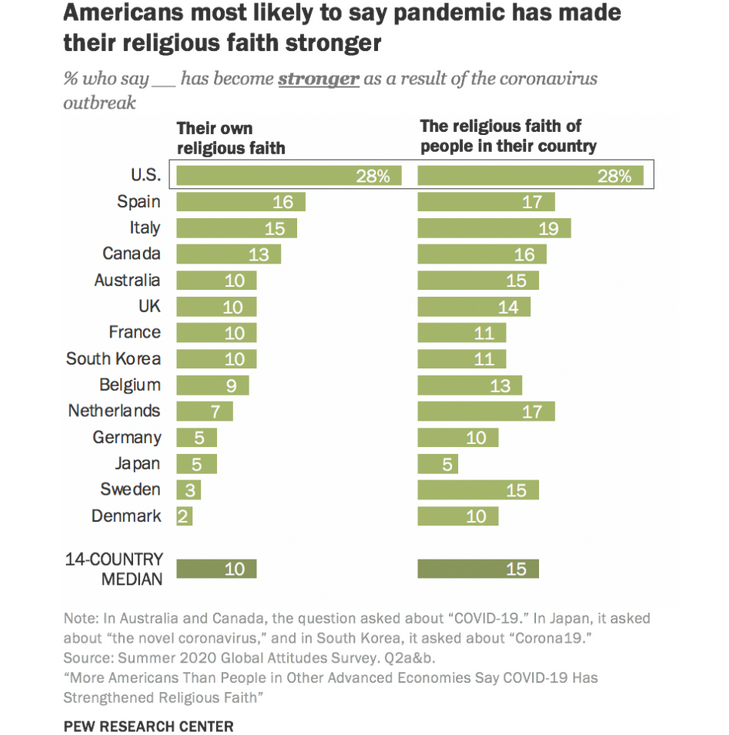

According to data from the Pew Research Center, more Americans turned to religion and increased their sense of personal faith during the pandemic. This faith in religion is also spilling over into their investment portfolios where returns aren’t the only things that are front and center.

“The success of a financial plan starts with the client–advisor relationship, especially for clients of faith,” a Wealthmanagement.com article said. “Knowing that a financial advisor treats their values and their faith with respect helps a client feel more comfortable. This is why it is crucial for advisors to have conversations with their clients about their faith, and how it may (or may not) impact their investment decisions.”

Two Options From Global X

ETF provider Global X has two options for investors to align their Catholic values with their investment objectives: the S&P 500 Catholic Values ETF (CATH) and the Global X Catholic Values Developed ex-U.S. ETF (CEFA).

CATH seeks investment results that correspond generally to the price and yield performance of the S&P 500® Catholic Values Index, which is based on the S&P 500® Index and generally is comprised of approximately 500 or fewer U.S.-listed common stocks. From this starting universe, constituents are screened to exclude companies involved in activities that are perceived to be inconsistent with Catholic values as outlined in the Socially Responsible Investment Guidelines of the United States Conference of Catholic Bishops.

- Invest in values: CATH excludes companies involved in activities perceived to be inconsistent with Catholic values as set out by the U.S. Conference of Catholic Bishops, including weaponry and child labor.

- Minimize tracking error: By providing exposure only to companies engaged in activities consistent with Catholic beliefs (through the S&P 500 Catholic Values Index), CATH seeks to minimize tracking error by matching the sector weightings of the broader S&P 500.

- ETF efficiency: CATH allows investors to buy and sell a broad basket of U.S. equities that conform with Catholic guidelines, with the tax efficiency of an ETF.

CEFA seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the S&P Developed ex-U.S. Catholic Values Index. The underlying index is designed to provide exposure to developed market equity securities outside the U.S. while maintaining alignment with the moral and social teachings of the Catholic Church.

- Invest in values: CEFA excludes companies involved in activities perceived to be inconsistent with Catholic values as set out by the U.S. Conference of Catholic Bishops, including weaponry and child labor.

- Minimize tracking error: By matching sector weightings, CEFA seeks to minimize tracking error to the S&P EPAC ex-Korea Large Cap Index (a benchmark for developed markets outside of the U.S.).

- ETF efficiency: CEFA allows investors to buy and sell a broad basket of global equities that conform with Catholic guidelines, with the tax efficiency of an ETF.

For more news, information, and strategy, visit our Thematic Investing Channel.