Every so often, the handwringing about indexes destroying the markets gets to a fever pitch, and I’m obliged to at least put something out there. Well, it’s been a year or so, so now’s the time. Here’s the most recent catalyst:

This was the closest to a longer conversation these two icons of social media — Elon Musk and Cathie Wood — were having about the issue of proxy voting — how the shares of individual securities like, say, Tesla or Twitter, are voted by active managers or individual shareholders vs. large index managers like Blackrock. In response, the media pulled up all the old arguments about the perils of indexing. I’m not going to go deep down the well on the voting issue here — I frankly just did that exhaustively with Samara Cohen from BlackRock.

This was the closest to a longer conversation these two icons of social media — Elon Musk and Cathie Wood — were having about the issue of proxy voting — how the shares of individual securities like, say, Tesla or Twitter, are voted by active managers or individual shareholders vs. large index managers like Blackrock. In response, the media pulled up all the old arguments about the perils of indexing. I’m not going to go deep down the well on the voting issue here — I frankly just did that exhaustively with Samara Cohen from BlackRock.

I don’t know or particularly have an opinion about Elon Musk; however, Cathie and I have known each other for some time, and I consider her a forthright colleague in this wacky business. We’ve had some arguments on-and-off stage or camera, and we’ve agreed about a lot both on and off camera.

But none of this is about Ark or Elon, or Tesla. It’s about the ethics of indexing. Is it “good?” Is it “Bad?”

What Are the Real Questions?

I try to break things down to their lowest levels, so here are the key questions I think are worth asking for any investor, advisor, policymaker, or asset manager. Not just now, but on a pretty regular basis. After all, nothing stands still for long anymore. The regulatory environment surrounding public markets is so radically different than, say, 1987 or 2000, or even 2008 that it’s almost ridiculous to use data from those periods to make any points at all. So we need to continuously test our assumptions about why the market behaves in certain ways and even how the market transmits capital and information — that changes too.

So here they are:

- Is the current dominance of passive strategies in flows perturbing how markets function?

- If so, is it possible to model those perturbations in a useful way — that one would change the decisions you make as an investor, policymaker, etc.

- Does pooled ownership (whether in CITs, MFs, CEFs, or ETFs) create any “winners or losers” in a way that isn’t representative of that ownership?

To me, that’s it. There’s one big question I’m not even going to bother with here, which is “does passive work,” and that’s really not even open for debate. For all the legitimate exploration of the above, there’s no debate on whether passive investing, as it has been and continues to be experienced by the actual investor, is the class-winning solution. Go grab the Morningstar Active/Passive Barometer or S&P’s Index vs. Active report for last year, and you’ll come to the same conclusion, almost regardless of what stats you want to highlight: S&P suggests that as a class, only 20% of active U.S. equity managers beat the S&P 1500 in 2021. By Morningstar’s bucket, the track record for active funds vs. passive funds directly is something worse than a coin flip, almost regardless of which bucket you pick.

The point is the core observation that trading and expenses destroy long-term investment performance remains intact (And for more on the core of the individual decision, check out Barry Ritholtz’s piece today on this topic from the Advisor’s perspective).

Put another way, almost regardless of the answer to the big questions, the “what should I do with my portfolio” question is still, based on the world we actually live in, that “cheap beta” is your friend.

