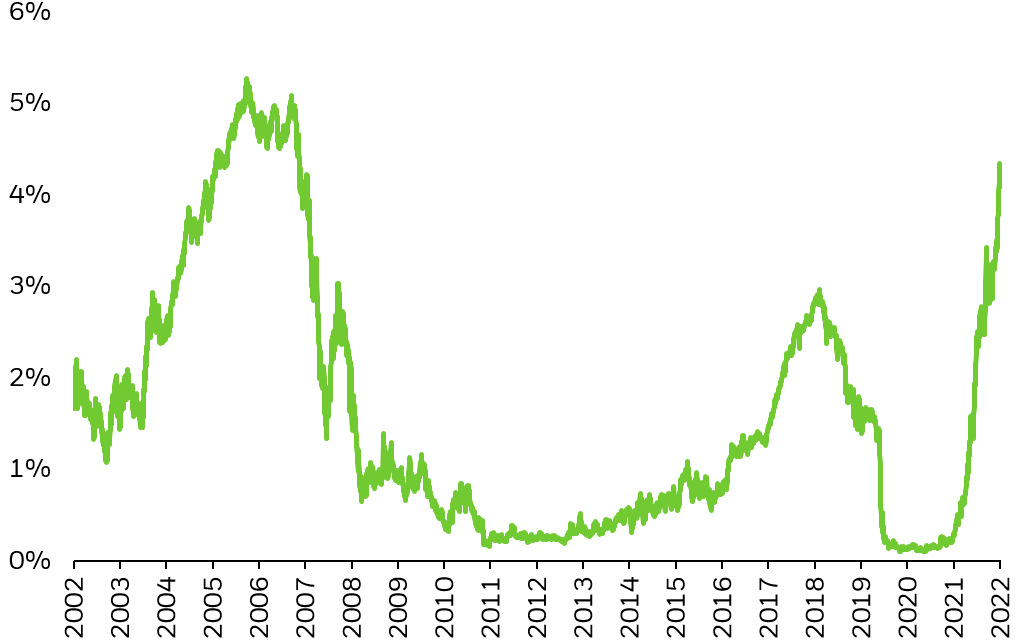

Comparison of yields currently available on different short-term investments

Source: BlackRock, FDIC, iMoneyNet, as of 9/30/2022. Govt Money Market Funds yield is the average 1-day simple net yield for government-only money market funds. Bond ETF yields are yield to maturity.

Performance data represents past performance and does not guarantee future results. Investment return and principal value will fluctuate with market conditions and may be lower or higher when you sell your shares. Current performance may differ from the performance shown. For standardized performance and most recent month end performance, click on the fund’s ticker symbol; SGOV, SHV, TFLO, FLOT.

Chart description: Bar chart showing a comparison of yields currently available on various short-term products

However, it’s important to note there are material differences between Savings accounts, Money Market Funds, CDs and ETFs, including investment objectives, risks, fees, and expenses:

- CDs are fixed income investments that generally pay a set rate of interest over a fixed time period until maturity, whereupon the original principal is typically returned plus any interest earned. Early withdrawal from CDs may result in early withdrawal fees.

- Most savings accounts pay compound interest, meaning earnings are added to the balance to create a larger base on which future interest is paid. Most savings accounts allow you to add or withdraw money at any time without incurring a fee. Both Savings accounts and CDs principal investments are insured by the FDIC up to applicable FDIC limits, while ETFs are not FDIC insured and may lose value.

- Money Market funds typically seek to maintain a net asset value of $1.00 per share, but there is no guarantee they will do so and are not FDIC insured.

- Most ETFs seek to track an index, before fees and expenses. ETFs trade on exchanges intraday at market price, which may be greater or less than net asset value. Transactions in shares of ETFs may result in brokerage commissions and may generate tax consequences. There can be no assurance that an active trading market for shares of an ETF will develop or be maintained. Short duration bond ETFs typically carry a higher degree of risk than the other cash alternatives and should not always be used as a substitute.

