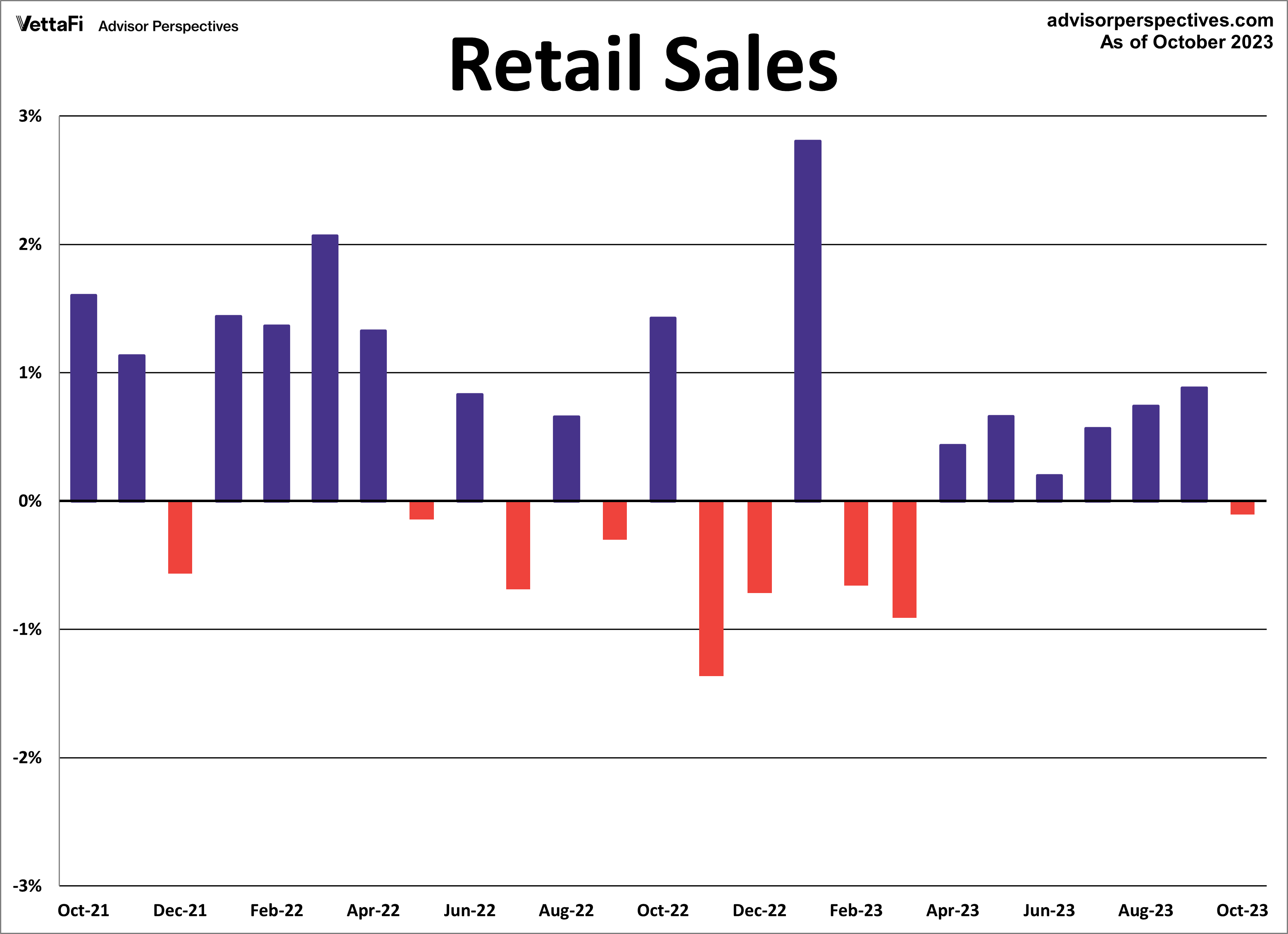

The Census Bureau’s Advance Retail Sales Report for October revealed a 0.1% decrease in headline sales compared to September. That marks the first month consumers have pulled back their spending since March. The latest figure was less than the anticipated 0.3% monthly decline. Core sales (ex Autos) beat expectations by increasing 0.1% in October compared to the expected 0.2% decline.

For an inflation-adjusted perspective on retail sales, take a look at our Real Retail Sales commentary.

Here is the introduction from today’s report:

Advance estimates of U.S. retail and food services sales for October 2023, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $705.0 billion, down 0.1 percent (±0.5 percent)* from the previous month, and up 2.5 percent (±0.7 percent) above October 2022. Total sales for the August 2023 through October 2023 period were up 3.1 percent (±0.4 percent) from the same period a year ago. The August 2023 to September 2023 percent change was revised from up 0.7 percent (±0.5 percent) to up 0.9 percent (±0.2 percent).

