Solar energy is a vital component in the push toward renewable energy—a win-win for the Global X Renewable Energy Producers ETF (RNRG).

Solar power was once an option that was exclusively available for the well-to-do. Nowadays, solar costs are dropping, making the technology more accessible for more individuals.

Furthermore, the federal government’s green agenda is pushing for more solar power in the coming years. The solar power sector has already experienced exponential growth over the last 10 years.

“Solar power in the U.S. has grown 4,000% percent over the last decade, but it still only accounts for 3% of electricity generation,” a CNBC report noted. “The Biden Administration wants to change that, and on Tuesday (August 17) said that solar could provide 40% of the country’s electricity by 2035 — if the government enacts supportive policies.”

RNRG seeks to track, before fees and expenses, the price and yield performance of the Indxx YieldCo & Renewable Energy Income Index. The fund invests at least 80% of its total assets in the securities of the underlying index and in ADRs and GDRs based on the securities in the underlying index.

The underlying index is designed to provide exposure to publicly traded companies that produce energy from renewable sources, including wind, solar, hydroelectric, geothermal, and biofuels (including publicly traded companies that are formed to own operating assets that produce defined cash flows). RNRG’s expense ratio comes in at 0.65%.

RNRG gives investors:

- High Growth Potential: RNRG enables investors to access high growth potential through companies at the leading edge of a structural shift in global energy production.

- Renewables Exposure: The ETF is a targeted, thematic play on renewable energy producers.

- A Conscious Approach: RNRG incorporates the environmental, social, & Governance (ESG) proxy voting guidelines from Glass Lewis.

Solar Costs Must Continue to Fall

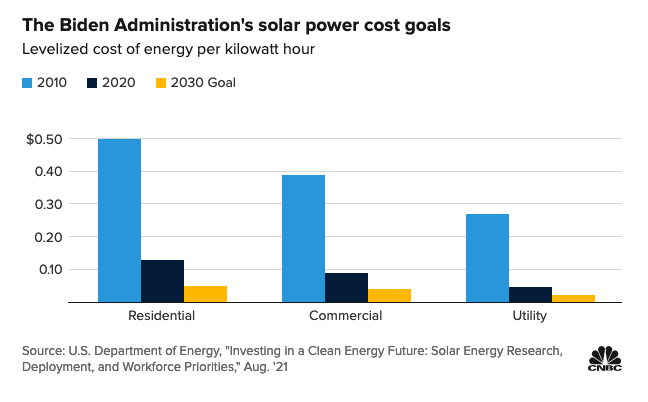

The government’s solar power goals are certainly ambitious. In order to meet these goals, solar costs must continue to decrease.

According to the CNBC report, “the Department of Energy said that solar’s growth rate will need to triple — or even quadruple — by 2030. That means costs will have to keep dropping.”

“The total cost of a solar system depends on variables including size, whether it’s purchased outright or leased and power prices in the specific location,” the report added. “Solar’s levelized cost of energy, which allows it to be compared to other forms of power generation, has fallen more than 70% over the last decade. But costs will need to continue to decline to meet these growth goals.”

For more news and information, visit the Thematic Investing Channel.