![]()

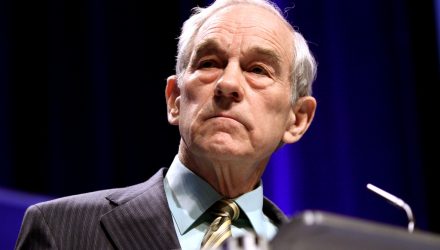

“The Congress spending and the Federal Reserve manipulation of monetary policy and interest rates — debt is too big, the current account is in bad shape, foreign debt is bad and it’s not going to change,” said Paul.

The Congressional Budget Office estimates that by 2019, federal deficits will average $1.2 trillion a year from 2019 to 2028. In addition, its 2018 deficit estimates increased by $242 billion over original forecasts in June 2017.

Related: Pimco Says Recession Possible in Next Three to Five Years

According to Paul, exacerbating the economic situation in the U.S. is the Federal Reserve’s hawkishness and propensity to increase interest rates–in addition to the two interest rate hikes the last two quarters, more spikes are expected through 2018. In addition to interest rate hikes, the Fed is also unloading assets from its balance sheet, expanding to $4.5 trillion since its quantitative-easing program after the financial crisis in 2007-08.

“The government will keep spending, and the Fed will keep inflating, and that distorts things,” said Paul. “When you get into a situation like this, the debt has to be eliminated. You have to liquidate the debt and the malinvestment.”

For more market trends, visit ETFTrends.com.