With over 2,000 exchange-traded funds (ETFs) in the United States alone in a bevy of assets, sectors and strategies, the industry is ready to continue capitalizing on its exponential growth seen within the past decade.

Over the course of its expansion, hot-button issues have arrived and in the latest episode of Bloomberg’s podcast “Trillions,” a group of expert ETF pundits came together to divulge their thoughts and debate on 20 topics swirling within the industry.

![]()

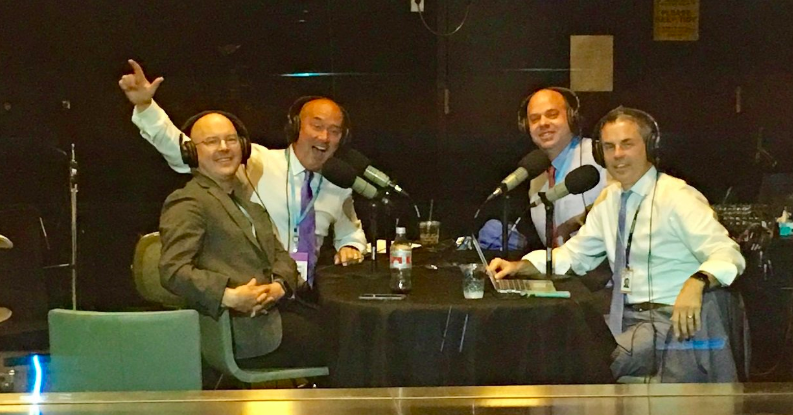

Joining “Trillions” hosts Joel Weber and Eric Balchunas were Dave Nadig, managing director of ETF.com; Tom Lydon, ETF Trends publisher; and Todd Rosenbluth, director of ETF and mutual fund research at CFRA. Topics included in this roundtable discussion were industry trends, expense ratios, social responsibility investing, and innovation.

Below is a smidgen of topics discussed on the podcast, but readers can derive the full benefits of hearing these industry experts by listening to the full podcast by clicking here or on the image below.

1. Expense Ratios: Is Too Much Attention Paid to Them?

An expense ratio, the cost charged to investors in order to manage an exchange-traded fund, may cause investors to screen ETFs solely on which provide the best return at the cheapest price. However, investors relying strictly on using expense ratios as a screener, can be foregoing opportunities that can be had if they looked at other fund characteristics.

“Most definitely (too much attention is paid to the expense ratio),” said Rosenbluth. “You’ve seen a race to the bottom, but there are products that compete with one another where the exposure is quite different from one another.”

“It always matters because fees are important,” said Nadig. “But, I think what Todd was trying to say, but stumbled over his own tongue, was that exposure matters way more than fees and that’s the number one thing that determines your performance.”

“Price is important, but major market indicators, if you’re paying four basis points that’s great,” said Lydon. “But as we see, thematic, factor, multi-factor–you’re going to pay a little bit more for it, but compare that to mutual fund expense ratios, it’s crazy.”

2. How Will a Bear Market Affect ETFs?

With the rise of ETFs following the recovery after the financial crisis and now into the extended bull run, the pundits addressed how they would perform when a market downturn does take place.

“It’s going to be great for ETFs because it’s going to flush out a lot of overpriced, underperforming, low-active, share-active managers,” said Nadig.

“We haven’t talked about this before, but a lot of money is going to go into mutual funds, money market funds, short-term fixed-income,” said Lydon. “The industry’s going to be hurt.”

“I think people don’t want to pay much when they’re losing money so the less that they can pay through ETFs, fixed-income and equity products I think are going to garner more interest,” said Rosenbluth.

3. How Much Responsibility is Given to ETFs for the Current Bull Market?

With the major indexes like the S&P 500 reaching historic levels, a lot of the current bull market can be attributed to growth in the technology sector, but are ETFs culpable as well?

“I would say ETFs are a symptom of that; not a cause,” said Nadig.

“The ETF is riding in the back seat of the car; not driving,” said Rosenbluth.

“They’ve just been along for the ride,” said Lydon.

4. Which ETF Provider is Most Likely to Crack the Top 5 that Isn’t there Now?

Cream rises to the top and with the number of ETFs rapidly expanding, a saturated market means that innovation can be born and ETF providers who weren’t in the forefront of the industry before can do so in the future.