By Ed D’Agostino, Publisher & COO

Apple CEO Tim Cook has a China problem.

He’s not the only one…

Apple makes around 90% of iPhones in China. From a supply chain perspective, this is better than where Apple stood a few years ago when it made all its iPhones there. Then COVID hit along with China’s extended lockdowns and the harsh realization that the country was, at best, an unreliable supply chain partner.

Since then, Apple has moved some production to India, and it’s pulling suppliers like Taiwanese electronics manufacturer Foxconn there with it. It plans to make around a quarter of all iPhones in India within the next two to three years.

I’ve written here before about the push to decouple from China and reshore/friendshore production by US companies. But China is taking similar steps to decouple from the US.

Just look at its iPhone policy. An increasing number of Chinese state and state-affiliated agencies are barring workers from bringing iPhones and other foreign tech into their offices.

Is that really any different from US agencies barring TikTok on government phones?

Yes, I would argue it is. We’re talking about a Communist country. China’s government has an entirely different relationship with its citizens, with unspoken but very real rules they need to discern to stay out of the crosshairs.

One example is China’s social credit system, which aims to, among other nebulous goals, promote “state-sanctioned moral values.” Does owning an iPhone for personal use influence your standing with the CCP? I cannot say for sure, but if it doesn’t want you on an iPhone at work, it’s not hard to read between the lines.

It just so happens that iPhone sales in China dropped 24% in the first six weeks of the year compared to the same period in 2023. Apple’s share of China’s cell phone market has dropped to 16%, putting it in fourth place, well behind its main Chinese competitor Huawei.

You know my stance on investing directly in China. With its prolific surveillance systems and a government that can change the rules around foreign investment on a dime, there are better risk/reward opportunities. This is something to consider before you buy individual stocks, but also many of the popular emerging markets ETFs, which are heavily weighted toward China.

Check for “Hidden” China Exposure

The bigger issue is that decoupling is a process, not an event. And I don’t anticipate a total split.

Look at a company like Walmart, where an estimated 70%–80% of the products on its shelves come from China. In the US, the push to decouple centers around high-value items, like pharmaceuticals, semiconductors, and other high-tech components. As long as China makes cheap goods, Walmart will buy them. (Walmart China, on the other hand, gets to “locally source” over 95% of its merchandise.)

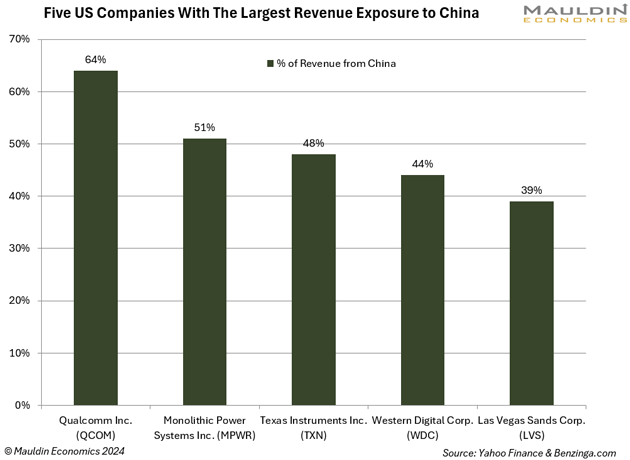

At this stage, I’m far more concerned about companies that rely on China for revenue. Here’s a chart showing the five US companies with the most revenue exposure to China. Tech company Qualcomm Inc. (QCOM) tops the list at 64%.

China has a deteriorating economy and a multiyear real estate crisis that poses an existential threat to its middle class. Against this backdrop, the CPP would do anything to prop up Chinese companies, including targeting unwelcome foreign competitors through its extensive state apparatus.

The CCP is implementing more aggressive laws and policies that favor Chinese companies, especially its state-owned companies. Its new foreign relations and espionage laws, which went into effect last year, open the door to more protectionist meddling. As Michael House, a partner at Perkins Coie gently put it, “The current environment lends itself to more occasions where a regulator or someone in the government in China may choose to take action that is non-transparent.”

The reality is the CCP can do whatever it wants. Just ask the folks at Bain & Co. and other US consultancies that China raided last year.

I am not making a call on any specific company here, but exposure to China is one factor to consider before you invest. Apple’s heavy reliance on China appears to be dragging it down. Who’s next?

That might be a question for my friend Louis Gave—few (if any) know more about investing in and around China than he does. Louis is speaking at the 20th Annual Strategic Investment Conference, which begins April 22. We’ll hear from 40+ speakers including Dr. Ed Yardeni, Ben Hunt, and Neil Howe over the five-day virtual conference. Click here for more on how to participate.

Thanks for reading.

Ed D’Agostino

Publisher & COO