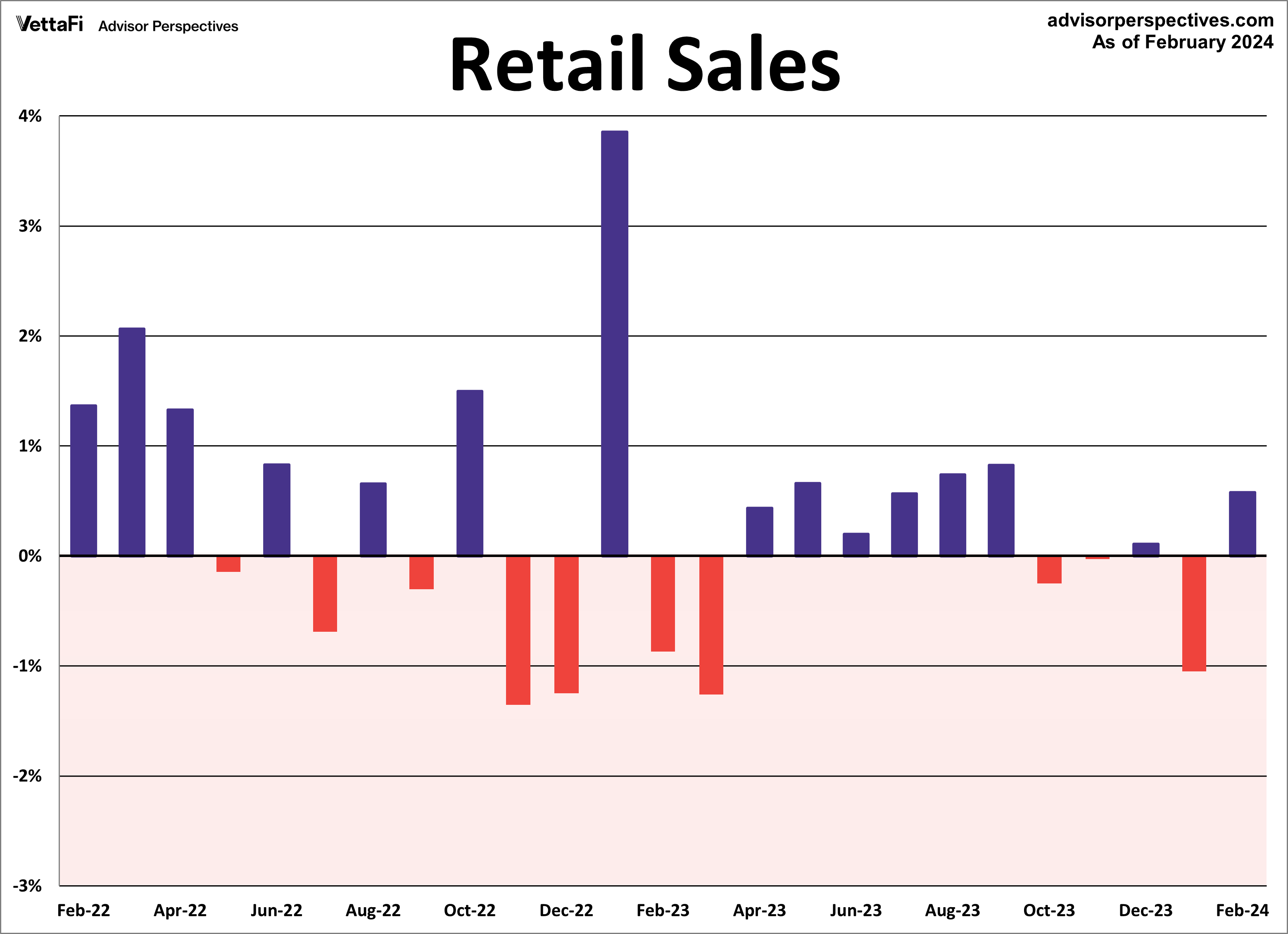

The Census Bureau’s Advance Retail Sales Report for February revealed a 0.6% rebound in headline sales from January, the largest monthly rise in consumer spending since September. The latest increase, however, was lower than the anticipated 0.8% monthly growth.

For an inflation-adjusted perspective on retail sales, take a look at our Real Retail Sales commentary.

Here is the introduction from today’s report:

Advance estimates of U.S. retail and food services sales for February 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $700.7 billion, up 0.6 percent (±0.5 percent) from the previous month, and up 1.5 percent (±0.7 percent) above February 2023. Total sales for the December 2023 through February 2024 period were up 2.1 percent (±0.5 percent) from the same period a year ago. The December 2023 to January 2024 percent change was revised from down 0.8 percent (±0.5 percent) to down 1.1 percent (±0.4 percent).