Retail trade sales were down 0.2 percent (±0.5 percent)* from September 2023, and up 1.6 percent (±0.5 percent) above last year. Gasoline Stations were down 7.5 percent (±1.1 percent) from last year. Nonstore retailers were up 7.6 percent (±1.6 percent) from October 2022.

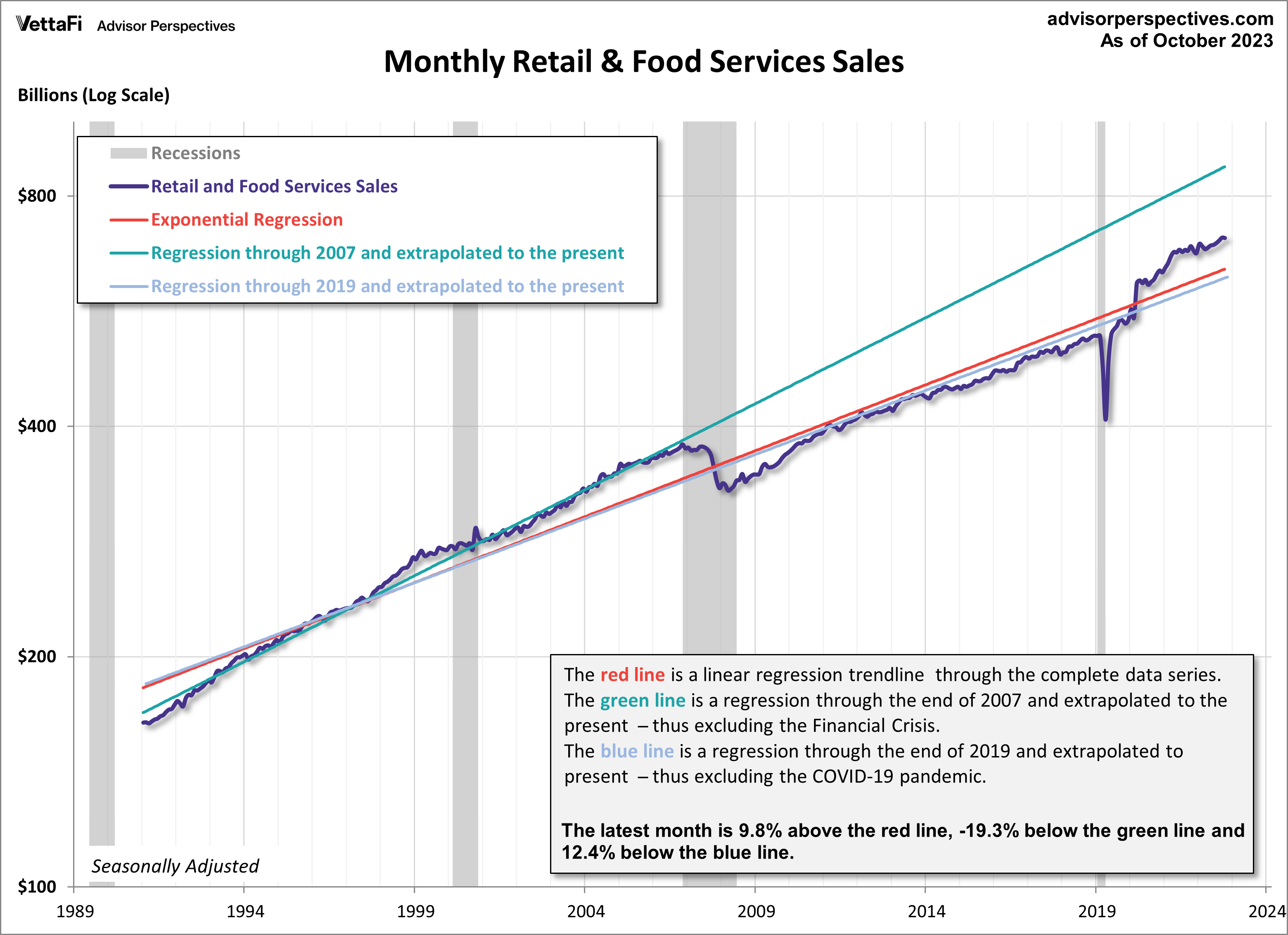

The chart below is a log-scale snapshot of retail sales since the early 1990s. The three exponential regressions through the data help us to evaluate the long-term trend of this key economic indicator.

- The red line is a linear regression through the complete data series.

- The green line is a regression from the start of the series through the end of 2007. It’s then extrapolated to the present – thus excluding the Financial Crisis.

- The blue line is a regression from the start of the series through the end of 2019. It is then extrapolated to the present – thus excluding the COVID-19 pandemic.

Monthly retail sales have been above the red and blue line since March 2021. This signals increased consumer spending that was most likely pent up as a result of the pandemic.

