One of the primary obstacles keeping cryptocurrencies from getting more mainstream adoption is security issues. Stories of hacked exchanges may be scaring off potential investors, but tangible data shows that those fears might be overblown.

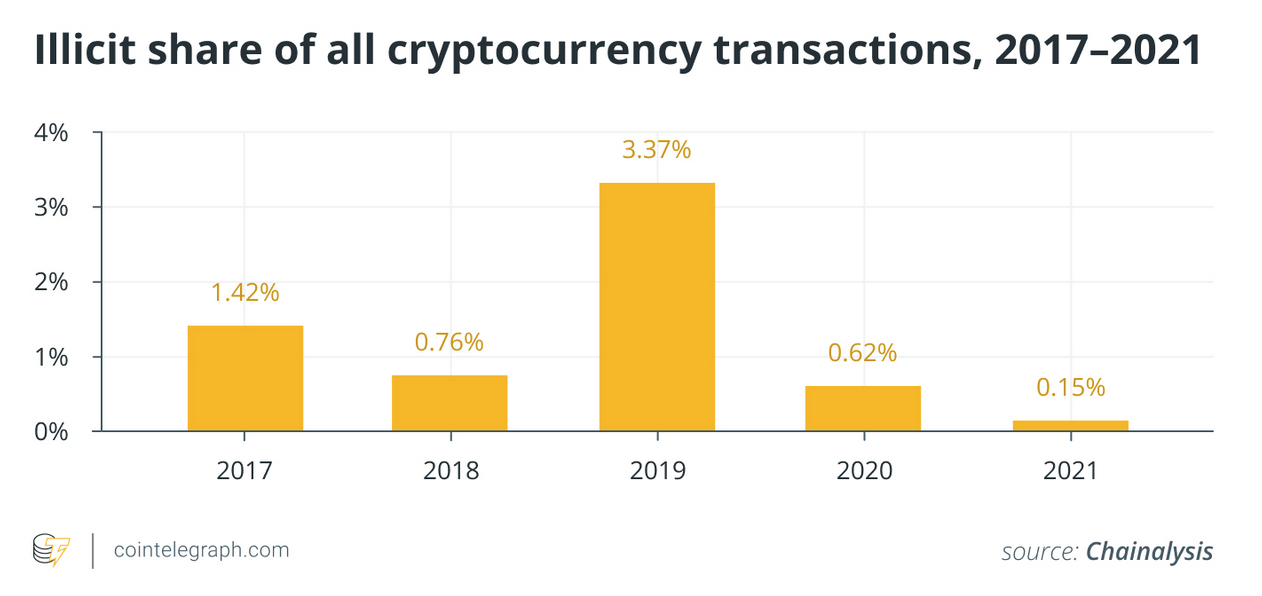

According to a Cointelegraph report, blockchain data platform company Chainanalysis noted that the percentage of illicit activities associated with cryptocurrency transactions was less than anticipated. In 2021, that share was a mere 0.15%, and in 2020 it was just 0.62%.

“The misconception that crypto is predominantly used by criminals probably has roots in the days of the Silk Road,” said Dmytro Volkov, chief technology officer at crypto exchange CEX.IO. “The truth is that the immutable aspect of the blockchain makes hiding transactions very difficult. In the case of Bitcoin, whose blockchain ledger is publicly available, a serious exchange with a competent analytics team can easily monitor and thwart hackers and launderers before the damage is done.”

2 ETFs to Consider

As cryptocurrencies continue to gain more adoption, more security will be asked of regulatory agencies as governments look to prevent cybersecurity issues. This can help propel opportunities in the Global X Blockchain ETF (BKCH) and the Global X Cybersecurity ETF (BUG).

First off, BKCH seeks to provide investment results that generally correspond to the price and yield performance of the Solactive Blockchain Index. The index is designed to provide exposure to companies that are positioned to benefit from further advances in the field of blockchain technology.

Overall, BKCH gives investors access to:

- High growth potential: The global blockchain market was valued at nearly $5 billion in 2021, with forecasts suggesting that it could grow over 10x to more than $67 billion by 2026.

- Global tailwinds: Blockchain technology is a global theme, poised to benefit as governments and industries seek to improve the accuracy, transparency, and security of financial transactions.

- An unconstrained approach: This theme is bigger than just cryptocurrency. BKCH invests accordingly, with global exposure across multiple sectors and industries.

BUG seeks to provide investment results that generally correspond to the price and yield performance, before fees and expenses, of the Indxx Cybersecurity Index. The index invests in companies that stand to potentially benefit from the increased adoption of cybersecurity technology, such as those whose principal business is in the development and management of security protocols preventing intrusion and attacks to systems, networks, applications, computers, and mobile devices.

BUG gives investors:

- High growth potential: BUG enables investors to access high growth potential through companies that are positioned to benefit from the rising importance and increased adoption of cybersecurity technology.

- An unconstrained approach: The ETF’s composition transcends classic sector, industry, and geographic classifications by tracking an emerging theme.

- ETF efficiency: In a single trade, BUG delivers access to dozens of companies with high exposure to the cybersecurity theme.

For more news, information, and strategy, visit the Thematic Investing Channel.