Retail trade sales were up 0.6 percent (±0.5 percent) from January 2024, and up 0.8 percent (±0.5 percent) above last year. Nonstore retailers were up 6.4 percent (±1.6 percent) from last year. Food services and drinking places were up 6.3 percent (±2.1 percent) from February 2023.

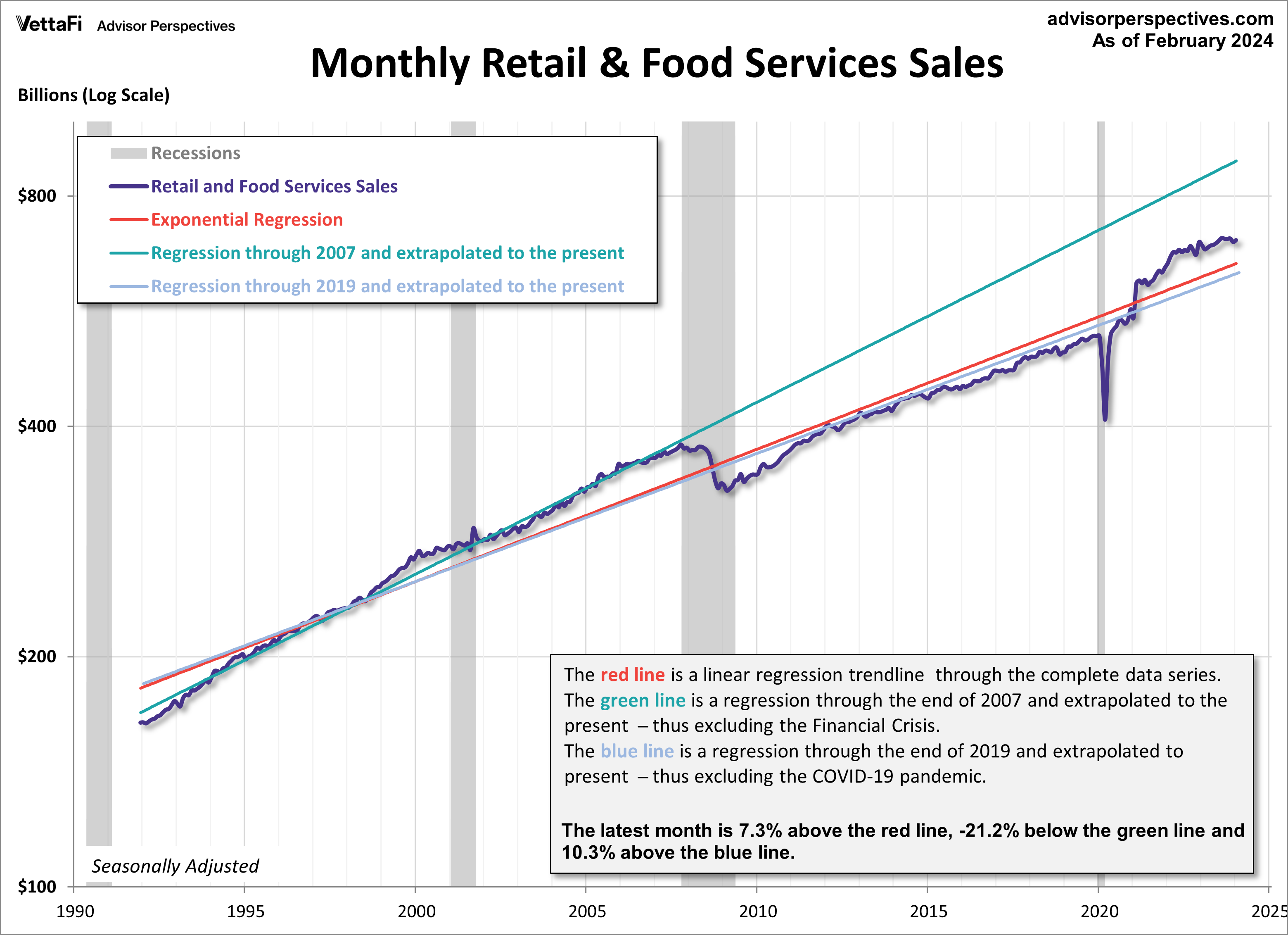

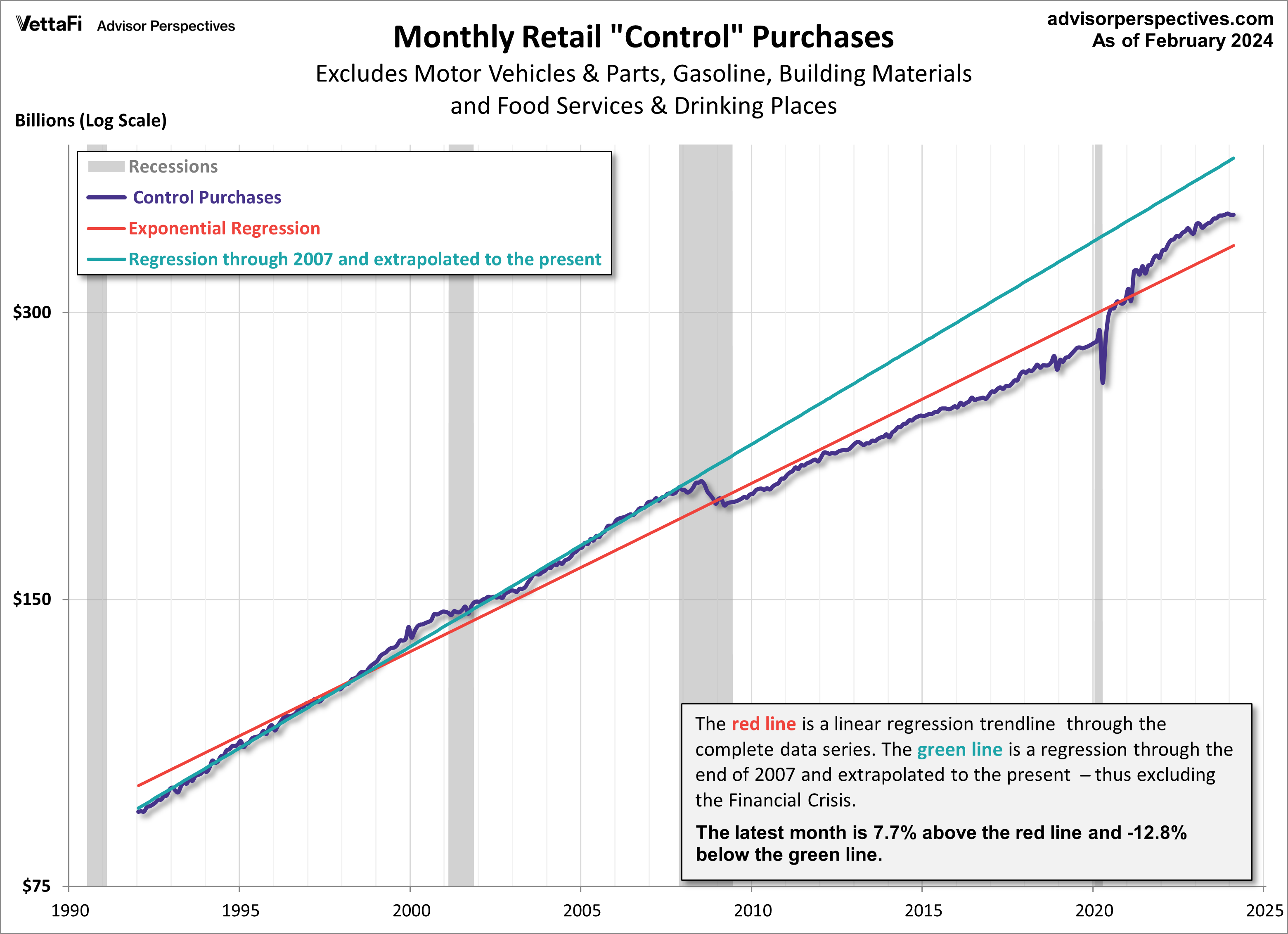

The chart below is a log-scale snapshot of retail sales since the early 1990s. The three exponential regressions through the data help us to evaluate the long-term trend of this key economic indicator.

- The red line is a linear regression through the complete data series.

- The green line is a regression from the start of the series through the end of 2007 and then extrapolated to the present – thus excluding the Financial Crisis.

- The blue line is a regression from the start of the series through the end of 2019 and then extrapolated to the present – thus excluding the COVID-19 pandemic.

Monthly retail sales have been above the red and blue line since March 2021. That signals increased consumer spending that was most likely pent up as a result of the pandemic.

