Bull vs. Bear is a weekly feature where the VettaFi writers’ room takes opposite sides for a debate on controversial stocks, strategies, or market ideas — with plenty of discussion of ETF ideas to play either angle. For this edition of Bull vs. Bear, James Comtois and Nick Peters-Golden discussed the case for and against Latin American equities and their ETFs.

Nick Peters-Golden, staff writer, VettaFi: Hi James! Excited to join you for the most recent edition of our ongoing Bull vs. Bear series. In this edition, I’d love to talk about how Latin American equities ETFs are, as the kids say, cooking.

According to YCharts, Latin America stock ETFs have outperformed every other ETF category over the last month. Those ETFs have returned 9.9%, with tech stocks some way back in second with 6.6% returns over one month. That tells me investors and advisors need to be looking at Latin America stocks and equities. What say you?

Political Uncertainty and Geopolitical Risk

James Comtois, staff writer, VettaFi: Greetings, Nick! I understand and admire your enthusiasm for the region. After all, there’s admittedly plenty to be excited about (including that nearly 10% return). But alas, I’m not quite sold on the space.

First off, while Latin American equity ETFs are cooking, we’re still talking about investing in emerging markets. As we know, emerging markets equities have their own inherent set of risks not found in developed markets. And one big risk the region is facing is political uncertainty and geopolitical risk.

Latin American countries have dealt with decades of political turmoil, with plenty of signs that this will continue. Former Brazilian president Jair Bolsonaro’s supporters attacked Brazil’s federal government buildings this year after Bolsonaro lost the 2022 general election. The recent protests in Peru have been the most intense the country has seen in at least a century.

But wait, there’s more. Argentina’s Vice President and former President Cristina Fernández de Kirchner was sentenced to six years in prison after being found guilty of fraud (and get this: she’s still Vice President). Mexico’s President Andrés Manuel López Obrador has jeopardized the country’s draw as a haven after interfering in the private sector.

I could go on. My point is, while the numbers currently look good, the political headlines the region has been generating make me nervous. That said, I’m guessing you’ve got more to say about the region, yes?

Coffee, Soybeans and Lithium: Oh My!

Peters-Golden: Fair. I respect that there are political issues. Let’s start, however, with perhaps the most potent case for Latin American equities — commodities. Yes, commodities are back with a vengeance, and Latin American equities are riding them hard. Commodities are a big wide world but let’s dig into the main drivers in what we loosely define as “Latin America.”

Let’s start of course with agricultural commodities. Whether it’s soybeans or coffee (and there’s an awful lot of coffee in Brazil), Brazil specifically has ridden a significant ag rally driven by an end of COVID-19 restrictions and worldwide growth. Some traders even talk of a “supercycle” for commodities. Brazil today is the largest producer of both of those products as well as the biggest exporter of beef and sugar.

That may help explain why the best performing Latin American equities ETFs focus on Brazil. Agribusiness and all of its various components may actually surpass more than 30% of Brazil’s GDP this year. If that China- and biofuel-driven supercycle does actually materialize, Brazil will take center stage. Per the FDA, Brazil’s agricultural sector could potentially gain an even larger share of global ag business in the years to come.

Agriculture isn’t the only story, there, though. Energy, of course, remains a player not only in Brazil but in the Latin American equities sector overall. Brazil and Mexico both lead the way with companies like Petrobras and Pemex respectively playing key roles. Once again, China is the key client, followed closely by the U.S.

Of course, both agribusiness and energy are very cyclical, but by layering in demand for battery metals, particularly, investors can diversify within a Latin America allocation. Consider the growing demand for lithium in South America. The global lithium market is projected to reach $22.6 billion by 2030, in large part thanks to the metal’s use in batteries.

The transition to electric vehicles will continue to drive that demand, with Chile, Argentina, and Brazil some of the biggest markets for the metal. While yes, there is enough lithium available to power the transition to electric vehicles, the bigger question is whether it’s accessible to miners. That will likely keep supply low enough to power solid returns for mining firms working in Latin America.

The Sprott Lithium Miners ETF (LITP) weights the Sociedad Quimica Y Minera De Chile S.A. (SQM) at 9.4%, more than double the next highest weight. Meanwhile, investors can get that Brazil exposure in ETFs like the VanEck Brazil Small-Cap ETF (BRF) and the iShares MSCI Brazil ETF (EWZ).

Could the Commodities Bubble Burst?

Comtois: I’m glad you brought up commodities because that actually leads to another point. Ultimately, your view on Latin American equity ETFs hinges on what you think commodities will do over the next year. While commodities are a tailwind for Latin American equities, it just takes one breakdown in global markets to collapse demand.

