Exchange traded fund (ETF) investors who want more from the newly signed infrastructure bill can get concentrated exposure, particularly in electric vehicles and internet infrastructure.

“The bill would spend $7.5 billion for electric vehicle charging stations, which the administration says are critical to accelerating the use of electric vehicles to curb climate change,” a Boston.com report notes.

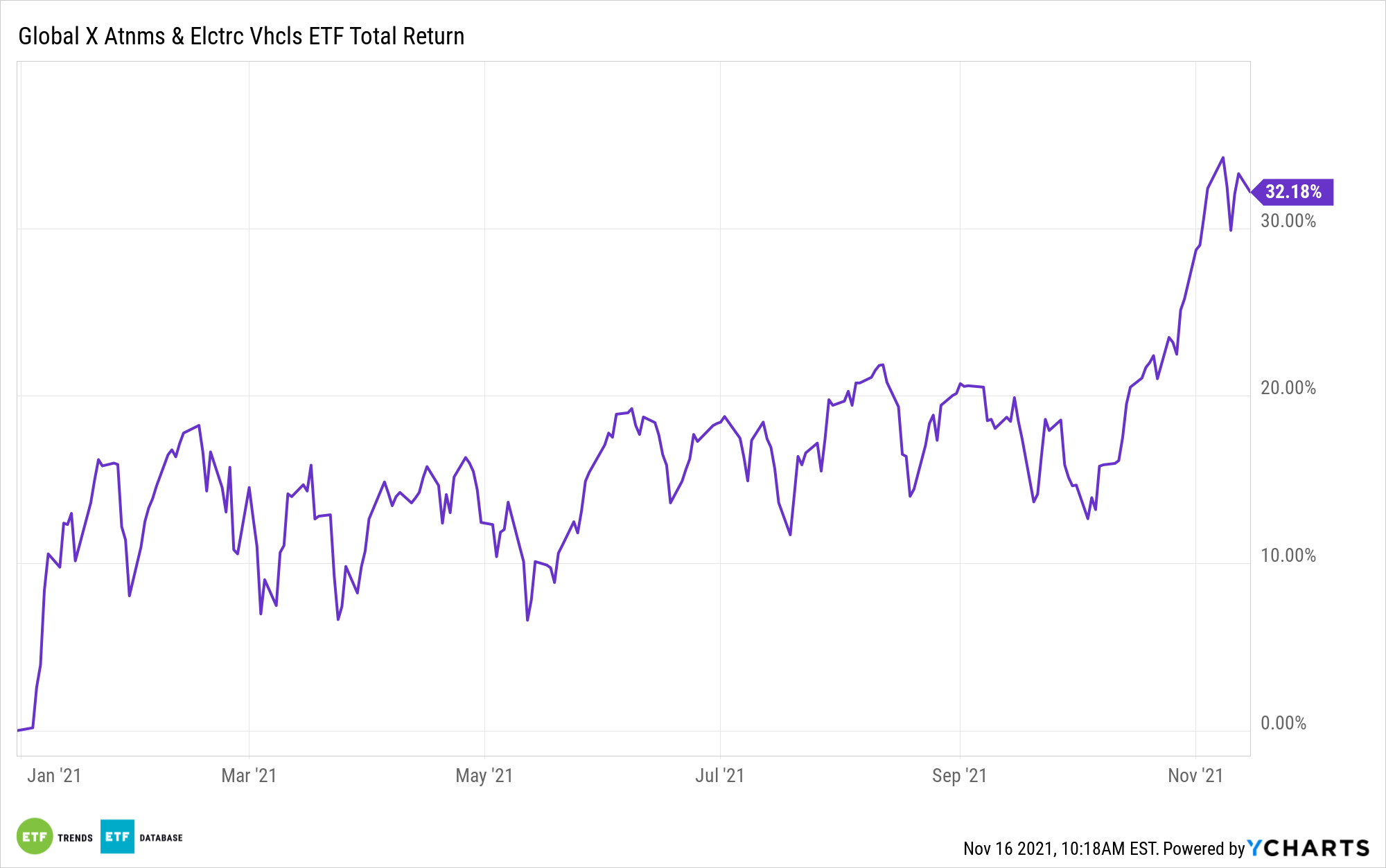

Given this, enter the Global X Autonomous & Electric Vehicles ETF (DRIV).

“The legislation’s $65 billion for broadband access would aim to improve internet services for rural areas, low-income families and tribal communities,” the report adds.

