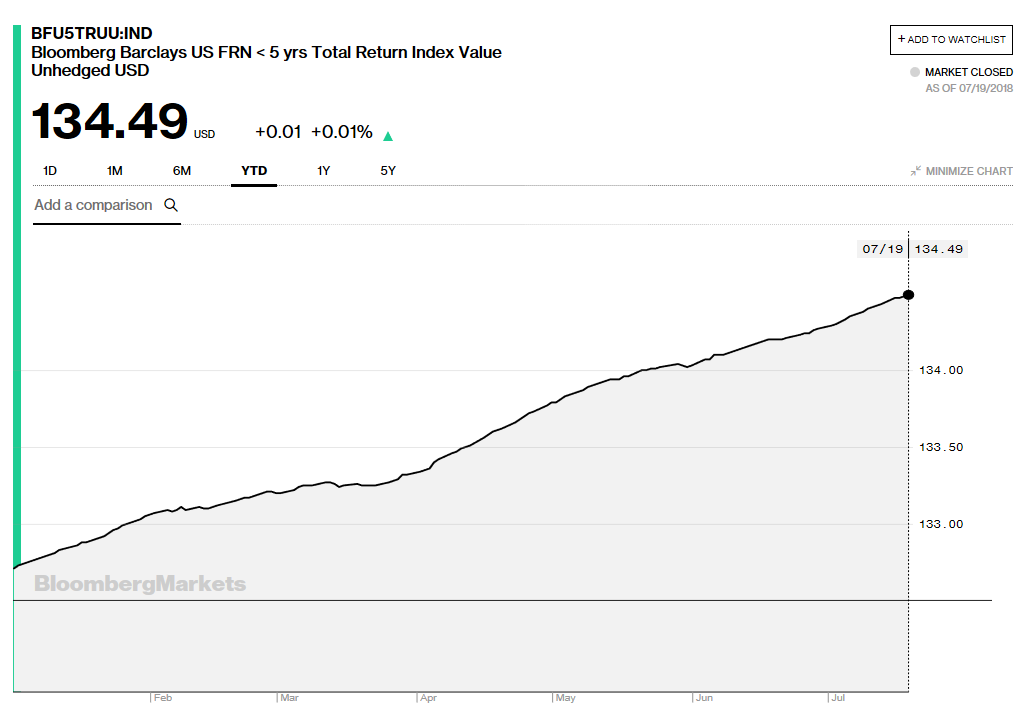

One such ETF is the iShares Floating Rate Bond ETF (BATS: FLOT) that tracks the investment results of the Bloomberg Barclays US Floating Rate Note < 5 Years Index. FLOT focuses on investment-grade floating rate notes that track the underlying index, which has been on an upward trajectory year-to-date.

![]()

Based on performance provided by Yahoo! Finance, FLOT has generated trailing returns of 1.18% year-to-date, 1.90% the past year and 1.44% the past three years. Versus similar benchmarks in its category, FLOT is outperforming its peers by 10.28% year-to-date and 68.14% the past year.

Speaking about similar funds like BlackRock Floating Rate Income Strategies Fund (NYSE: FRA) and Eaton Vance Floating Rate Income Fund (NYSE: EFT), BNK Invest chief investment strategist Brett Owens was quick to point out the benefits of floating rate ETFs.

“These funds barely blink when stocks plummet, and they even hold steady when rates plummet,” said Owens. “Their secret? They buy corporate bonds. These issues have higher yields and more flexibility than, say, U.S Treasuries. As rates move higher, these money managers aren’t left with has-been pieces of paper.”

For more floating rate ETF stories, visit our Fixed Income Channel.