Most ETFs are created as passively managed funds, essentially meaning that they are designed to track an underlying benchmark, such as the S&P 500 Index, as closely as possible.

This ETF strategy is useful for a lot of investors because they are aware of the fund holdings and often have lower fees associated with the funds, as the assets are typically fixed.

In contrast to passive ETFs, the key concept behind an actively managed ETF is that the fund design enables a portfolio manager to alter the investments within the fund as desired. Thus, active fund managers are not responsible for a certain set rules for tracking an index like passively managed ETF managers.

Instead of trying to match the target index, an active fund manager attempts to beat a benchmark using research and trading strategies. Both traditional actively managed ETFs and passively managed ETFs report their positions daily and are priced throughout the day, in contrast to a mutual fund, where this level of reporting is not required.

For investors looking for actively managed ETFs, there are a number of options to choose from.

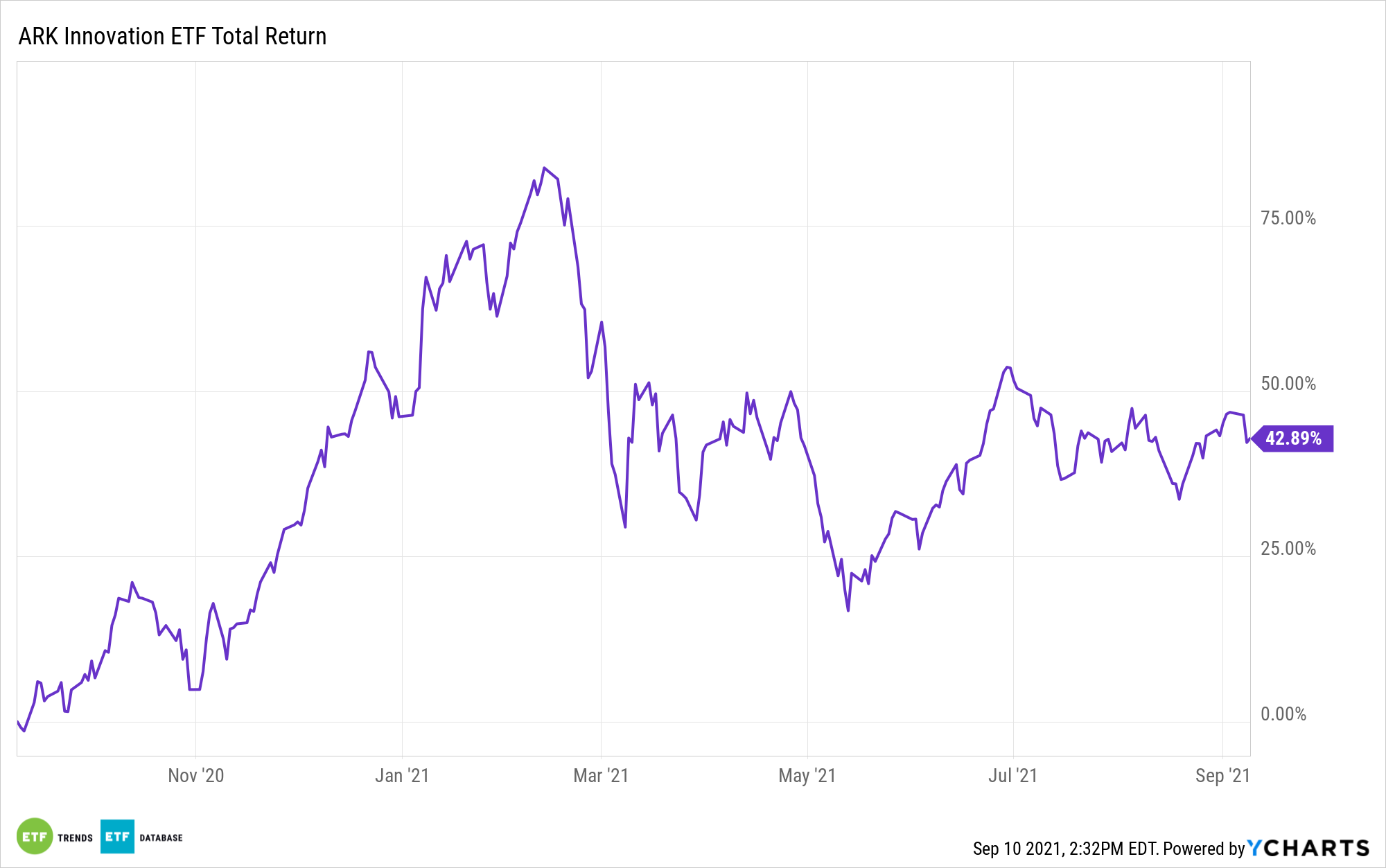

The ARK Innovation ETF (ARKK) is one of the most popular active ETFs, and for good reason. ARKK has a five year track record that approaches a 500% return and holds some of the most popular, fresh, and progressive stocks, such as Tesla and Coinbase.

