There are a lot of growth themes to consider right now. ETF investors can opt for a thematic macro perspective with the Global X Thematic Growth ETF (GXTG), which is up over 70%.

GXTG seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Thematic Growth Index. The fund invests at least 80% of its total assets in the securities of the underlying index.

The underlying index seeks to provide broad exposure to thematic growth strategies using a portfolio of ETFs. Overall, GXTG gives investors:

- A Multi-Theme Solution: In a single trade, GXTG delivers access to multiple disruptive macro-trends arising from technological advancements, changing demographics and consumer preferences, or evolving needs for infrastructure and other finite resources.

- High Growth Potential: The fund invests in a basket of individual thematic ETFs that exhibit high long-term growth potential.

- A Core Building Block: GXTG is designed to be a core building block for growth-oriented portfolios, offering broad thematic exposure at a 0.50% total expense ratio.

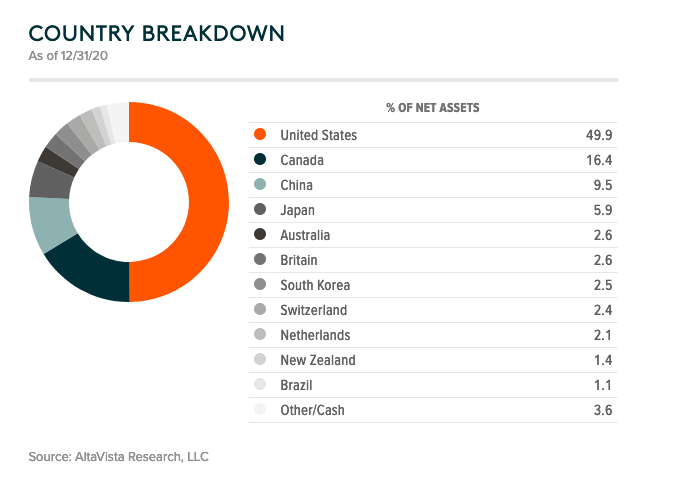

As mentioned, GXTG has been a stellar performer within the past year with a checkmark-style rebound since the pandemic sell-offs back in June. The fund also offers exposure to several different countries.

More Growth Ahead for GXTG?

There’s no denying the fund’s current strength, but can it maintain this upward trajectory? Technical analysis can help.

In this case, we’re looking at the 3-month chart and notice heavy volume to start the first month of 2021. When applying a relative strength indicator (RSI), one can see that it’s deep into overbought territory at 82.65, which explains the fund recently reaching a high of $50.90.

To confirm the current momentum, we can apply a stochastic relative strength index (RSI) and once again, the 1.00 level confirms overbought territory. Traders looking for an ideal entry point may want to keep an eye on whether it pulls back closer to its 50-day moving average.

Additional stimulus can keep GXTG trending even higher through 2021. Short-term pullback or not, the prospects of the fund maintaining its upward trajectory looks good so far.

For more news and information, visit the Thematic Investing Channel.