The Rabbithole

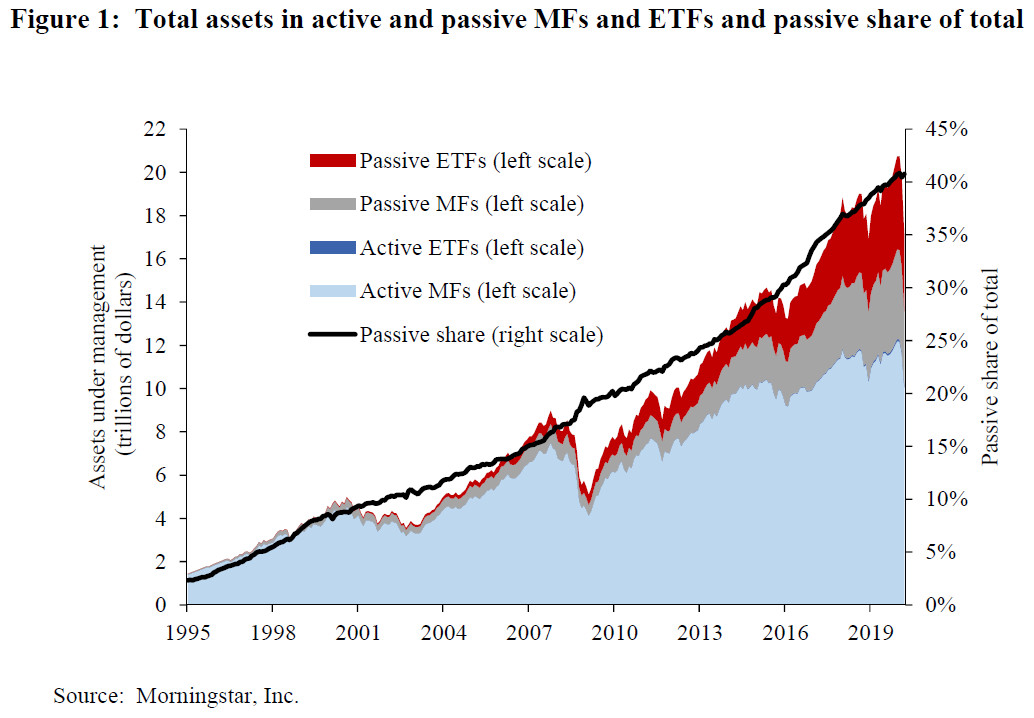

So let’s approach this directly. First off, how big a deal is passive, really? Well, here’s a great chart from the Boston Fed on that very topic:

Using Morningstar data, the Fed estimates that roughly 40% of the assets in U.S. packaged products are passive right now. Of course, that skips institutions, SMAs, and all sorts of other ways folks get exposure, but given that passive started as an institutional phenomenon and was actually late to the packaged product party, it’s safe to assume these numbers are at least informative of the vector here, even if the absolute numbers are incomplete. So sure, passive has become a big deal. But the footnote in the Fed paper is where the rabbit hole really begins:

Although the passively managed segments of the MF and ETF industries are smaller than the active segments,

passive funds have attracted the bulk of net inflows (share purchases) from investors over the past couple of

decades. From 1995 to March 2020, cumulative net flows to passive MFs and ETFs totaled $5.2 trillion, compared

to $1.8 trillion for active funds.

This distinction between holdings and flows is really where my thinking on this topic has shifted.

Just as a thought experiment, it’s reasonable to assume that if 40% of the market was passive and just stayed invested, then that 40% would be somewhat irrelevant to the functioning of the market. That passive share wouldn’t be helping price IPOs, and, nearly by definition, won’t be trading around earnings calls or engaging in merger-arb and so on.

However, it’s important to distinguish between “owning” something and the character of “buying” something. When Inigo Fraser Jenkins at Bernstein published his hit piece on indexing a few years ago (The Silent Road to Serfdom: Why Passive Investing is Worse Than Marxism), it spawned countless rebuttals (including this chart I’m still chuffed about from me):

This is why I want to firmly state that throughout this debate, for going on 30 years, I’ve primarily focused on the ownership issues, not the flow issues, myself.

Money In Motion is not “Capital,” it’s “Force”

In constructing the right mental model for the market, it’s easy to forget about everyone else. I go to my Schwab account, and I put in a limit order to buy a stock or a fund, and “the market” just takes care of the execution. But ultimately, as small as my activity is, I have taken a source of potential energy — my buying power in my Schwab account, whether its cash or margin — and turned it into kinetic energy — actual force moving through the ecosystem. Captain obvious, I know. Barry Ritholtz is fond of saying, “wait, buying makes prices go up? who knew?” when he’s being particularly sarcastic.

But from a market structure perspective, it’s the only thing that matters. My stagnant 401k portfolio sitting in index funds is irrelevant to the market activity today. However, I’d hope it’s axiomatic that my incremental buy order, whether it comes from my payroll provider through my 401k into the market or whether I hit “buy” myself — that total buy order has some impact on the market in proportion to how big I am, relative to everyone else. My trades matter less than Elon’s trades, but both transactions impact the market.

There’s a second and related subtlety to flows. There’s a difference between my flows coming into a single stock and my flows coming into a big broad diversified index-as-asset-class vehicle like a mutual fund, collective investment trust, or ETF. Instead of buying Twitter, Elon could spend billions purchasing the S&P 500. He’s applying force to the market, and the right question is probably, “how is it different when that force goes through a passive construction than when it’s all aimed at Twitter.”

