One ETF that’s up over 60% thus far this year could see more of the same in the next: the Global X Cloud Computing ETF (Nasdaq: CLOU).

The fund seeks to track the Indxx Global Cloud Computing Index, the fund holds a basket of companies that potentially stand to benefit from the continuing proliferation of cloud computing technology and services. CLOUD gives ETF investors:

- High Growth Potential: CLOU enables investors to access high growth potential through companies that are positioned to benefit from the increased adoption of cloud computing technology.

- An Unconstrained Approach: CLOU’s composition transcends classic sector, industry, and geographic classifications by tracking an emerging theme.

- ETF Efficiency: In a single trade, CLOU delivers access to dozens of companies with high exposure to the cloud computing theme.

The cloud computing industry refers to companies that (i) license and deliver software over the internet on a subscription basis (SaaS), (ii) provide a platform for creating software applications which are delivered over the internet (PaaS), (iii) provide virtualized computing infrastructure over the internet (IaaS), (iv) own and manage facilities customers use to store data and servers, including data center Real Estate Investment Trusts (REITs), and/or (v) manufacture or distribute infrastructure and/or hardware components used in cloud and edge computing activities.

Looking at its YTD chart, it’s easy to see why CLOU would be a prime option.

As more business models look to utilize technology amid social distancing, cloud computing will only grow to greater heights. Prior to the pandemic, businesses were already transitioning to increasing usage of cloud computing to streamline their processes.

CLOU Positioning for Future Growth

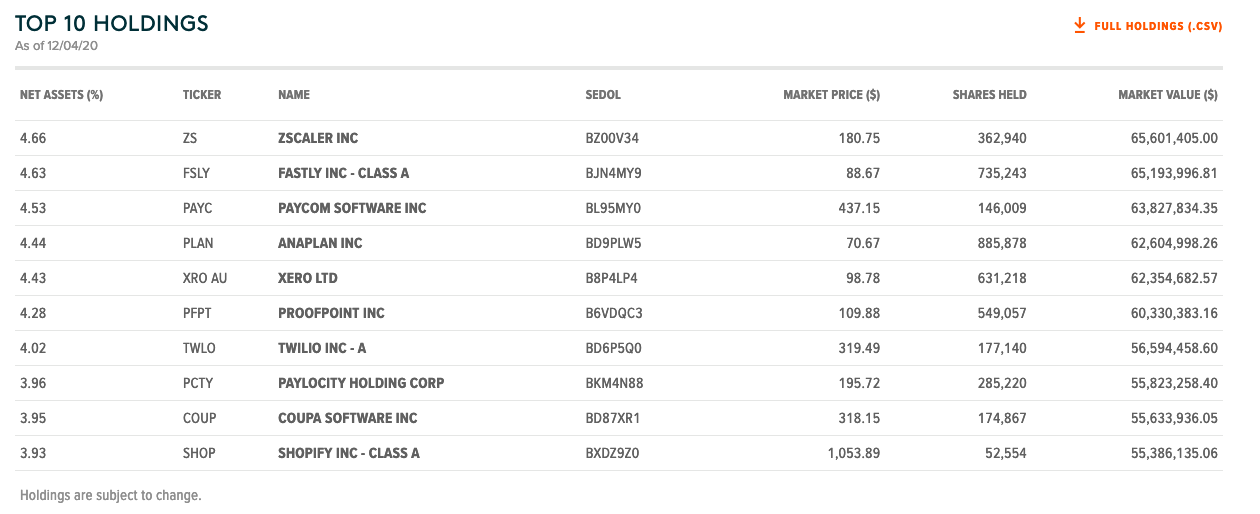

CLOU doesn’t have typical tech names like Apple, Google, and Amazon in its top ten holdings.

Instead, you’ll see stocks like cloud-based security company Zscaler. It’s not a household name, but one that you should be familiar with when it comes to the future growth of cloud computing.

The company’s recently revenue “rose 52.3% to $142.58 million, beating consensus estimates by $10.16 million, and non-GAAP earnings reached 14 cents per share, beating consensus estimates by eight cents per share. The biggest surprise was non-GAAP operating margins coming in at 14%, which was significantly higher than the 2.9% consensus estimate,” according to an Investopedia article.

Holdings like Zscaler is just one of the reasons CLOU investors are keeping their heads in the clouds.

For more news and information, visit the Thematic Investing Channel.