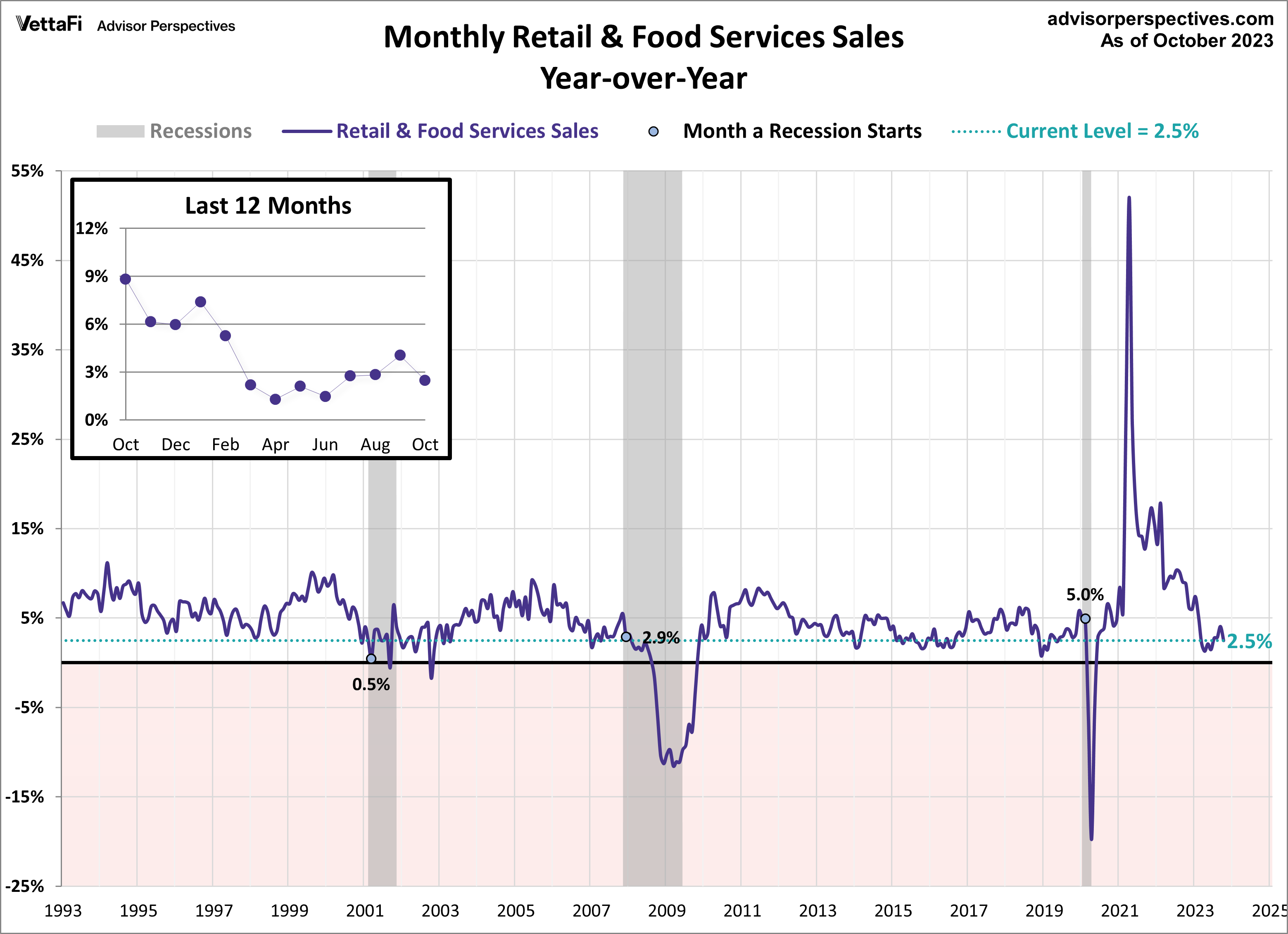

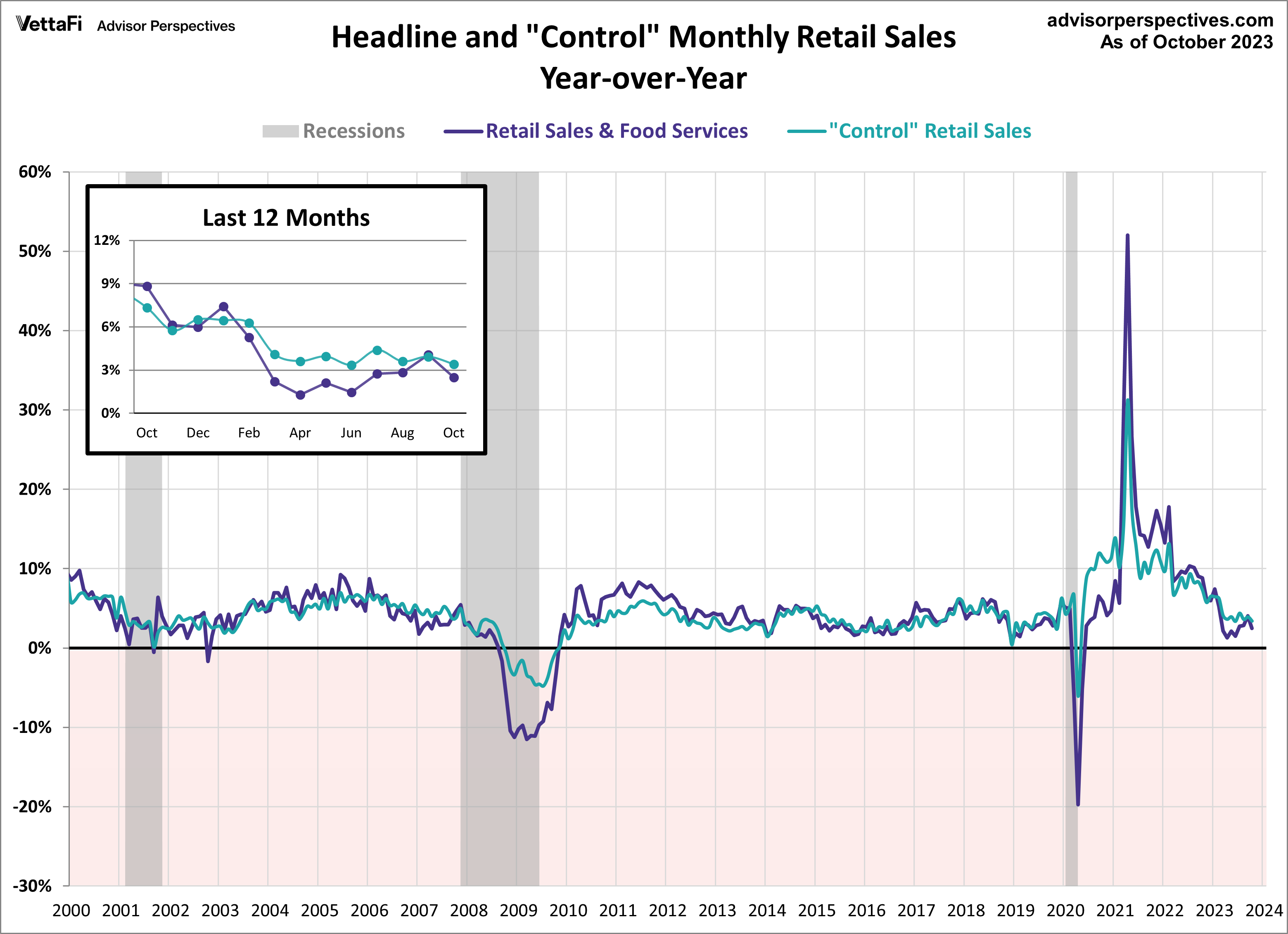

The year-over-year percent change provides another perspective on the historical trend. Current retail sales are up 2.5% compared to October 2022. Here is the headline series with a callout to the most recent 12 months.

