By Roland Morris, Portfolio Manager and Strategist, Commodities

Macro Outlook: Roll Yield Heats up in Energy and Agriculture

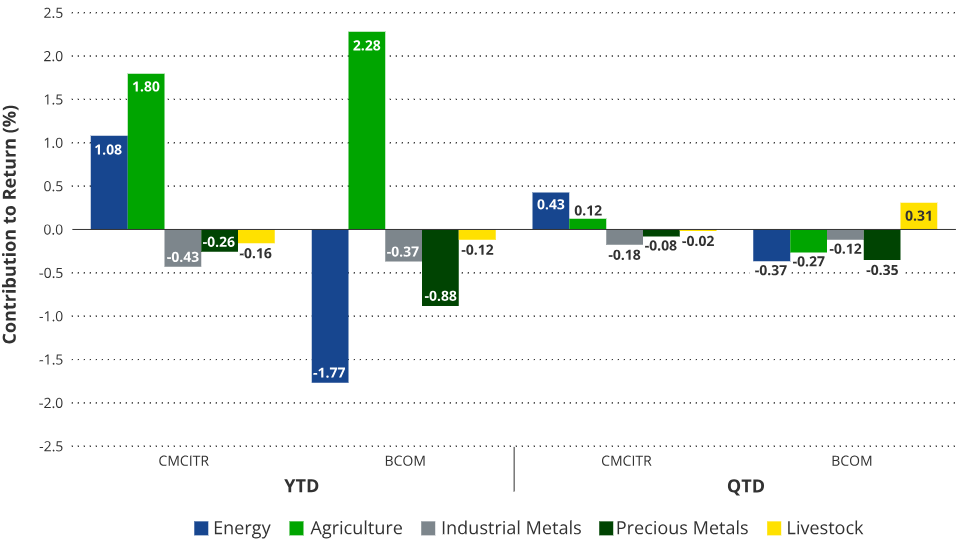

Commodity indexes had a strong 3rd quarter, led by the energy sector. The UBS Constant Maturity Commodity Index (CMCITR) had strong relative performance versus the Bloomberg Commodity Index (BCOM). CMCITR returned 7.18% versus BCOM’s 4.71%. Some outperformance was related to roll yield spread across the energy and agriculture sectors. CMCITR’s roll mythology continues to outperform BCOM generating slightly positive yield (+0.3%) during the quarter, while BCOM’s roll yield was negative (-0.8%).

Sector Review: Energy Led Gains While Curve Positioning Attributed to Outperformance

The energy sector rallied sharply during the quarter led by strong gains in gasoil and heating oil. There is a global shortage of diesel refining capacity that impacts both gasoil and heating oil. Interestingly, unleaded gas lagged due to the refineries running full steam to produce diesel. Unleaded gas as a byproduct was slightly over supplied during the quarter. WTI crude oil and Brent crude oil both rallied close to 20% during the quarter. Natural gas was down for the quarter but is projected to have a sharp rally early in the 4th quarter as we approach the heating season.

The industrial metals sector was up a little over 3% for the quarter and CMCITR’s larger exposure to the sector allowed for slightly improved relative performance versus BCOM. Gains in the sector were led by aluminum (+8%) and zinc (+12%). Disappointing growth in China continues to be a concern for the sector as China is the largest consumer of industrial metals by a wide margin.

The agriculture sector was mixed with large gains for sugar, cocoa, and cotton, while wheat fell around 15%. Soybeans, soy meal and bean oil all fell marginally. Curve positioning of CMCITR for the agriculture sector added to relative performance versus BCOM.

The livestock sector gained 2.5% during the quarter, led by continued gains in live cattle. It is currently trading at all-time historic highs. Lean hogs steered BCOM’s outperformance in the livestock sector ahead of CMCITR; however, the small sector weight in both indexes (CMCITR: 4.5%; BCOM: 6.15%) contributed minimally to absolute performance. This is evidenced in the Roll Yield chart below.

The precious metals sector was the only sector down during the quarter, falling around 3.6%. This was led by a 4% drop in gold prices. CMCITR’s smaller exposure to this sector versus BCOM added to the relative outperformance.

End of Year Outlook: Commodities Should Expect to Face Supply Shortages

The near-term outlook for commodities continues to be uncertain as U.S. interest rates and the U.S. Dollar continue to rise. The sharp rise in 10-year U.S. treasury yields late in the 3rd quarter was a headwind for growth and commodity demand. Over the longer term, we still believe commodity supplies will be tight, which will likely lead to higher prices and continued positive roll yield. Interest rates are also likely to remain higher for longer times, which will continue to provide positive returns on collateral.

Estimated Roll Yield Contribution

Source: Bloomberg. Data as of September 2023. Past performance is no guarantee of future results. Index performance is not illustrative of fund performance. It is not possible to invest in an index.

Learn more about the VanEck CM Commodity Index Fund and the recently launched VanEck CMCI Commodity Strategy ETF (CMCI) which seek to track, before fees and expenses, the CMCITR.

To receive more Natural Resources insights, sign up in our subscription center.

Disclosures

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities, financial instruments or digital assets mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, tax advice, or any call to action. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results, are for illustrative purposes only, are valid as of the date of this communication, and are subject to change without notice. Actual future performance of any assets or industries mentioned are unknown. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third-party data. The information herein represents the opinion of the author(s), but not necessarily those of VanEck or its other employees.