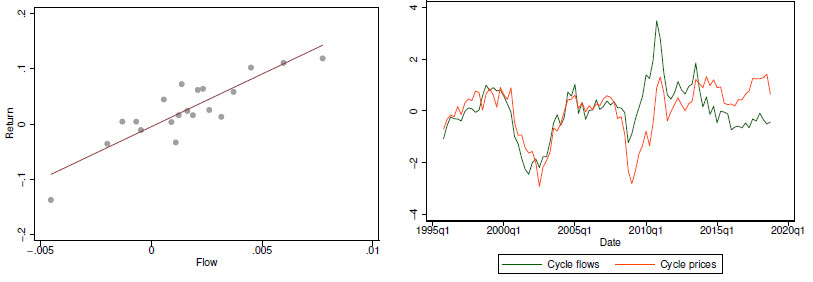

Luckily I don’t need to reinvent the wheel on this jump down the Rabbithole. Mike Green is the Chief Strategist at Simplify Asset Management, but he’s more of a market-structure-Sherpa. He has a bit of a (deserved) reputation for being acerbic on social media, but that’s oddly antithetical to his enormous patience and generosity one-on-one, at least with me. Personality or opinions aside, he’s been collecting evidence around this flows-based-markets angle for a long time (and if you’ve got an hour, I highly recommend checking out one of his presentations on this topic). I won’t regurgitate it all here, but Green highlights five key things we would expect to see if, in fact, passive flows are mucking with our core market expectations.

- Increased correlation

- Increased valuations regardless of fundamentals

- Increased concentration (because of momentum effects)

- Fewer IPOs

- Reduced market elasticity

There’s at least evidence for all of these (and reasonable disagreement about some of them): Correlations are surprisingly open to interpretation, but most thoughtful work is suggesting that stocks are, in fact, increasingly correlated, particularly at certain times. Pick your measurement of valuation, but certainly, we are not sitting at fire sale valuations even today. Market concentration is decidedly high, and I’d rate the “IPO” angle as challenging to tease apart from the exogenous market environment. But my point is, there is evidence here if you want to look, which brings us to…

Elasticity

The interesting argument to me — the one worth really understanding — is the argument about elasticity. If you remember from Econ class, elasticity is how tightly price and supply/demand are connected. If a tiny increase in price results in new supply, you have a super elastic market — new demand is easily absorbed. Put another way, in a superelastic market, it takes enormous amounts of demand to move prices. From a stock market perspective, the only contemporaneous “supply” of stock shares is held by other owners (Secondary offerings take time).

Most financial assets — actual beta assets that aren’t manufactured derivatives — have a limited supply, so we expect some level of elasticity in pricing. That’s why, for instance, you can buy 100 shares of IBM right now for $129.15, but if you want 1 million shares, you have to engage with sellers who just think it’s worth more than that (right now, it’s about $130 to push that million through). Presumably, all of the other holders who won’t sell even then think it’s worth more (if they felt it was worth less, they’d sell it lower!).

So how does this relate to the index issue? Enter an absolute banger of a paper from Xavier Gabais # Talkph Koijen from last year: In Search of the Origins of Financial Fluctuations: The Inelastic Markets Hypothesis. In it, they create an approach to understanding the difference between how stocks trade and how asset classes trade against each other.

For example, the elasticity multiplier of any individual stock seems to be about 1 — meaning if an incremental million dollars goes and buys TSLA, the impact on TSLA’s valuation is about $1 million. The number of shares of TSLA doesn’t change, but the price goes up by about enough to make the market cap represent that “new” million. However, when they actually do the math of calculating how flows seem to have impacted (and they’re kind enough to provide “undergraduate” examples as well, for idiots like me), they find that from an asset class flows perspective, the decision to allocate into an equity portfolio with capital from a non-equity source (that is, from bonds, from cashflow, from selling your house), the elasticity multiplier skyrockets to 5. Meaning for every new $1 million that enters the equity market, the overall equity markets valuation goes up by $5 million.

How is that possible? While I highly recommend reading all 54 pages of the paper to grok-in-fullness, it’s really as simple as this: finding a seller for “equities” is simply much harder than finding a seller for “Tesla.” The notional owners of “indexes” in whatever form they may be aren’t inclined, as a class, to flip out of equities simply because you offered them the last traded price. Or if it helps to think of it in old-Wall Street terms: All the dumb money (hand up) is mostly in index funds, and mostly dollar cost averaging in. That means the only folks trading TSLA earnings now are all doing it for the same reasons with the same information. So when there’s a surprise? Katie bar the door.

And this makes sense! Tesla is fungible with Ford, or the Qs, or Nvidia far more than “The S&P 500” is fungible to “The Bloomberg Aggregate” or “The Dax.” The implication is pretty simple: strong flows mean strong markets.