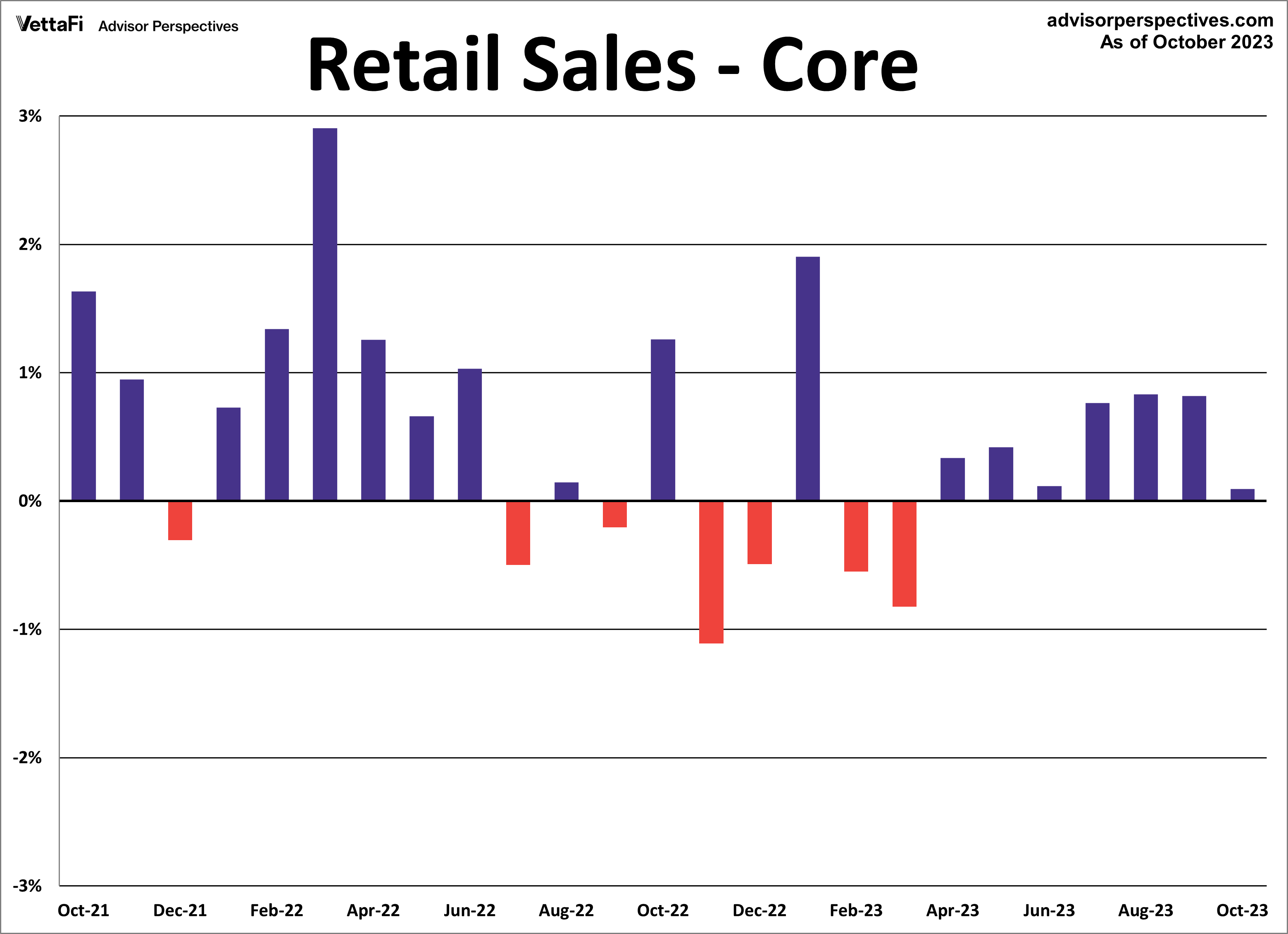

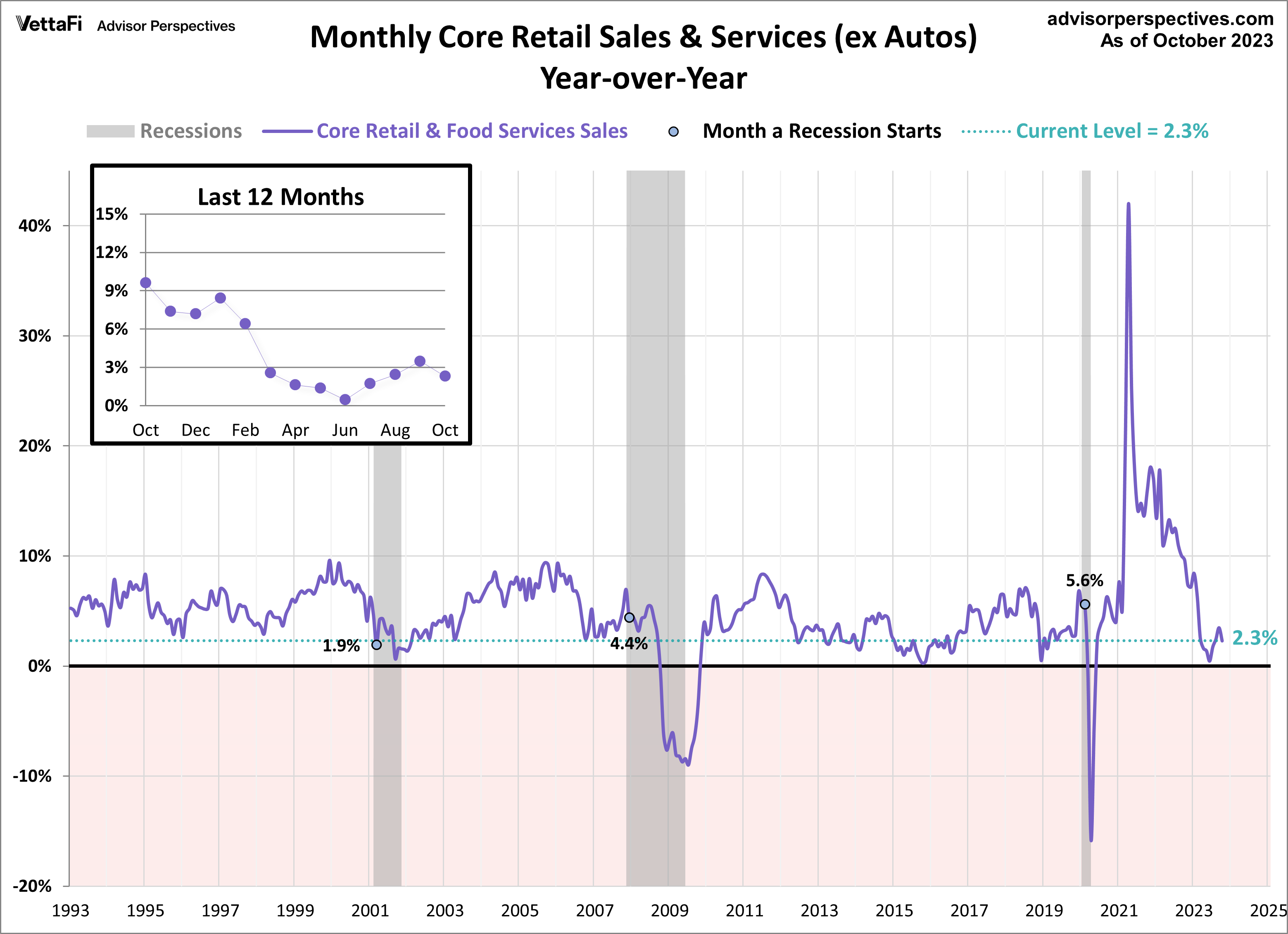

Core Retail Sales

Ex-autos, core sales beat expectations by increasing 0.1% in October compared to the expected 0.2% decline. Core retail sales have now increased for 7 consecutive months.

Core retail sales are up 2.3% compared to October 2022. Here is the year-over-year chart of core retail sales with a callout to the most recent 12 months.