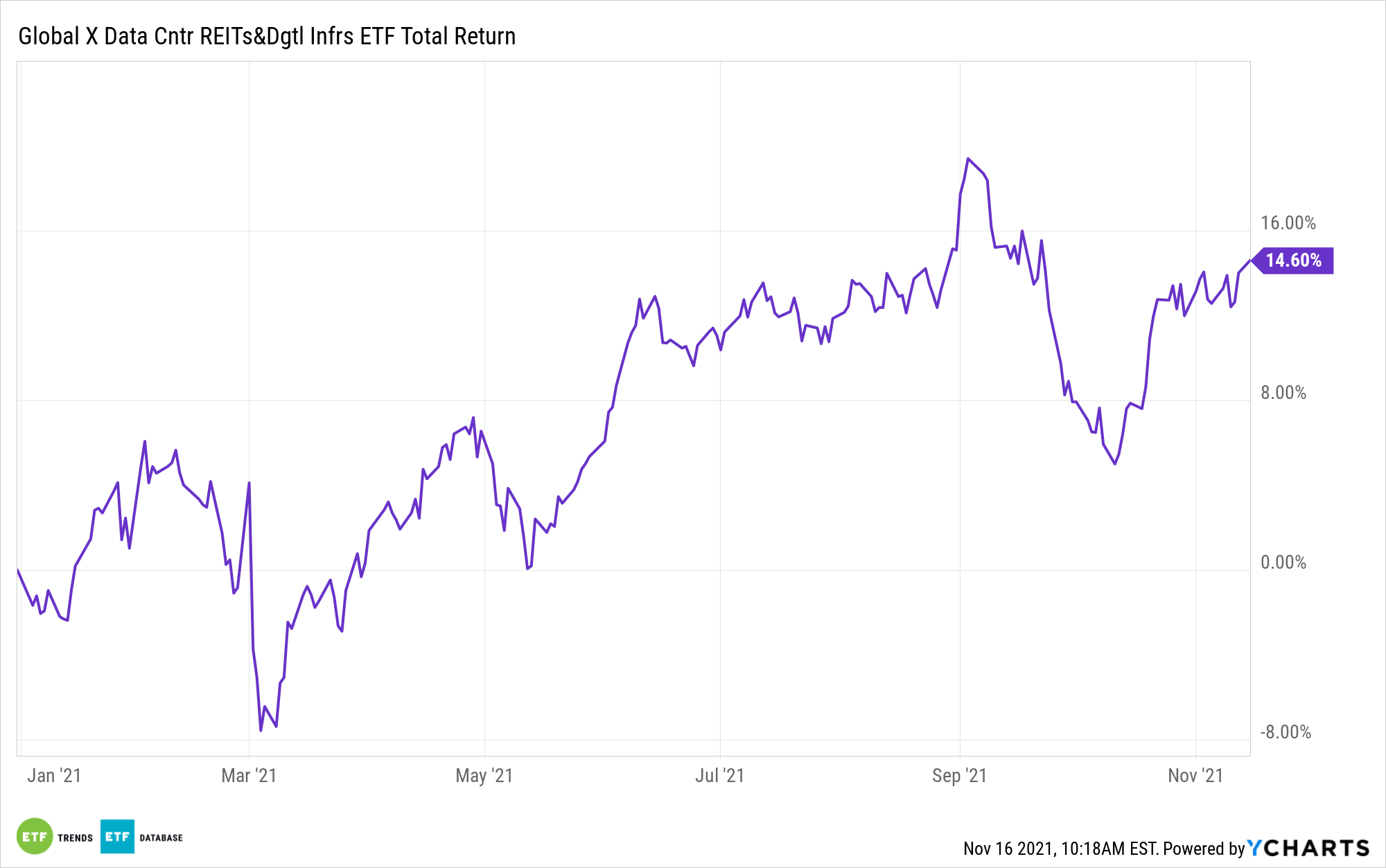

This is where the Global X Data Center REITs & Digital Infrastructure ETF (VPN) comes into play.

An Electric Vehicle ETF to Charge Portfolios

DRIV seeks to invest in companies involved in the development of autonomous vehicle technology, electric vehicles (EVs), and EV components and materials. This includes companies involved in the development of autonomous vehicle software and hardware, as well as companies that produce EVs, EV components such as lithium batteries, and critical EV materials such as lithium and cobalt.

DRIV seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Autonomous & Electric Vehicles Index. The fund offers:

- High growth potential: DRIV enables investors to access high growth potential through companies critical to the development of autonomous and electric vehicles — a potentially transformative economic innovation.

- An unconstrained approach: DRIV’s composition transcends classic sector, industry, and geographic classifications by tracking an emerging technological theme.

- ETF efficiency: In a single trade, DRIV delivers access to dozens of companies with high exposure to the autonomous and electric vehicles theme. Having the disruptive automotive industry in an ETF wrapper also gives traders access to short-term market maneuvers within the sub-sector.

An Internet Infrastructure Option

VPN seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Data Center REITs & Digital Infrastructure Index.

VPN investors can get access to:

- High growth potential: VPN enables investors to access high growth potential through companies providing the digital infrastructure for 5G and next generation communication networks.

- REIT exposure: VPN invests in REITs, among other holdings, an asset class that has historically provided high income potential.

- ETF efficiency: In a single trade, VPN delivers access to dozens of companies with high exposure to the data center and digital infrastructure theme.

For more news, information, and strategy, visit the Thematic Investing Channel.