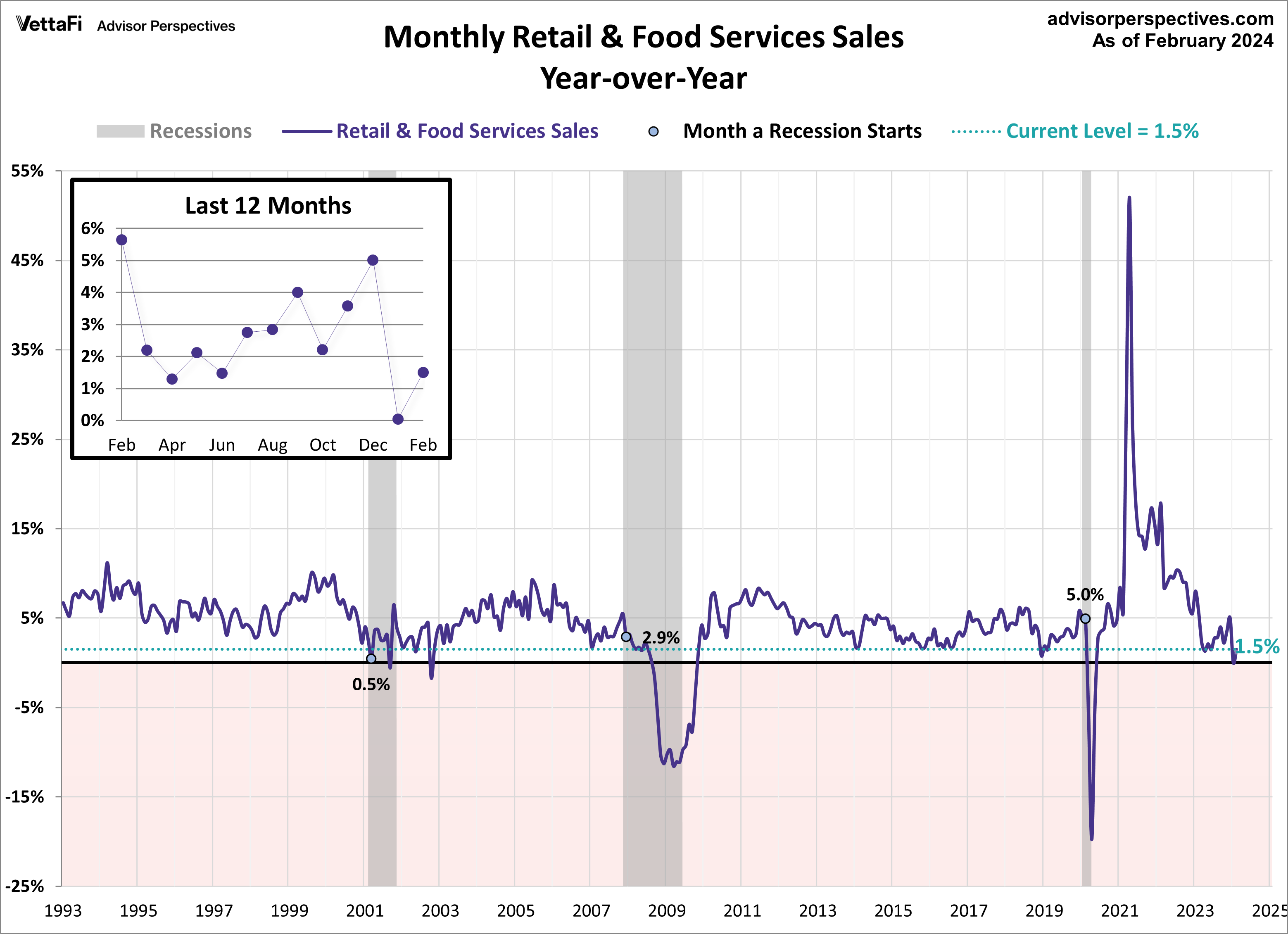

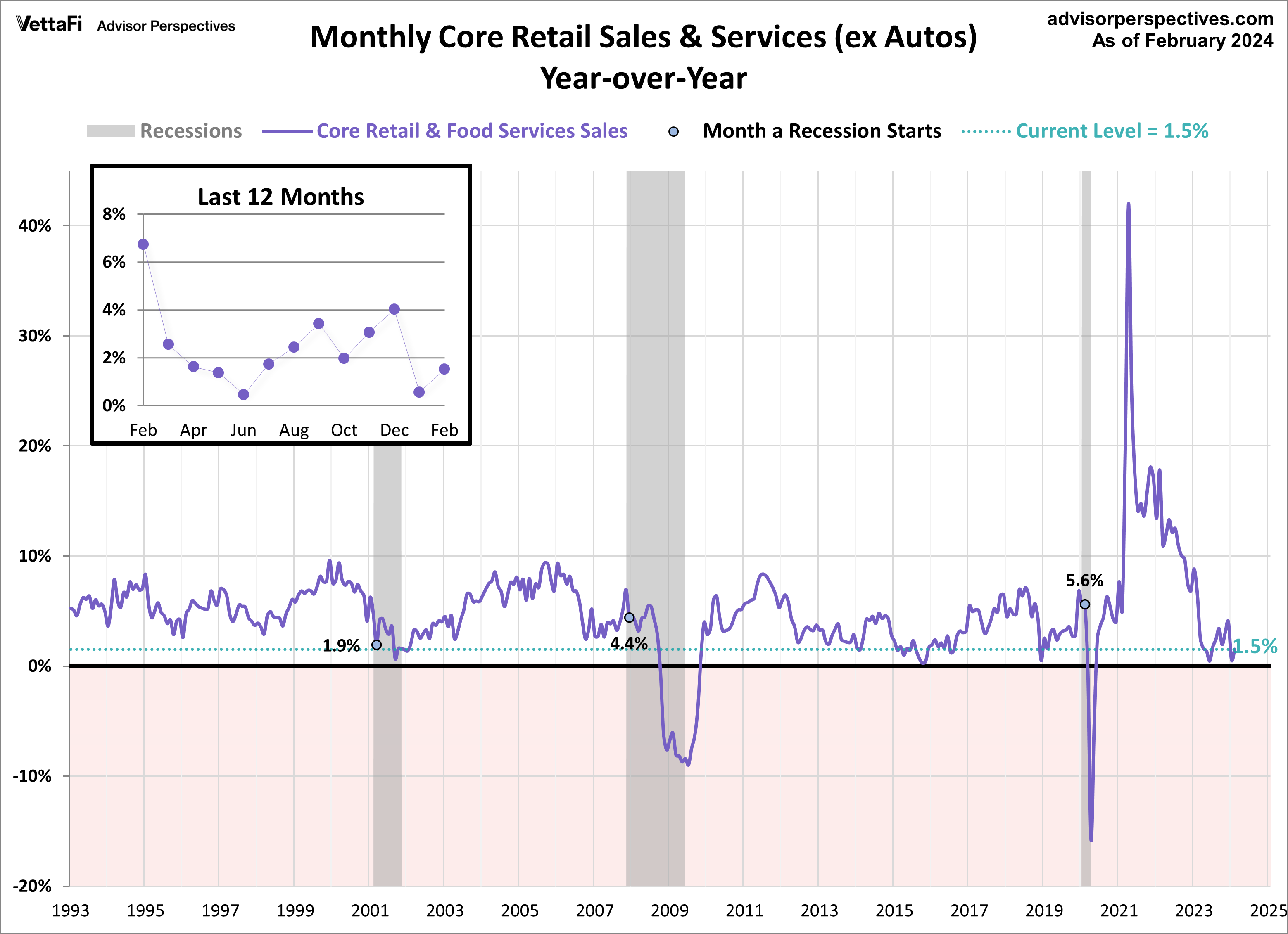

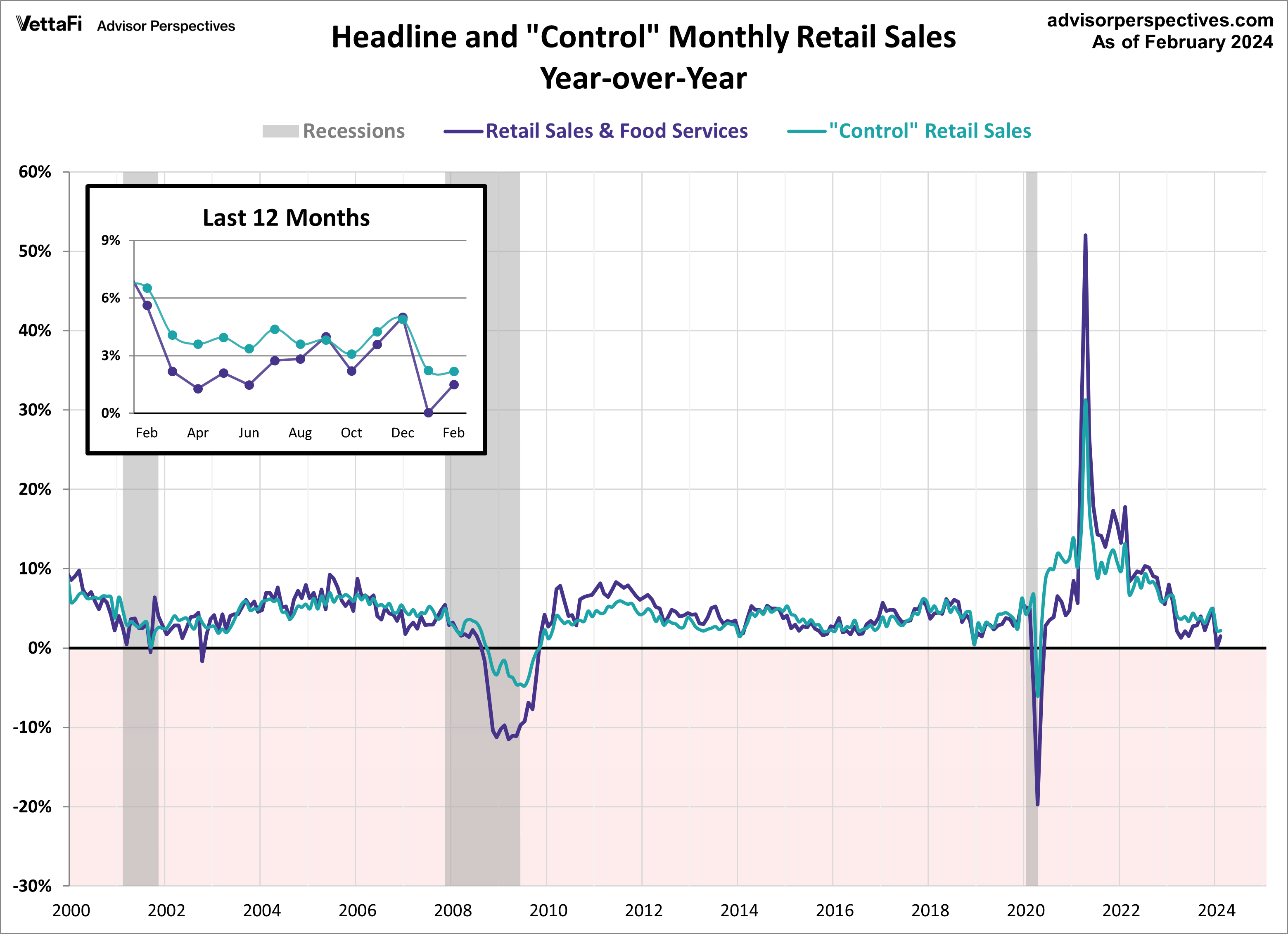

The year-over-year percent change provides another