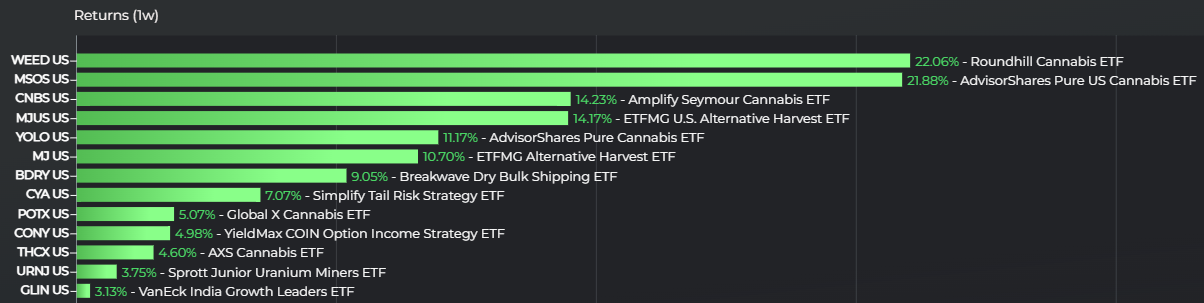

This week, cannabis ETFs took the top performing ETF positions, according to Logicly. Eight of the top twelve strategies, including the top three, all focus on cannabis. While cannabis strategies have not necessarily performed as well as some may have hoped since they arrived on the scene, they still present an intriguing opportunity for some investors.

Why invest in cannabis? As legal marijuana use becomes more and more widespread, consumer interest has followed. In Massachusetts, for example, the industry has produced $5 billion in marijuana sales since adult-use marijuana became legal five years ago. That suggests a significant market for marijuana sales may exist in other states where the substance has not yet become legal.

Specifically, the big spike for marijuana ETFs over the last week owes to its official reclassification as a “Schedule 3” drug and the passage of the Safe Banking Act. The reclassification would take cannabis from the “most addictive” Schedule 1 tier to the low-to-moderate risk of dependence Schedule 3 category. The Safe Banking Act, meanwhile, looks set to streamline the cannabis industry’s interaction with credit card companies.

Eyeing the Cannabis ETFs

The Roundhill Cannabis ETF (WEED) led the way for the week, returning 22.1% in that time. The AdvisorShares Pure U.S. Cannabis ETF (MSOS) returned 21.9%, a close second. The Amplify Seymour Cannabis ETF (CNBS) and ETFMG U.S. Alternative ETF (MJUS) both returned 14.2%. AdvisorShares and ETFMG both saw two different cannabis strategies appear in the top twelve.

Cannabis was not the only area to appear in the top twelve strategies, however. Uranium and India-focused strategies both also appeared in the top performing ETFs ranking along with cannabis ETFs. The Sprott Junior Uranium Miners ETF (URNJ) and the VanEck India Growth Leaders ETF (GLIN) returned 3.9% and the 3.1% respectively.

Taken together, investors may want to keep an eye on the status of cannabis ETFs moving forward. While they have largely disappointed so far since launching, the new regulatory status for the industry could help significantly.

Cannabis ETFs lead the top performing ETFs of the last week.

For more news, information, and analysis, visit VettaFi | ETF Trends.

Visualizations and data provided by LOGICLY, which is a wholly owned subsidiary of VettaFi.