Investors can breathe a sigh of relief now that October is coming to a close–a forgettable one for U.S. equities. Needless to say, October hasn’t been kind to U.S. stocks as the technology sector, in particular, has been getting trounced with the Nasdaq Composite falling by 9.2% in October, making it its second largest decline since it fell 10.8% back in November 2008.

Nonetheless, capital allocations into exchange-traded funds (ETFs) have been a constant and ETF Trends Publisher Tom Lydon joined Yahoo Finance Live on Wednesday to discuss opportunities that are abound in ETFs even in today’s volatile markets.

Top-Performing ETFs Surprise Investors

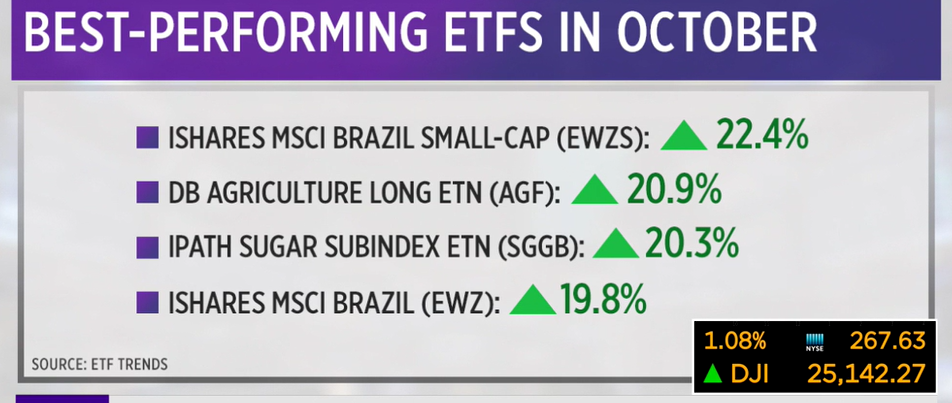

With sectors like technology getting roiled by October’s downpour of volatility, tech-centric ETFs like the Vanguard Information Technology ETF (NYSEArca: VGT) and Technology Select Sector SPDR ETF (NYSEArca: XLK) were obviously hit hard. However, on the other end of the spectrum, ETFs that have fallen on hard times in 2018 experienced a twist of fate in October, such as Brazil ETFs.

“The surprising thing is some of the unloved ETFs actually did really well,” said Lydon.

The election of the polarizing Jair Bolsonaro was the message Brazilian voters communicated to the world that anti-establishment was in and traditional politics was out. Of course, Bolsonario’s biggest task is to help extract the country from its current economic doldrums, but his election is perceived by market experts as one that leans toward the benefit of the country’s capital markets.

This bodes well for Brazil-focused ETFs like the iShares MSCI Brazil Capped ETF (NYSEArca: EWZ) and the iShares MSCI Brazil Small-Cap ETF (NasdaqGM: EWZS). Additionally, for investors looking to obtain emerging markets exposure, Brazil isn’t a bad place to start.

“Emerging markets have really been killed,” said Lydon. “Brazil is really quite an anomaly. Most emerging markets stocks and ETFs have been down for the month October. The key thing is if you’re looking for value, a lot of the emerging markets stocks and ETFs that wrap around them are in the single-digit PEs (price-to-earnings ratios)–that doesn’t happen that often.”

Skip to 26:00 to watch Lydon on Yahoo Finance:

In essence, emerging markets represent a value proposition for those investors who are willing to accept the risk in lieu of the returns in the long-term horizon.