perspective on the historical trend. Current retail sales are up 1.5% compared to February 2023. Here is the headline series with a callout to the most recent 12 months.

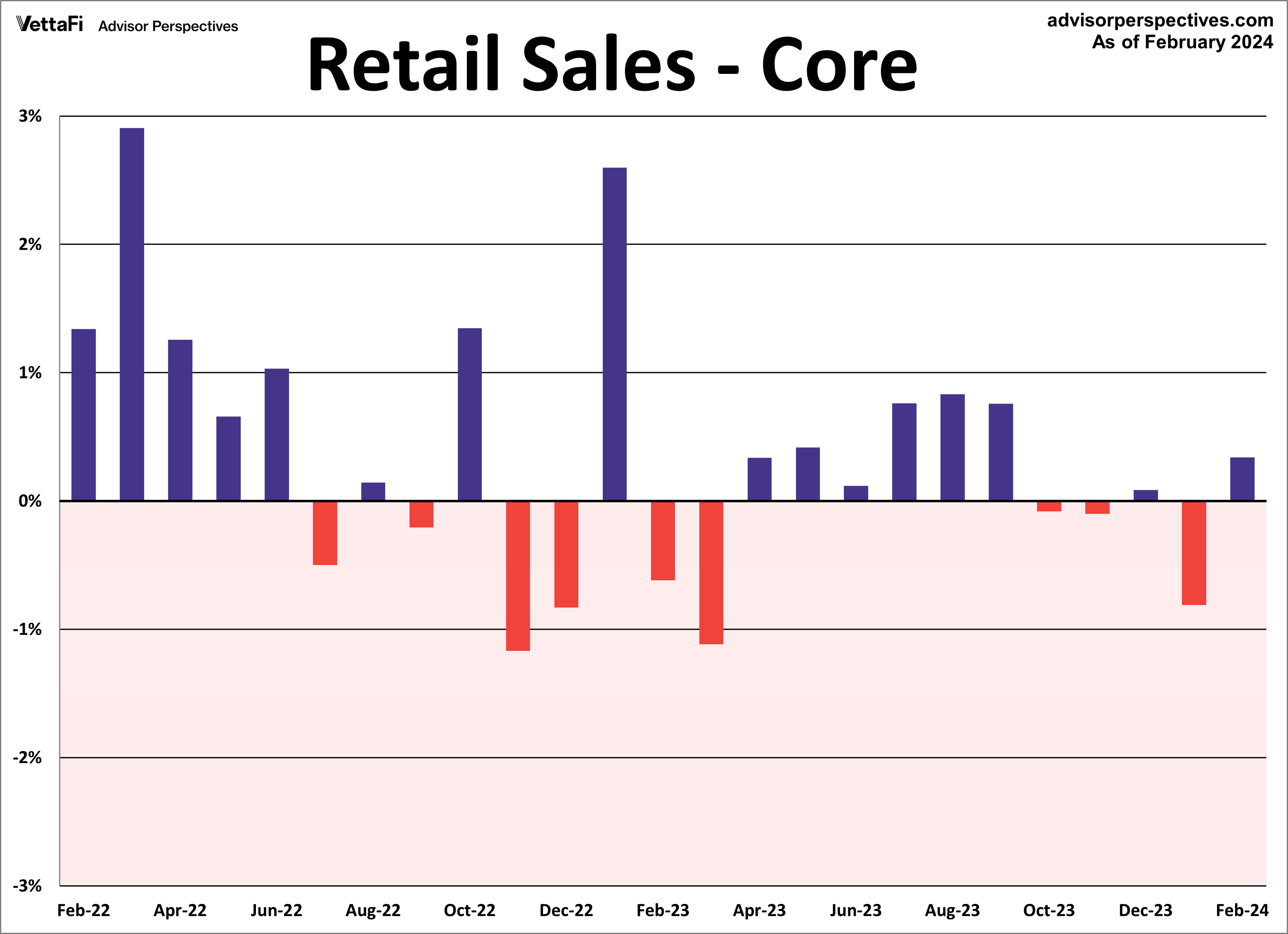

Core Retail Sales

Core sales (ex Autos) also fell short of expectations by increasing 0.3% in February compared to the expected 0.5% growth.