PUTTING CASH TO WORK

For many, it helps to think of your cash in layers, and segment it based on how soon you will need to use it. For daily cash needs to pay for living expenses like gas and groceries, bank accounts are the most flexible, and are also insured, up to $250,000 per account, by the Federal Deposit Insurance Corp.

However — for any additional cash that will go unused immediately, individuals have options beyond bank accounts, including CDs, money market funds, U.S. Treasury bills and short-term bond ETFs.

As noted above, investors may be able to invest in short-term bond ETFs to potentially earn more income with savings they don’t need in the near future. Bond ETFs provide efficient access to short-term bonds including US Treasuries, corporates or municipal bonds.

IN A RISING RATE ENVIRONMENT, FLOAT WITH THE FED

For investors looking to have their investments adjust with interest rate hikes, Treasury floating rate notes may be a potential solution.

Treasury floating rate notes are U.S. government bonds with coupons that reset weekly using 3-month (13 week) Treasury bill (T-bill) rates. The Treasury department began issuing these bonds in January 2014 and they are backed by the full faith and credit of the U.S. government. Coupons, or the annual interest rate, on Treasury floating rate notes (FRNs) are adjusted weekly based on the following formula:

Coupon = 13-week T-bill high auction rate + fixed spread

Compared to government money market fund yields, Treasury FRNs can help investors keep up with the Fed’s rate hikes since the bonds’ coupons float with short-term yields. Unlike other “fixed-rate” bonds, Treasury FRNs have minimal price sensitivity to interest rate moves, making them a potentially less volatile investment option. iShares Treasury Floating Rate Note (TFLO) allows investors to access these bonds.

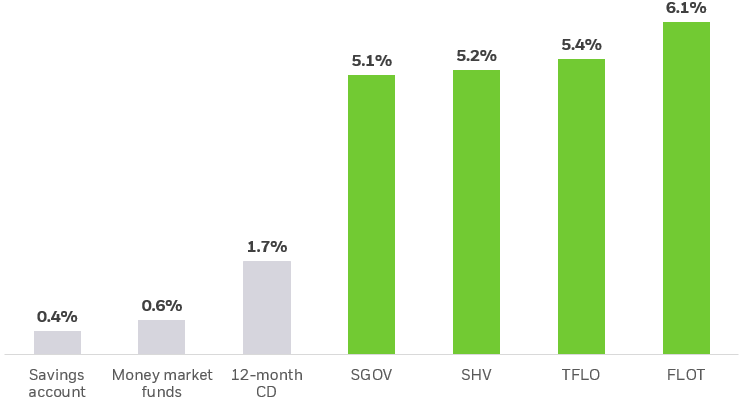

Yield comparison of iShares Treasury Floating Rate Bond ETF (TFLO) and the average government money market fund

Source: BlackRock and iMoney Net. TFLO yield represented by the fund’s yield to maturity and government money market fund represented by the average government only money market fund 1-day net yield as provided by iMoneyNet.

Performance data represents past performance and does not guarantee future results. Investment return and principal value will fluctuate with market conditions and may be lower or higher when you sell your shares. Current performance may differ from the performance shown. For standardized performance, click here.

Chart description: Chart showing how yields on the iShares Treasury Floating Rate Note ETF track the fed funds rate more closely than average government money market funds.

CONCLUSION

Investors can also consider these additional short-term bond ETFs:

- The iShares 0-3 Month Treasury Bond ETF (SGOV) invests in Treasury bonds with less than or equal to 3 months remaining till maturity.

- The iShares Short Treasury Bond ETF (SHV) invests in Treasury bonds with less than 12 months remaining to maturity.

- The iShares Floating Rate Bond ETF (FLOT) holds investment grade corporate bonds whose coupons reset with short-term interest rates. They offer the potential for additional yield over government bonds but do have credit risk.

When putting cash to work, investors should balance their needs for preservation of capital, income and liquidity. With attractive yields available in short-term bond markets, investors may consider using ETFs to add income and keep pace with inflation.

This article originally published on iShares.com on Oct 26, 2022

For more news, information, and analysis, visit the US Treasury and TIPS Fixed Income Channel.