In fact, commodity prices are expected to fall by 21% this year. That expected drop in prices marks the sharpest decline since the pandemic. And prices are expected to remain stable — which is to say, flat — next year.

Energy prices are also expected to be 23% lower this year than last and remain stable (read: flat) in 2024. Shocks to commodity markets remain present. These include potential disruptions in the energy and metal supply chains, escalating geopolitical tensions, China’s industrial sector recovering faster than expected, and adverse weather.

Beyond the Commodity-Verse in Latin American Equities

Peters-Golden: Of course, the story of Latin America’s equities isn’t solely focused on commodities. Commodities face inherent limitations that may turn some investors off. They also aren’t always the best source of durable economic development.

Instead, two other trends deserve a look from investors and advisors looking at Latin American equities ETFs. E-commerce and nearshoring are driving economic growth on different sides of the Latin American world, but nonetheless need to be considered in investors’ calculation.

E-commerce for North American investors calls to mind some of the brightest parts of tech investing in firms like Shopify (SHOP). Of course, no name stands out like Amazon (AMZN) when one thinks of e-commerce, as well. Now take the growth of e-commerce and move it to Latin America in the form of Mercado Libre (MELI).

MELI is an Argentine firm based in Montevideo, Uruguay, that is up 41.6% YTD. MELI has a $60 billion market cap and is riding a big bounce since declining significantly between June 2021 and this past June. Much like AMZN or even Alibaba (BABA), it’s the dominant e-commerce name for its country. It actually dominates the whole continent, really, with a presence in Argentina, Brazil, Chile, Colombia, Mexico, Peru, and Venezuela.

That wide moat combined with good growth already on the books augurs well for Latin American equities investors. The Global X MSCI Argentina ETF (ARGT) weights MELI higher than any other stock at 19.1%.

Joining the MELI story is the “nearshoring” trend spiked by the pandemic. Really, nearshoring is about the U.S.-Mexico relationship, but could grow to other countries, too. Rather than outsource work overseas, some firms like Mattel (MAT) are “nearshoring,” bringing supply chains to the Western Hemisphere.

Nearshoring presents an opportunity for transportation and real estate investing in Mexico and anywhere else the trend takes hold. One could argue that added foreign investment could also boost wages and the overall economy, driving consumer spending, too. In whichever case, the iShares MSCI Mexico ETF (EWW) presents one potent option therein. It’s actually returned 25.6% YTD, too, a robust number for those looking south of the U.S. border.

Slow Growth, High Inflation

Comtois: Oh, for sure. Commodities are doing well. Nearshoring is a growing trend. But it should be noted that these are side issues. Ultimately, we’re talking about equities here. Which brings me to my final point. Not only are many Latin American countries dealing with political risk, but economic risk as well.

The region is poised for slow economic growth and persistently high inflation. This will likely be a challenging year for Latin America equities. Per the International Monetary Fund, growth in the region is primed to slow to 2% this year. In Brazil alone, real GDP is projected to grow by only 1.7% in 2023 and 1.2% in 2024.

Both jobs and consumer spending are slowing in Latin America. Consumer and business confidence are weakening.

And all of this is amid higher interest rates and high consumer prices. Yes, inflation in the region has gone down. But the IMF contends that the battle to bring down inflation will likely be a slow and protracted process. This doesn’t inspire confidence.

