As automobiles become more computerized, the semiconductor industry is roaring, putting driving dynamics in the hands of motherboards as opposed to human drivers. It’s all well and good for semiconductor-focused exchange-traded funds (ETFs) like the VanEck Vectors Semiconductor ETF (SMH).

SMH seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS® US Listed Semiconductor 25 Index. The fund normally invests at least 80% of its total assets in securities that comprise the fund’s benchmark index.

The index includes common stocks and depositary receipts of U.S. exchange-listed companies in the semiconductor sector. Such companies may include medium-capitalization companies and foreign companies that are listed on a U.S. exchange.

SMH is coming off a 2019 in which the fund gained 64%. With 2020 obviously being a pandemic-ridden one, it might seem that SMH would even out. Despite the challenges, it’s still up 41%.

Market research company TechNavio noted in a report that “the global semiconductor chip packaging market size is poised to grow by USD 365.55 billion during 2020-2024, progressing at a CAGR of over 26% throughout the forecast period,” according a press release.

“The increasing use of semiconductors in the automobile sector will drive the growth of this industry during the forecast period,” the release said. “A variety of semiconductor ICs are used in automotive products such as GPS, airbag control, anti-lock braking system (ABS), power doors and windows, infotainment, automated driving, and collision detection technology. Apart from these factors the increase in car production, will also boost the demand for electronic devices. This in turn will indirectly trigger the demand for semiconductor chip packaging during the forecast period.”

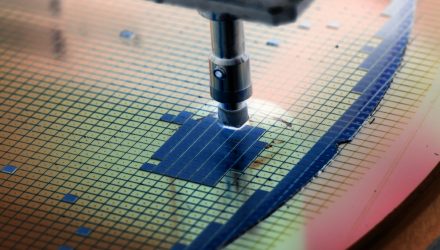

Reduced cost as a result of longer diameter wafers, thin slices of semiconductors, is driving down cost.

“The shift to longer diameter wafers reduces the cost of manufacturing semiconductor ICs by nearly 20%-25%,” the release noted. “Recent semiconductors have increased the size of the silicon wafers from 100 mm to 300 mm because of the above-mentioned reason. This trend is expected to gather further momentum during the forecast period as companies are investing a substantial amount in constructing and upgrading fabs to manufacture 300-mm wafers. With the success of this, there are few recent advancements where the industry is planning to develop 450-mm wafer technology, which will also have a positive impact on the semiconductor chip packaging market.”

For more news and information, visit the Tactical Allocation Channel.