All indices are unmanaged and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. An index’s performance is not illustrative of the Fund’s performance. Indices are not securities in which investments can be made. Past performance is no guarantee of future results.

The UBS Bloomberg Constant Maturity Commodity Index (CMCITR) is a total return rules-based composite benchmark index diversified across 29 commodity components from within five sectors, specifically energy, precious metals, industrial metals, agricultural and livestock.

Bloomberg Commodity Index (BCOM) provides broad-based exposure to commodities, and no single commodity or commodity sector dominates the index. Rather than being driven by micro-economic events affecting one commodity market or sector, the diversified commodity exposure of BCOM potentially reduces volatility in comparison with non-diversified commodity investments.

UBS AG AND ITS AFFILIATES (“UBS”) DO NOT SPONSOR, ENDORSE, SELL, OR PROMOTE CM COMMODITY INDEX FUND (THE “PRODUCT”). A DECISION TO INVEST IN THE PRODUCT SHOULD NOT BE MADE IN RELIANCE ON ANY OF THE STATEMENTS SET FORTH IN THIS WEBSITE. PROSPECTIVE INVESTORS ARE ADVISED TO MAKE AN INVESTMENT IN THE PRODUCT ONLY AFTER CAREFULLY CONSIDERING THE RISKS ASSOCIATED WITH INVESTING IN THE PRODUCT, AS DETAILED IN THE PROSPECTUS THAT IS PREPARED BY OR ON BEHALF OF VANECK (“LICENSEE”), THE ISSUER OF THE PRODUCT. UBS HAS LICENSED CERTAIN UBS MARKS AND OTHER DATA TO LICENSEE FOR USE IN CONNECTION WITH THE PRODUCT AND THE BRANDING OF THE PRODUCT, BUT UBS IS NOT INVOLVED IN THE CALCULATION OF THE PRODUCT, THE CONSTRUCTION OF THE PRODUCT’S METHODOLOGY OR THE CREATION OF THE PRODUCT, NOR IS UBS INVOLVED IN THE SALE OR OFFERING OF THE PRODUCT, AND UBS DOES NOT MAKE ANY REPRESENTATIONS OR WARRANTIES WITH RESPECT TO THE PRODUCT AND DISCLAIMS ANY LIABILITY FOR ANY INACCURACY, ERROR OR DELAY IN, OR OMISSION OF THE DATA.

Investments in commodities can be very volatile and direct investment in these markets can be very risky, especially for inexperienced investors.

VanEck CM Commodity Index Fund: You can lose money by investing in the Fund. Any investment in the Fund should be part of an overall investment program, not a complete program. Commodities and commodity-linked derivatives may be affected by overall market movements and other factors that affect the value of a particular industry or commodity, such as weather, disease, embargoes or political or regulatory developments. Derivatives use leverage, which may exaggerate a loss. An investment in the Fund may be subject to risks which include, but are not limited to, risks related to commodities and commodity-linked derivatives, credit, derivatives, government-related bond, index tracking, industry concentration, investments in money market funds, interest rate, LIBOR replacement, market, operational, and subsidiary investment risk, all of which may adversely affect the Fund. The use of commodity-linked derivatives such as swaps, commodity-linked structured notes and futures entails substantial risks, including risk of loss of a significant portion of their principal value, lack of a secondary market, increased volatility, correlation, liquidity, interest-rate, valuation and tax risks. Gains and losses from speculative positions in derivatives may be much greater than the derivative’s cost. Investment in commodity markets may not be suitable for all investors. The Fund’s investment in commodity-linked derivative instruments may subject the Fund to greater volatility than investment in traditional securities.

VanEck CMCI Commodity Strategy ETF: An investment in the Fund may be subject to risks which include, among others, risks related to investing in the agricultural commodity sector, commodities and commodity-linked instruments, commodities and commodity-linked instruments tax, derivatives counterparty, energy commodity sector, metals commodity sector, U.S. treasury bills, Subsidiary investment, commodity regulatory and tax risks with respect to investments in the Subsidiary, gap, cash transactions, credit, debt securities, interest rate, derivatives, commodity index tracking, repurchase agreements, regulatory, market, operational, authorized participant concentration, new fund, no guarantee of active trading market, trading issues, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversified, and commodity index-related concentration risks, all of which may adversely affect the Fund. The use of commodity-linked derivatives such as swaps, commodity-linked structured notes and futures entails substantial risks, including risk of loss of a significant portion of their principal value, lack of a secondary market, increased volatility, correlation, liquidity, interest-rate, valuation and tax risks. Investment in commodity markets may not be suitable for all investors. The Fund’s investment in commodity-linked derivative instruments may subject the Fund to greater volatility than investment in traditional securities. The level of derivatives counterparty risk may be heightened due to the Fund currently only having a single counterparty available with which to enter into swap contracts on the Index.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider the investment objective, risks, charges and expenses of a Fund carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.

© 2023 Van Eck Securities Corporation, Distributor, a wholly-owned subsidiary of Van Eck Securities Corporation.

Originally published October 17, 2023.

For more news, information, and analysis, visit the Beyond Basic Beta Channel.