ARKK is the flagship actively-managed fund from the team at ARKInvest. The advisory firm, led by Catherine Wood, has an impressive track record doing what most stock pickers fail to do: beating the market.

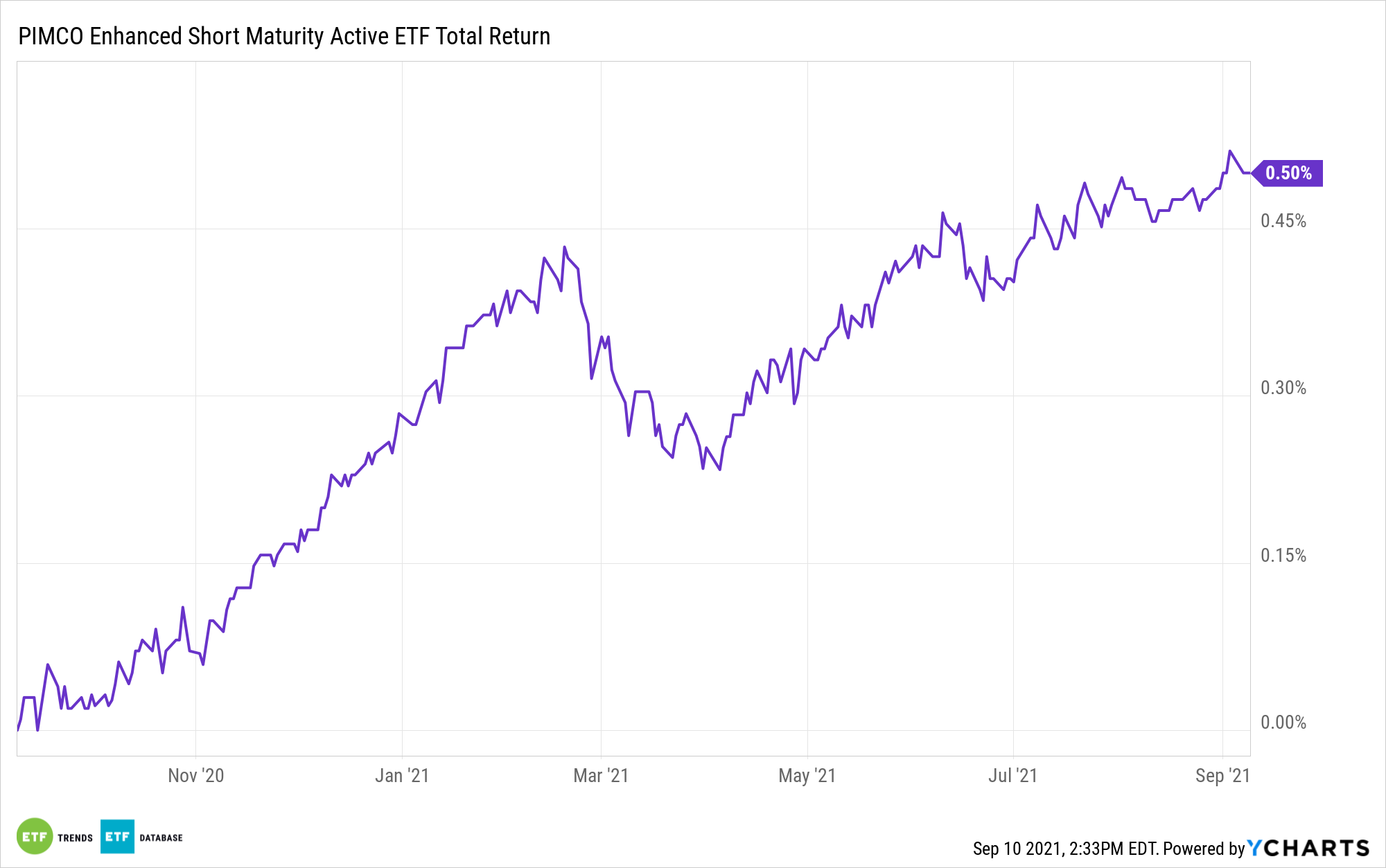

Bond investors looking for an active ETF can consider the PIMCO Enhanced Short Maturity Active ETF (MINT).

