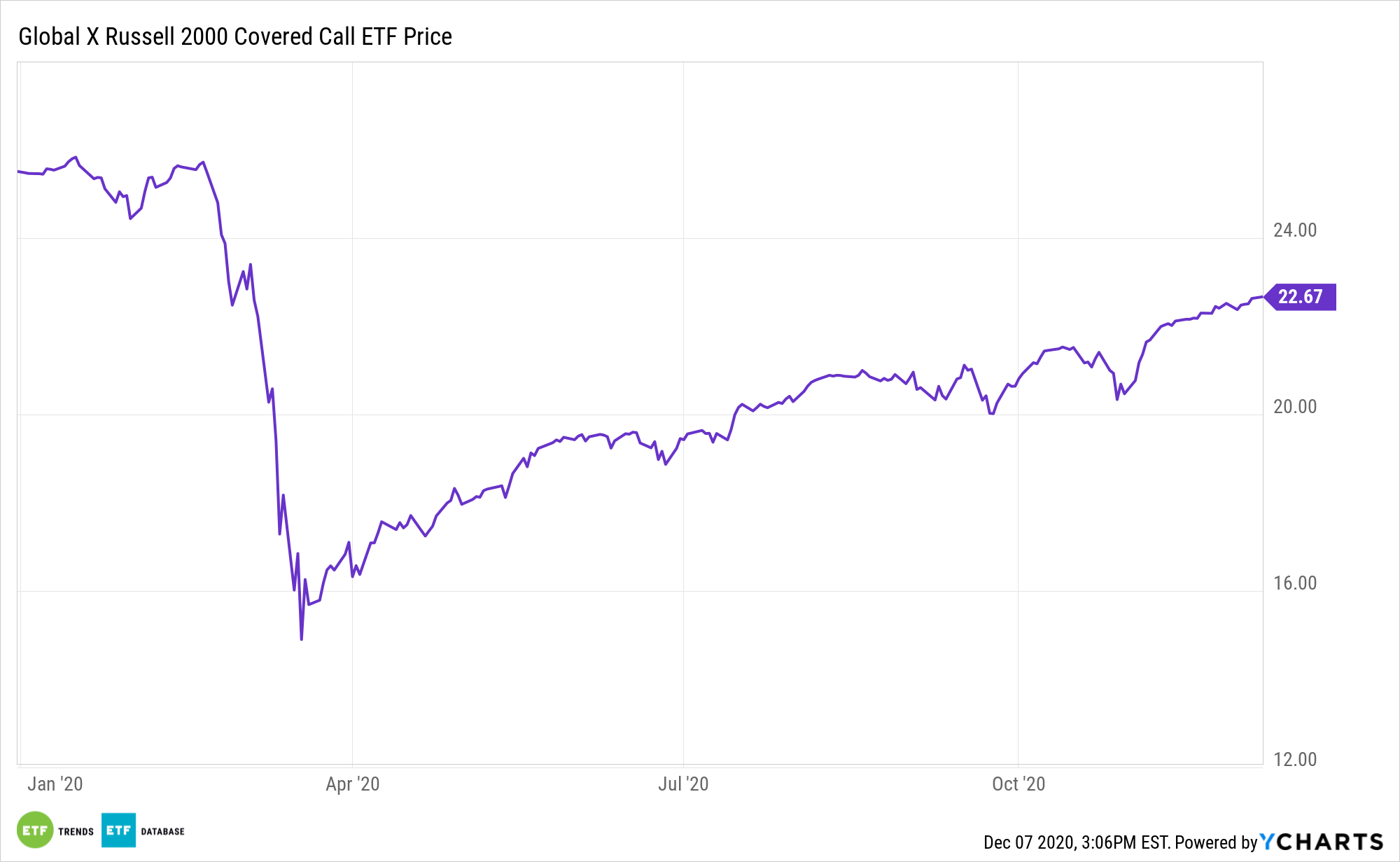

Finding investment income doesn’t always mean taking on more duration risk via safe haven government bonds. A stimulating yield ETF with a buy-write strategy is the Russell 2000 Covered Call ETF (RYLD).

RYLD seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Cboe Russell 2000 BuyWrite Index. The Global X Russell 2000 Covered Call ETF (RYLD) follows a “covered call” or “buy-write” strategy, in which the fund buys exposure to the stocks in the Russell 2000 Index and “writes” or “sells” corresponding call options on the same index.

As outlined by Investopedia, a buy-write strategy involves “an option trading strategy where an investor buys a security, usually a stock, with options available on it and simultaneously writes (sells) a call option on that security. The purpose is to generate income from option premiums.”

“Because the option position only decreases in value if the price of the underlying security increases, the downside risk of writing the option is minimized,” the article added. “The most common example of this strategy is the use of a covered call on a stock already owned by an investor.”

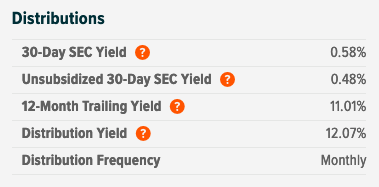

RYLD’s expense ration comes in at 0.60% net, while its distribution numbers are outlined below:

What’s In Store For The Russell 2000?

How is the Russell 2000 expected to cope with continued COVID uncertainty?

Per a MarketWatch report, investors in smaller cap Russell 2000 companies are in a good place “because smaller companies run lean compared to large companies. So when prices go up, more of the gain falls to the bottom line.”

“Small companies have greater operating leverage so their profits grow faster,” says Jim Paulsen, market strategist and economist at the Leuthold Group. “Historically small companies have done a lot better compared to large companies when inflation goes northward. We prefer small to large amid expectations for a strong U.S. economic recovery.”

For more news and information, visit the Thematic Investing Channel.