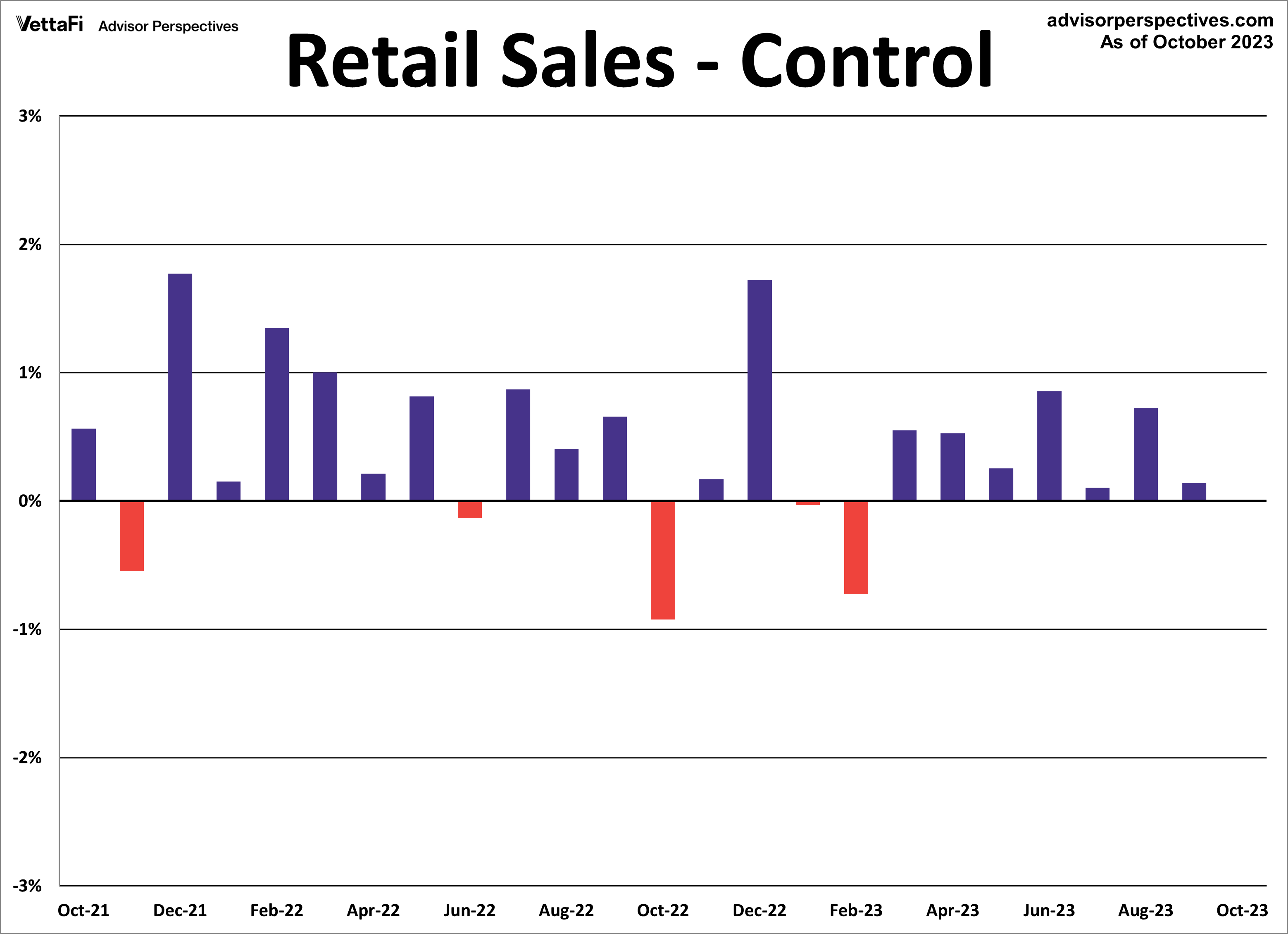

Retail Sales: “Control” Purchases

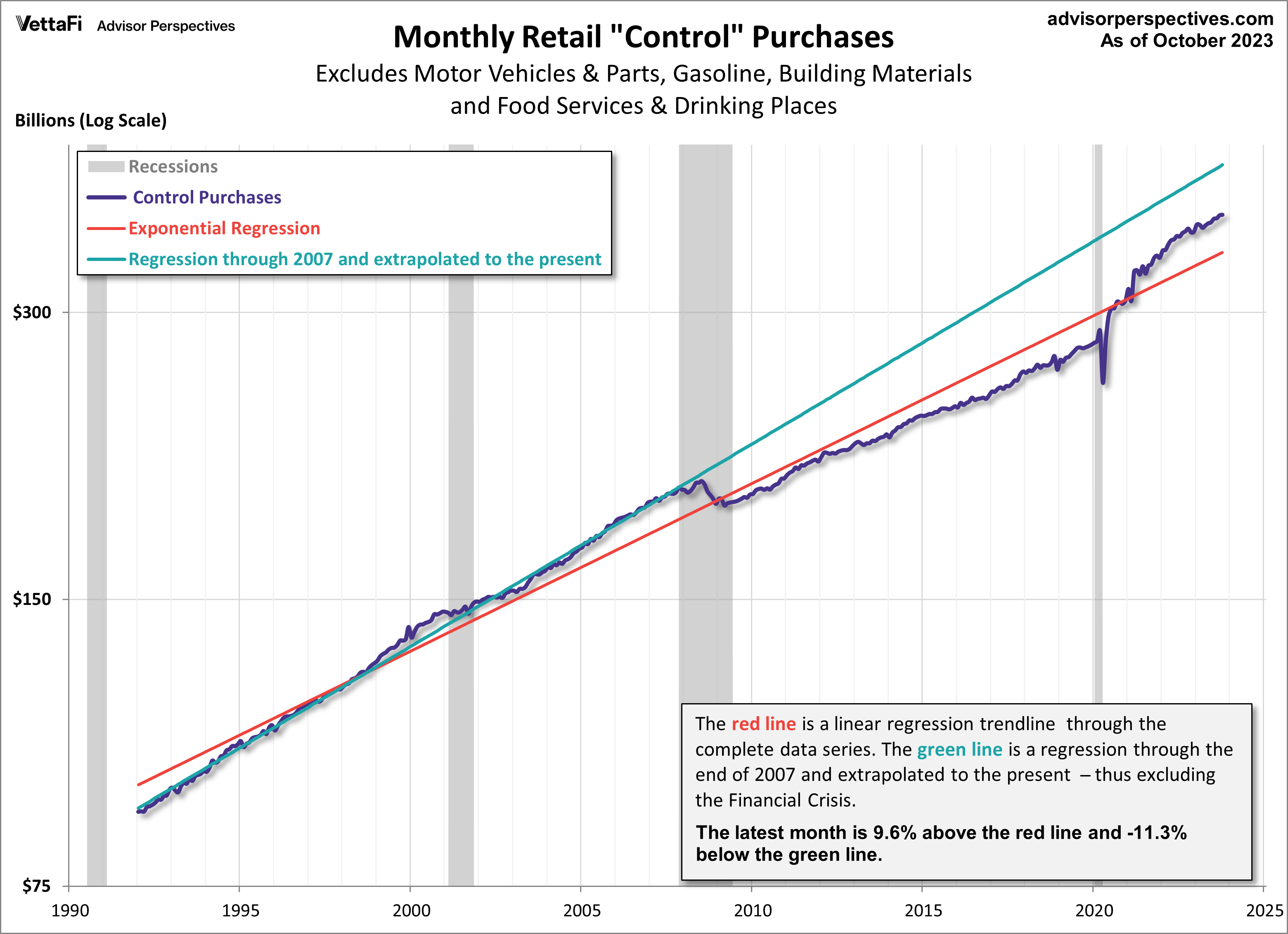

The next two charts illustrate retail sales “control” purchases, which is an even more “core” view of retail sales. This series excludes motor vehicles & parts, gasoline, building materials as well as food services & drinking places. The popular financial press typically ignores this series, but it’s a more consistent and reliable reading of the economy. Retail sales control purchases increased 0.1% in October.

