BMO Capital Markets noted that the Federal Reserve’s recent hawkishness on the economic recovery could tamp down prices for silver through the rest of 2021.

An improving economy is causing the central bank to eye 2022 as the year to start raising interest rates. The Fed is looking to start tapering off its stimulus measures as the economy continues to undergo a recovery from the effects of the ongoing pandemic.

“As inflation makes its way through value chains, a variety of central banks have either started to remove accommodative monetary policy or at least embark on that journey. And this includes the Federal Reserve,” the BMO analysts said in a report, according to Kitco News. “Even though negative real yields should prevent rapid macro asset reallocation away from commodities, caution towards precious metals is justified until the taper has taken place.”

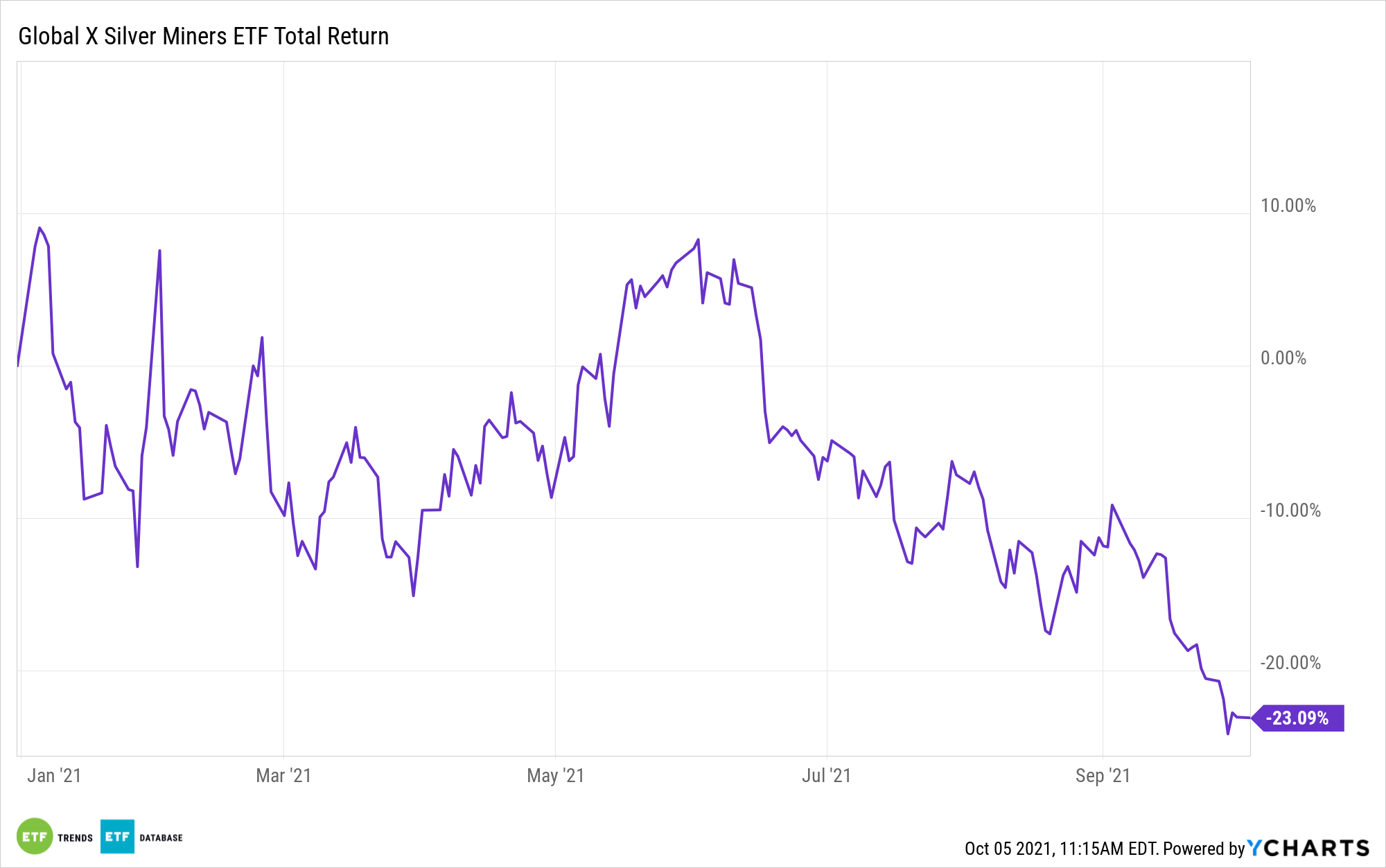

Still, that shouldn’t deter investors from still playing silver with ETFs like the Global X Silver Miners ETF (SIL). SIL seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Silver Miners Total Return Index.

As consumer prices start to rise, silver can potentially serve as an ideal inflation hedge despite the current price weakness. This only opens up opportunities for investors to buy silver on the dips.

Overall, SIL gives investors:

- Targeted exposure: SIL is a targeted play on silver mining.

- ETF efficiency: In a single trade, SIL delivers efficient access to a basket of companies involved in the mining of silver.

Silver Still Has Long-Term Potential

Moreover, the BMO analysts still see silver as a viable option in the long term. The precious metal can be used to diversify a portfolio while also hedging against inflation.

“We expect to see positive investor sentiment surrounding silver‘s longer-term industrial uses, particularly related to the energy transition, to underpin the price over the near term,” the analysts said.

Additionally, silver has a higher degree of utility versus its more expensive brethren, gold. This gives silver more flexibility beyond simply serving as a store of value or a safe haven metal.

“Because silver has a very high conductivity, it’s used for many technological applications in solar energy and the electric automotive industry,” says Giancarlo Camerana, a strategic advisor at QORE Switzerland, a precious metals and investment advisory company.

For more news, information, and strategy, visit the Thematic Investing Channel.