By Natalia Gurushina, Economist, Emerging Markets Fixed, VanEck Global

The Turkish lira broke through the 7/U.S. Dollar level despite weeks of interventions. The U.S./China tensions are spiking up again.

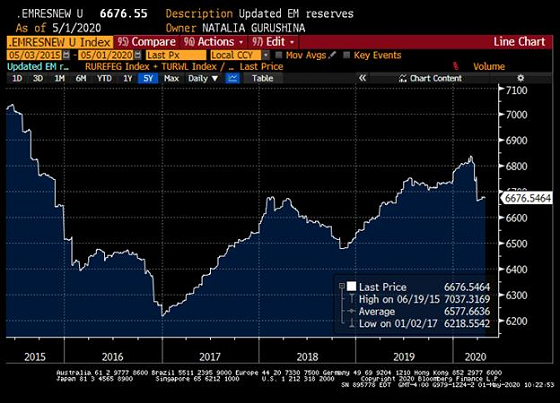

Turkey provides the most valuable macro lesson of the week – do not waste the reserves defending some random but “psychologically important” exchange rate level because it ends up in tears. The currency still breaks through the ceiling (7.00/U.S. Dollar in this particular case), but a big portion of your “safety cushion” (~30% of the gross international reserves) is now gone – a big contrast with Emerging Market’s (EM) aggregate reserves that are holding on quite well (see chart below). Going forward, letting the lira go (especially against the backdrop of additional rate cuts) is a positive development, because it can re-ignite the external adjustment process with smaller trade/current account deficits and more fundamental support for the currency in the future.

The U.S.-China tensions are spiking up again. News reports are abuzz with comments about U.S. administration exploring COVID-19 reparations from China and/or new China tariffs. We are not political experts, but it seems to us that policy-makers in China and the U.S. often operate with very different time horizons in mind. In this week’s comment about the forthcoming session of the 13thNational People’s Congress, Xinhua talked about the “first centenary goal to finish building a moderately prosperous society”. This is what I call long-term planning. Politics aside, we continue to keep a close eye on China’s macroeconomic developments, and we have just updated our China blog to reflect the latest figures and commentary.

The ISM activity gauges in the U.S. were predictably weak in April, with all components hitting the multi-year lows. The real GDP growth is now expected to remain negative in year-on-year terms at least until Q2-2021 (with the worst contraction seen in Q2) – a major headwind for EM economies whose growth models rely on exports.

Chart at a Glance: EM Aggregate International Reserves Are Holding On Well

Source: Bloomberg LP

IMPORTANT DEFINITIONS & DISCLOSURES

PMI – Purchasing Managers’ Index: economic indicators derived from monthly surveys of private sector companies; ISM – Institute for Supply Management PMI: ISM releases an index based on more than 400 purchasing and supply managers surveys; both in the manufacturing and non-manufacturing industries; CPI – Consumer Price Index: an index of the variation in prices paid by typical consumers for retail goods and other items; PPI – Producer Price Index: a family of indexes that measures the average change in selling prices received by domestic producers of goods and services over time; PCE inflation – Personal Consumption Expenditures Price Index: one measure of U.S. inflation, tracking the change in prices of goods and services purchased by consumers throughout the economy; MSCI – Morgan Stanley Capital International: an American provider of equity, fixed income, hedge fund stock market indexes, and equity portfolio analysis tools; VIX – CBOE Volatility Index: an index created by the Chicago Board Options Exchange (CBOE), which shows the market’s expectation of 30-day volatility. It is constructed using the implied volatilities on S&P 500 index options.; GBI-EM – JP Morgan’s Government Bond Index – Emerging Markets: comprehensive emerging market debt benchmarks that track local currency bonds issued by Emerging market governments.; EMBI – JP Morgan’s Emerging Market Bond Index: JP Morgan’s index of dollar-denominated sovereign bonds issued by a selection of emerging market countries; EMBIG – JP Morgan’s Emerging Market Bond Index Global: tracks total returns for traded external debt instruments in emerging markets.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities mentioned herein. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Certain information may be provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as the date of this communication and are subject to change.

Investing in international markets carries risks such as currency fluctuation, regulatory risks, economic and political instability. Emerging markets involve heightened risks related to the same factors as well as increased volatility, lower trading volume, and less liquidity. Emerging markets can have greater custodial and operational risks, and less developed legal and accounting systems than developed markets.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.