Similar to the retail sales snapshot chart earlier, the chart below is a log-scale snapshot of control purchases since the early 1990s and includes two of the exponential regressions previously mentioned.

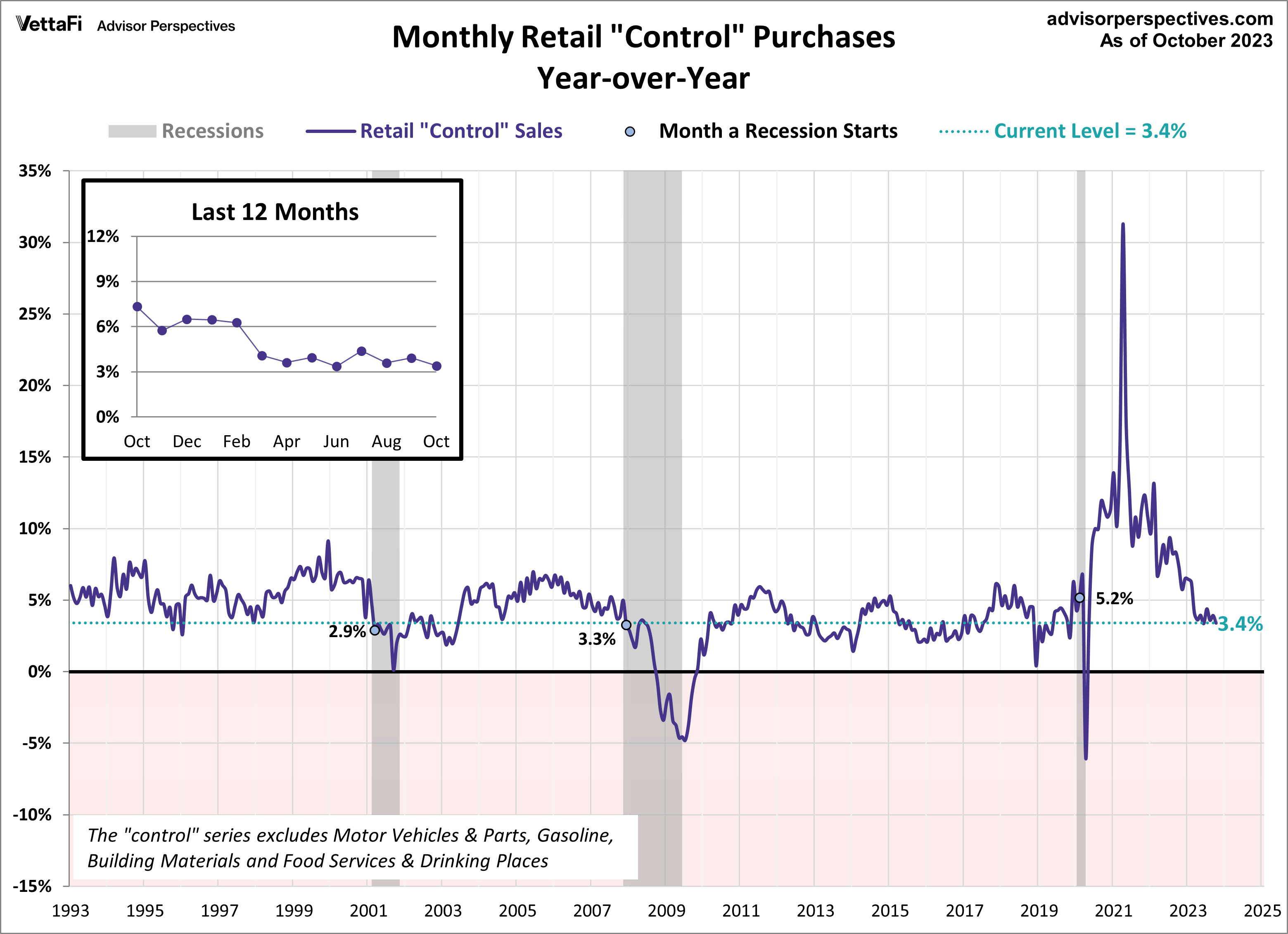

Here is the same series year-over-year. Current control purchases are up 3.4% compared to October 2022.

For a better sense of the reduced volatility of the “control” series, here is a YoY overlay with the headline retail sales. Note that the two series follow each other closely, but headline sales have more extreme highs and lows than the control series.

Bottom Line: Headline retail sales fell for the first time in 7 months as consumers pulled back on spending. However, core and control sales both increased from September, marking the 7th straight month of increased sales for each of the series.

Retail sales will impact interest in the SPDR S&P Retail ETF (XRT), VanEck Retail ETF (RTH), Amplify Online Retail ETF (IBUY), and ProShares Online Retail ETF (ONLN).

For more news, information, and strategy, visit the Beyond Basic Beta Channel.