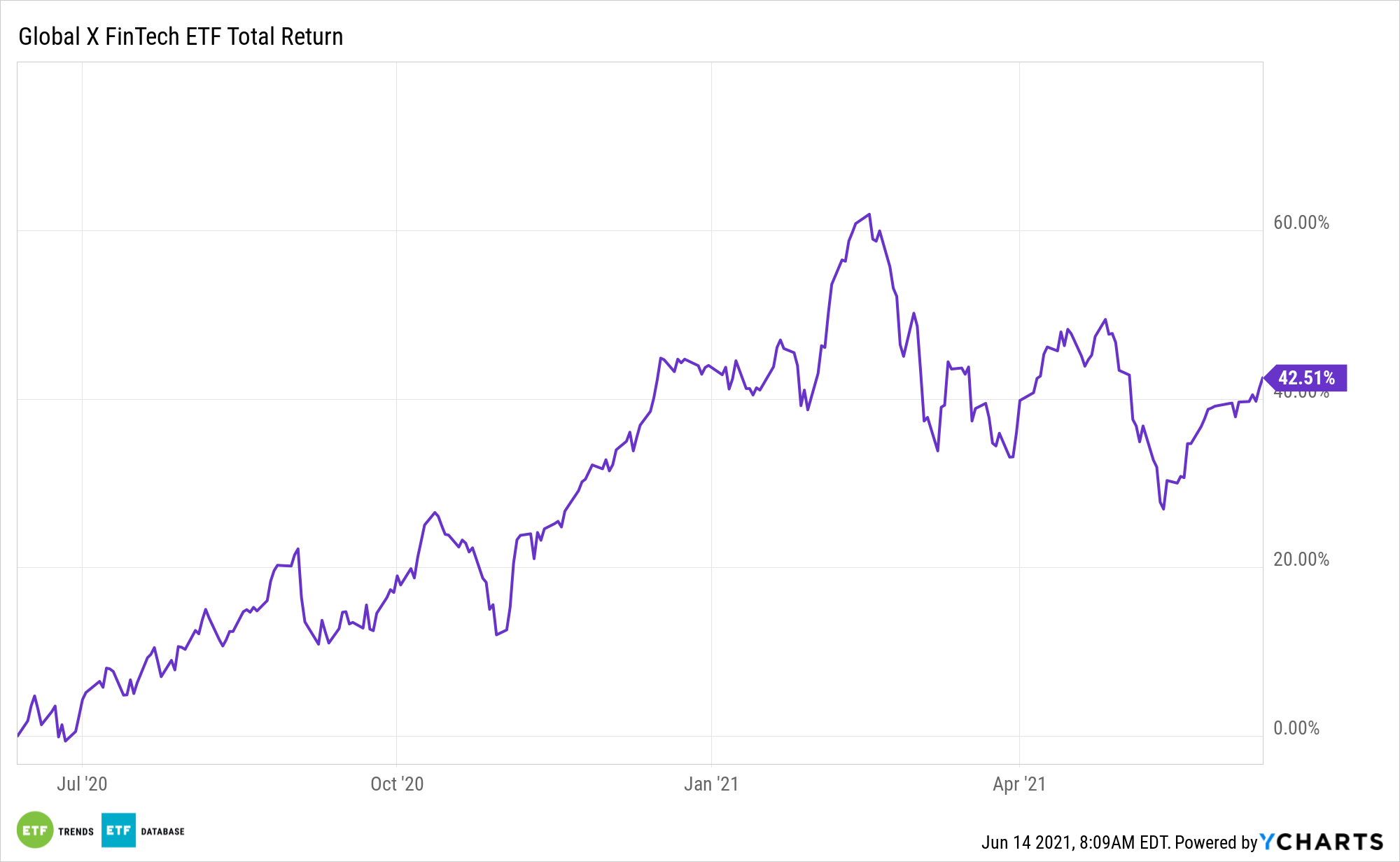

As the capital markets await a potential Bitcoin exchange traded fund (ETF), investors can snag indirect exposure to the phenomenon with funds like the Global X FinTech ETF (FINX).

Like precious metal investors who use miners as a backdoor play, getting crypto exposure can be had with companies that focus on blockchain technology. Blockchain is the tech that underpins cryptocurrencies with its ledger-based functions for handling transaction data.

One of FINX’s top holdings, accounting software company Intuit, offers Bitcoin accounting features in its popular QuickBooks software. As more financial tech companies adopt ways to incorporate cryptocurrencies into their products, this move could provide further tailwinds for FINX.

“We create accounts in your Chart of Accounts for each Bitcoin address/xPub,” the Intuit website said. “Transactions are automatically created in the account when they occur, with the exchange rate attached. For outgoing transactions, the app also records the capital gain/loss in an income account. You can manually set the QuickBooks customer, memo, tax code, and transaction type, or you can create a rule to automatically set them.”

As per the fund description, FINX seeks to provide investment results that correspond to the Indxx Global Fintech Thematic Index. The index is designed to provide exposure to exchange-listed companies in developed markets that provide financial technology products and services, including companies involved in mobile payments, peer-to-peer (P2P) and marketplace lending, financial analytics software, and alternative currencies, as defined by the index provider.

The fund gives investors exposure to:

- Outsized Growth Potential: FINX enables investors to access high-growth potential through companies that are applying technological innovations to disrupt and improve the delivery of financial services.

- An Unconstrained Approach: The fund’s composition transcends classic sector, industry, and geographic classifications by tracking an emerging theme.

- ETF Efficiency: In a single trade, FINX offers access to dozens of companies with high exposure to the fintech theme.

Fintech Embracing Crypto

Movers and shakers in the fintech industry are already embracing the crypto space. This should keep feeding into the growth component of FINX and provide investors with further upside over the long-term horizon.

“The meteoric rise of bitcoin – from $10,000 since last year’s list to an all-time high of $65,000 this April – and other major cryptocurrencies over the past few months secured a record eight spots on this year’s Fintech 50 list for blockchain and cryptocurrency focused companies,” a Forbes article said.

For more news and information, visit the Thematic Investing Channel.