MINT offers exposure to the ultrashort end of the maturity curve, focusing on corporate debt that matures within one year. This popular ETF is extremely light on both interest rate risk and credit risk, and as such will generally deliver a very low expected return. MINT can be a great safe haven to park assets in volatile markets, and could outperform others in the category, but it has by far the highest expense ratio of the money market funds.

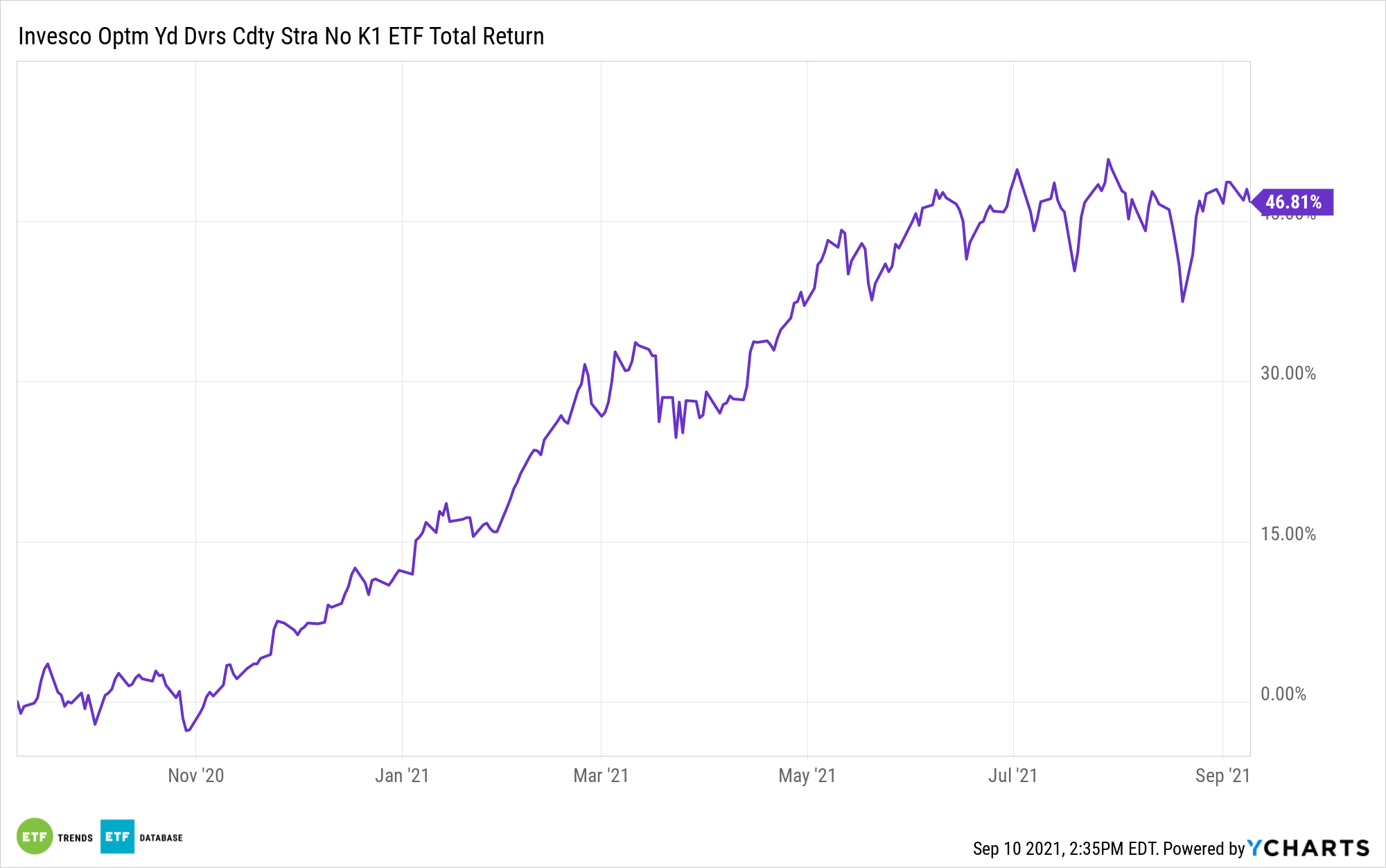

Finally, commodity ETF investors can explore the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC).

The Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC), as the name implies, offers exposure to commodity futures without the tax hassle of a K-1, which some investors avoid. The fund is actively managed and tries to avoid “negative roll yield,” a well-known problem of passive commodity funds that can substantially erode returns over time. There are several similar strategies on the market, including some that charge a lower fee, but PDBC has by far the most assets and trading volume.

This is just a small sample of the more than 500 top ETFs available today that make it possible for fund investors to gain the diversification and rate of return desired, based on their risk tolerance and asset class preferences.

For more market trends, visit ETF Trends.