And core retail sales are up 1.5% compared to February 2023. Here is the year-over-year chart of core retail sales with a callout to the most recent 12 months.

Retail Sales: “Control” Purchases

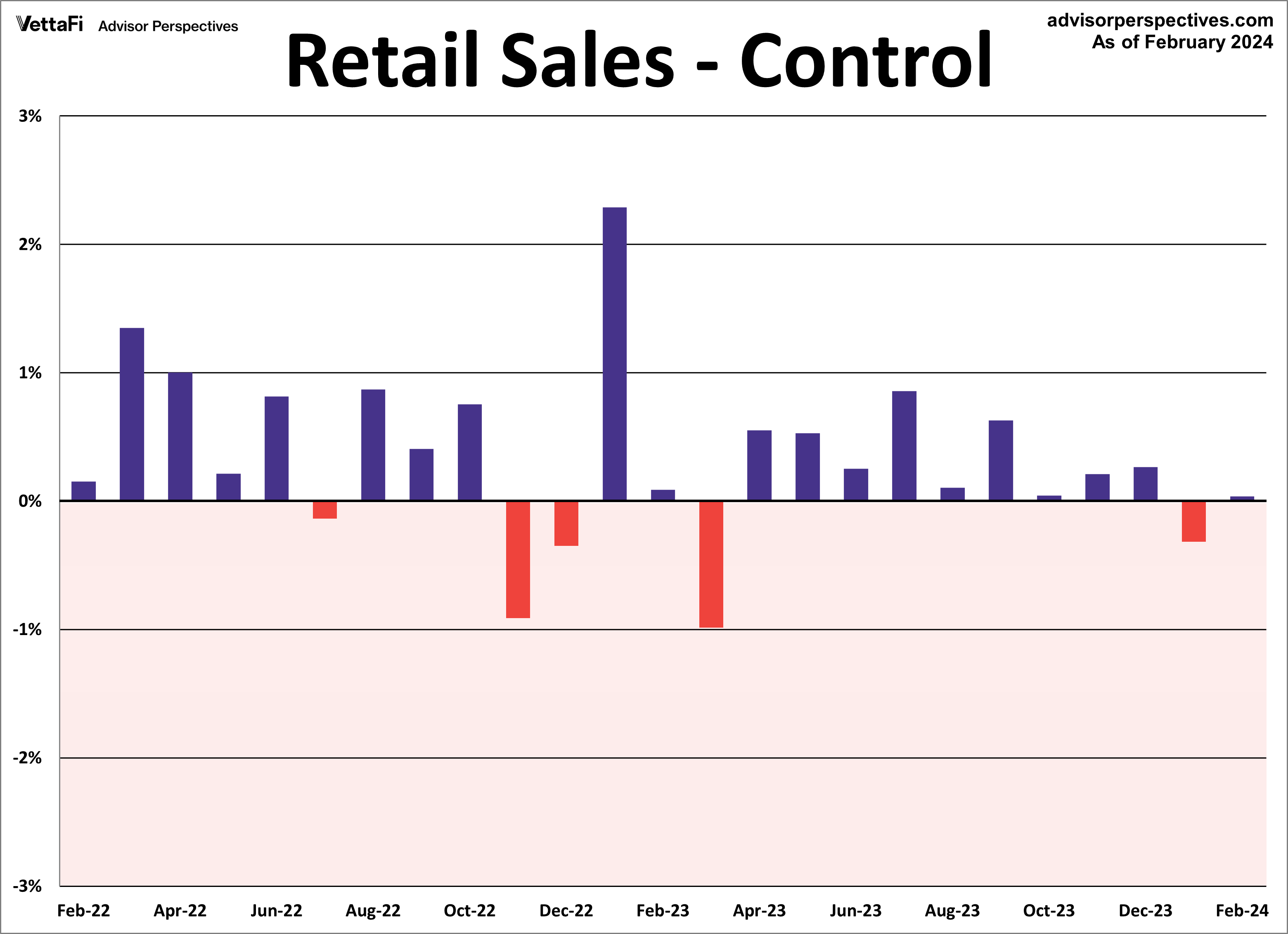

The next two charts illustrate retail sales “control” purchases, which is an even more “core” view of retail sales. This series excludes motor vehicles & parts, gasoline, building materials as well as food services & drinking places. The popular financial press typically ignores this series, but it’s a more consistent and reliable reading of the economy. Retail sales control purchases were flat in February.

