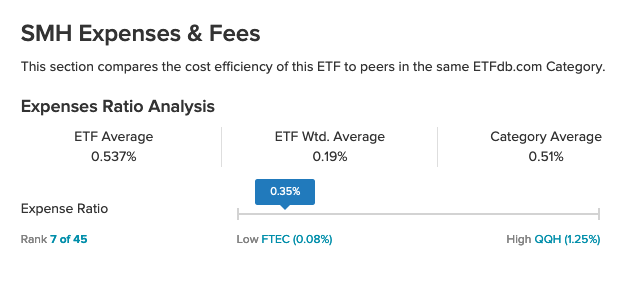

ETF investors don’t have to sacrifice performance for low cost. The VanEck Vectors Semiconductor ETF (SMH) is up over 60% within the past year with just a 0.35% expense ratio.

With a categorical average of 0.51%, SMH’s expense ratio comes in at 12 basis points lower.

For that low cost of entry, ETF investors have snagged a top performer over the last 12 months:

SMH seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS® US Listed Semiconductor 25 Index. The fund normally invests at least 80% of its total assets in securities that comprise the fund’s benchmark index.

The index includes common stocks and depositary receipts of U.S. exchange-listed companies in the semiconductor sector. Such companies may include medium-capitalization companies and foreign companies that are listed on a U.S. exchange.

The ETF is already surpassing the S&P 500 Semiconductor index for the same 12-month time frame:

Overall, SMH offers:

- Highly Liquid Companies: Index seeks to track the most liquid companies in the industry based on market capitalization and trading volume

- Industry Leaders: Index methodology favors the largest companies in the industry

- Global Scope: Portfolio may include both domestic and U.S. listed foreign companies for enhanced industry representation

The Outlook for Semiconductors in 2021

When it comes to the semiconductor industry, growth prospects look promising. An Investor’s Business Daily article notes that the “industry is poised for faster growth in 2021 now that it has recovered from a cyclical downturn.”

“World Semiconductor Trade Statistics predicts that chip sales will accelerate to 8.4% growth next year, reaching $469 billion in revenue,” the article added. “For 2020, it estimated that chip sales would rise 5.1% to $433 billion. That’s after semiconductor industry sales fell 12% to $412 billion in 2019. Semiconductor industry sales returned to growth this year despite disruptions from the Covid-19 pandemic.”

The industry is also getting a vote of confidence from global investment firm UBS.

“Elsewhere, investment bank UBS forecasts that semiconductor industry revenue will rise 12% in 2021 to about $492 billion,” the article noted further. “UBS estimates that semiconductor revenue grew about 7% to $439 billion in 2020, bucking a challenging economic climate from the coronavirus pandemic.”

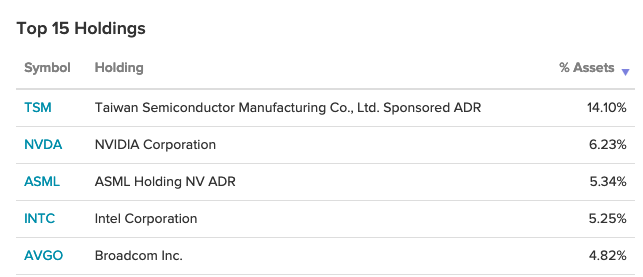

SMH’s top holding, with a 14% allocation as of January 18, is Taiwan Semiconductor Manufacturing Co Ltd (TSM), which is up over 110% within the past year.

For more news and information, visit the Tactical Allocation Channel.