So What, Big Deal

So, the math is there; the intuition is there. What does the “inelastic markets hypothesis” actually mean?

Event Risk: The first thing is that, almost by definition, the flow participating in the above charts — with its positive correlation to performance overall — is not determining whether TSLA should trade up or down on earnings day. Instead, there remains an entirely separate the process of price setting that happens in the market that big-block-index trades don’t really participate in differentially between individual companies. I’m reluctant to call this “Active” because tons of folks out there are enormously active who simply don’t trade single stocks. So really, what we have is, perhaps, fewer “single-stock traders” in the market around events, working with a diminishing supply of available shares to trade (and I’d argue separately, little non-public information to inform their trading). That should make event-trading more volatile, and indeed, Goldman has shown that earnings day moves are now about 4X a typical day in terms of volatility vs. the long-term average of about 2.5. In other words, don’t fool yourself into headline trading unless you’re really sure you know what you’re doing.

Convexity: I’ve pointed out the “tipping point” market issues before, but ultimately, if all of the above is explanatory, it provides further impetus to get some convexity into your portfolio. The implication of the above (and, I’d argue, a dozen or so structural, social, and cultural issues for another time) is that markets will “feel” fine until all of a sudden they feel very different. As in, welcome to 2022 and our new understanding of market tails.

The Relentless Bid: As Josh Brown coined the term, the continuous flood of money into the markets from 401k investors is a real thing, and I’m skeptical another point or two on interest rates is all of a sudden going to chase equity holders out, particularly in retirement accounts. Data is sadly not real-time on retirement allocations. Still, a just-published ICI study using 2019 data suggests that 80% of plan assets are held by people under the age of 60, with roughly 42% of the assets in equity funds and 31% in target-date funds (although TDFs are held in 60% of accounts, suggesting the flows will continue). How big are the flows? The 2019 data from the Department of Labor suggest about $570 billion a year. The implication (based on the inelastic markets hypothesis) is that that translates into something north of $2.5Trillion in price impact — measured as the overall increase in market cap — a year. That number is absolutely wrong, but it’s directionally correct and likely has the decimal point in the right place.

Even absent net flows, the rebalancing of Target Date Funds themselves seem to be having some measurable affects on markets. Another recent NBER paper suggests that on longer time horizons, TDF rebalancing is a volatility dampener over longer time frames, but may exacerbate exogenous shocks between asset classes.

As an investor myself, those are the three takeaways I have from what I understand about market structure right now—more event risk, more tail risk, with a longer-term positive upward bias.

When I asked Mike Green for his “So What..” on this he chimed in with this: ““Buy cheap beta but wear a seatbelt… if I’m right, markets are increasingly sending poor fundamental signals to both investors and policy makers which raises the risks of a significant ‘accident.’”

But… But…

To keep this short, I’ve skipped a lot. There are other factors at work that have real impacts, which I will continue to try and stay smart about. Here are just a few things I suspect to make the ethics of indexing even more complex. I haven’t dug into how knowledgeable the 401k Target Date Fund rebalance and withdrawal pattern is. There are clear impacts from increased derivatives trading on the underlying betas that the Volatility folks are all over, but I haven’t included them. Honest conversations around proxy voting, common ownership, and shareholder capitalism are worth having. There are genuine public policy responses to be debated, like altering the retirement plan incentives and safe harbors, and even potentially the ’40 act rules.

But almost regardless of your stance on any of those real issues, there is one overwhelming truth that’s difficult to get past: In 1978, we, as a country, decided to outsource retirement entirely. Yes, Social Security still exists, but ever since 1978, almost every piece of public policy has driven the ability to survive in society after the age of 65 or so into the hands of the individual with a single toolset: the market. We codified and recodified and reincentivized corporate America and the individual to plow money into the market, from George Bush’s ownership society to Obama’s “myRA” attempt, we, collectively, built the infrastructure to put us right where we are. If “capital allocation” is being done “wrong,” as the conversation between Elon Musk and Cathie Wood suggests, it’s absolutely baked into what America is right now: George Bush’s Ownership Society on steroids. It may or may not be worse than Marxism, but it’s unquestionably American.

We can tweak the tax code and market structure around the edges, but until someone rewrites the Internal Revenue Code, ERISA, and the 1940 Act from scratch and provides a solution other than “get your money in the market” for retirement, I firmly believe passive investing is the correct answer for the average retirement-saver.

Whether they then choose to also be an “active investor” is up to them, but the math isn’t on their side.

For more news, information, and strategy, visit ETF Trends.