On Wednesday, VanEck announced the launch of the VanEck Vectors Digital Transformation ETF (NASDAQ: DAPP), a new equity fund designed to provide investors with pure-play exposure to the companies powering the digital transformation of the world’s economy.

“The digitalization of the global economy has been picking up steam for the past several years, and as digital assets mature, this has driven the growth of several innovative companies—not only miners of digital assets but also digital asset exchanges, payments, services, storage, e-commerce and much more,” said Ed Lopez, Managing Director, Head of ETF Product for VanEck. “To this point, however, investors have had to choose among funds that too often included companies only tangentially involved with digital assets. That is something we’ve sought to solve with the launch of DAPP, a fund we’re very excited to be bringing to market.”

DAPP seeks to track, as closely as possible, the price and yield performance of the MVIS Global Digital Assets Equity Index (“The Index”), a rules-based modified capitalization weighted, float adjusted index intended to give investors a means of tracking the overall performance of companies involved in digital assets. As the Index is designed to be a pure-play overview of the relevant players in the space, to be eligible for inclusion, a company must generate at least 50% of its revenues from digital assets projects; generate at least 50% of its revenues from projects that, when developed, have the potential to generate at least 50% of their revenues from digital assets or digital asset projects; and/or have at least 50% of its assets invested in direct digital asset holdings or digital asset projects.

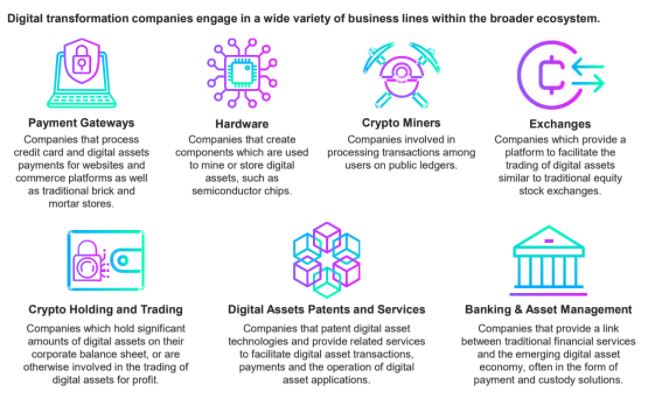

The Index provides significant exposure to key companies in mining, hardware, exchanges, holding and trading, payment gateways, patents and services, and banking. The Fund will not invest in digital assets (including cryptocurrencies) directly or indirectly through the use of digital asset derivatives. The Index rebalances quarterly.

A Digital Landscape

“Digital transformation companies cover a broad swath of the investment landscape related to digital assets, well beyond what’s taking place with cryptocurrencies like bitcoin. It’s also important to note that digital transformation represents a long-term structural growth story, supported by significant ongoing investment and adoption on a global scale by both retail and institutional investment participants,” continued Lopez. “We as a firm have long believed in the utility and viability of digital assets as an asset class, and we are thrilled to be providing investors with exposure to companies powering the digital transformation.”

“Nasdaq’s ETF listings business centers on working with forward-thinking partners like VanEck, who provide access to growing and innovative asset classes,” added Giang Bui, Head of U.S. Exchange Traded Products at Nasdaq. “Today’s launch of the VanEck Vectors Digital Transformation ETF demonstrates Nasdaq’s value as a resource for growing digital asset strategies in the evolving ETF market.”

DAPP, which has an expense ratio of 65 basis points, joins a VanEck thematic equity ETF lineup that also includes the VanEck Vectors Video Gaming and eSports ETF (NASDAQ: ESPO), which is the largest ETF by assets under management that provides targeted exposure to the fast-growing global video gaming and esports industries; VanEck Vectors Gaming ETF (BJK), which is the first ETF in the U.S. to focus on global gaming; and VanEck Vectors Semiconductor ETF (SMH), which is designed to track the largest and most liquid semiconductor production and equipment companies, based on market capitalization and trading volume.

For more information, visit Vaneck.com.