The U.S.-China Trade war is making its effects apparent in higher freight costs. This could certainly put transportation-focused exchange-traded funds (ETFs) on notice moving forward, particularly after China recently introduced new tariffs and resumed automotive duties as well.

“I don’t think we’ve seen anything quite like this before and that sets up all sorts of unusual behavior in the industry,” said Mark Diamond, a principal at consulting firm ICF.

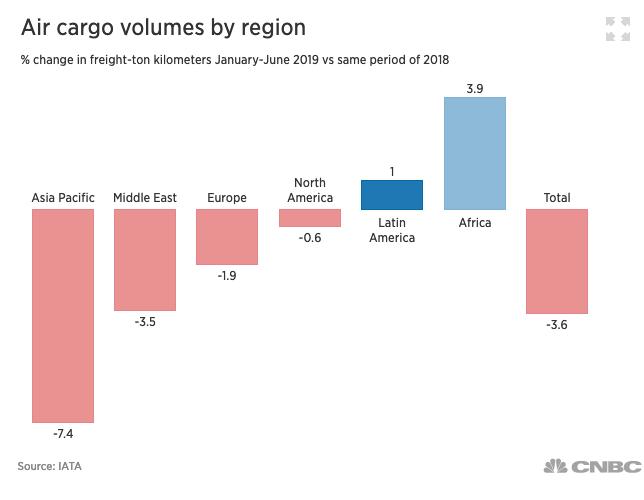

The decline is certainly showing thus far this summer.

“With the -5.9% drop in July, following the -5.3% drop in June, and the -6.0% drop in May, we repeat our message from last two months: the shipments index has gone from “warning of a potential slowdown” to “signaling an economic contraction,” strategist Donald Broughton wrote in the report for Cass Information Systems, a freight payments processor.

The transportation index is a key metric for analysts to watch in terms of assessing the health of the broad market. As far as any potential roadblocks for transportation exchange-traded funds, the U.S.-China trade wars are certainly a potential danger, but selecting the right exchange-traded funds (ETFs) could relegate them to a mere speed bump.

Trade disputes are “forcing companies to run down inventory, curbing new orders,” Jefferies wrote in a note Wednesday. “This is corroborated by weak export growth from Asia during the peak shipping season. The good news is that the run down in the backlog of orders and import intentions appears to be close to a nadir.”

The trade wars between the two largest economies have certainly been a negative factor for many sectors, and the transportation industry wasn’t immune to its effects. However, any weakness in the transportation sector could present an opportunity for investors to jump into a sector that could be morphing into a commodity.

Here are three ETFs that are moving in the transportation sector:

- iShares Transportation Average ETF (NYSEArca: IYT): seeks to track the investment results of the Dow Jones Transportation Average Index composed of U.S. equities in the transportation sector. The underlying index measures the performance of large, well-known companies within the transportation sector of the U.S. equity market.

- SPDR S&P Transportation ETF (NYSEArca: XTN): seeks to provide investment results that correspond generally to the total return performance of an index derived from the transportation segment of a U.S. total market composite index. The index represents the transportation segment of the S&P Total Market Index (“S&P TMI”).

- Direxion Daily Transportation Bull 3X Shares (NYSEArca: TPOR): seeks daily investment results equal to 300 percent of the daily performance of the Dow Jones Transportation Average. The index measures the performance of large, well-known companies within the transportation industry.

For more real estate trends, visit ETFTrends.com.