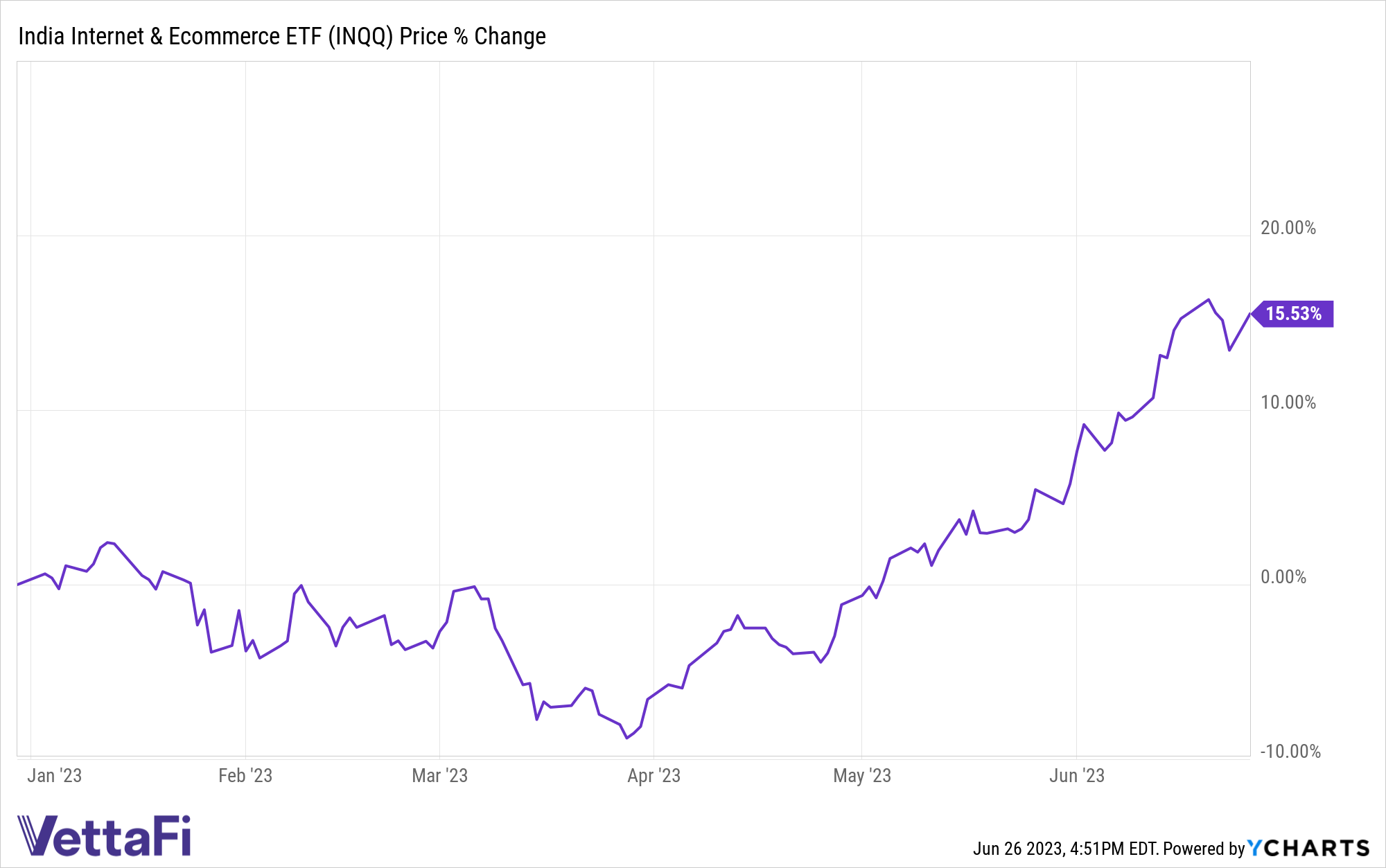

So, if one wants to invest in an emerging markets fund, might I suggest the India Internet & Ecommerce ETF (INQQ)? EMQQ Global’s India-centric fund has returned nearly 16% year-to-date.

INQQ presents an alternative with its focus on India.

Rating the Future of Latin American Equities

Peters-Golden: Much of the bull case that we’ve already touched on has been backwards looking, I’ll admit. Let’s turn to the future, now, because there’s a big turn that could be coming for the region. Recent reporting suggests that following record tightening by central banks throughout Latin America, rate cuts could be arriving soon. Those cuts could boost economies throughout the region, with credit flowing once again to businesses and consumers.

The region’s central banks started their rate hike regime back in 2021 in an effort to curb pandemic-related price increases. Those prices, driven by bottlenecks on production and rising food prices, took their toll on the economy. That inflation lifted rates to numbers as high as 11.25% in Chile and Mexico and 13.75% in Brazil.

Those high rates mean that some economists expect that Latin American central banks will be the “first to cut rates globally.” If so, that could provide a powerful boost to economies from Mexico all the way down to Chile.

That follows cuts already made by Costa Rica and Uruguay, with Chile expected to cut as soon as July. Of course, Argentina represents a significant outlier that likely won’t be cutting for a long time, but cuts for other countries could be very beneficial. The cuts could arrive at a time when Brazilian firms at least could really use financial relief.

All in all, that should invite investors and advisors to look again towards broad, Latin American equities ETFs. That includes names like the iShares Latin America 40 ETF (ILF) and the Franklin FTSE Latin America ETF (FLLA). ILF has returned 20.8% YTD and 34% over one year charging 47 basis points, while FLLA has returned 19.4% YTD and 30% over one year for 19 basis points.

Comtois: Once again, Nick, you have provided excellent points and given me much to think about. I can’t argue that Latin American equities ETFs don’t have many things going for them now. However, the political uncertainty, expected lowered commodities prices, and anticipated sluggish economic growth makes me cautious.

Until next time, Nick!

Peters-Golden: Likewise, James, I enjoyed our conversation! I’m putting on some bossa nova and sitting down to read some more about Latin American equities ETFs. Until next time, indeed!

For more news, information, and analysis, visit the Beyond Basic Beta Channel.