Similar to the retail sales snapshot chart earlier, the chart below is a log-scale snapshot of control purchases since the early 1990s. It includes two of the exponential regressions previously mentioned.

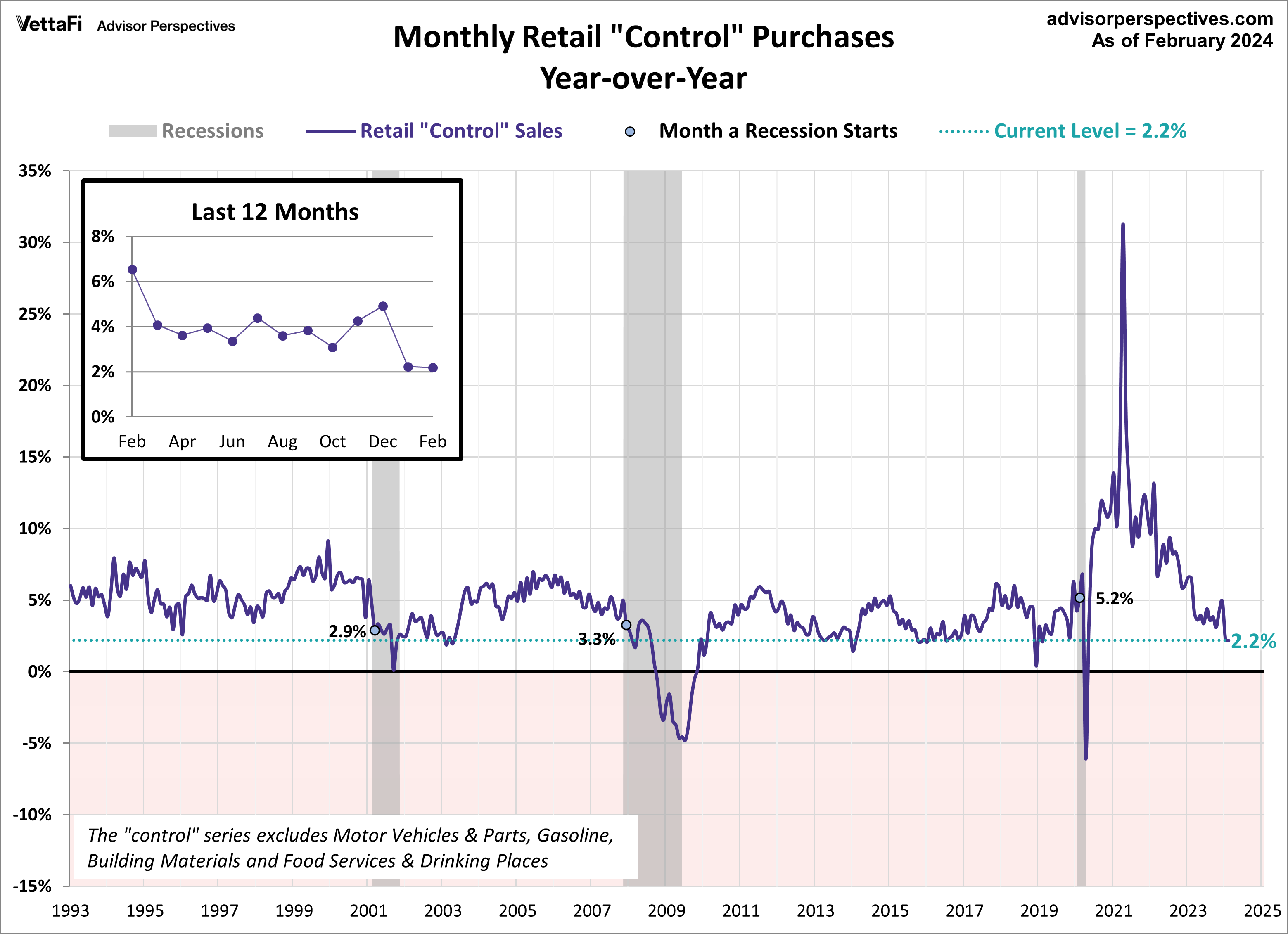

Here is the same series year-over-year. Current control purchases are up 2.2% compared to February 2023, the lowest level since April 2020.

For a better sense of the reduced volatility of the “control” series, here is a YoY overlay with the headline retail sales. Note that the two series follow each other closely. But headline sales have more extreme highs and lows than the control series.

Bottom Line

Retail sales rebounded in February following the pullback in consumer spending in January. With that said, both headline and core retail sales fell short of expectations, suggesting a cautious consumer.

Retail sales will impact interest in the SPDR S&P Retail ETF (XRT), VanEck Retail ETF (RTH), Amplify Online Retail ETF (IBUY), and ProShares Online Retail ETF (ONLN).

For more news, information, and strategy, visit the Beyond Basic Beta Channel.