Retail earnings season is starting to wind down with reports from some smaller names finally starting to roll in. While a few smaller retailers still have yet to report, we now have earnings numbers from all the major bellwethers after receiving the recent report from Kohl’s.

Most major retailers have put up attractive comparisons versus their consensus estimates, which have boosted retail exchange-traded funds.

E-commerce Retail Earnings

Let’s start with the major e-commerce retailers, which were among the first to report. Amazon posted adjusted earnings of $1 per share on $170 billion in sales, beating the consensus estimates of 80 cents per share on $166.26 billion in revenue.

Unlike the other companies on this list, Amazon isn’t pure-play retail, as it rakes in significant profits from its cloud business, Amazon Web Services. In the fourth quarter, AWS accounted for $24.2 billion of Amazon sales, while advertising accounted for $14.7 billion, so the lion’s share of its revenue still comes from online sales. For the first quarter, Amazon projects sales of $138 billion to $143.5 billion, which was weak versus the consensus estimate of $142.1 billion for Q1.

Meanwhile, eBay also beat earnings estimates, although not by as much as Amazon. eBay’s fourth-quarter numbers came in at $1.07 per share in adjusted earnings on $2.56 billion in revenue, versus the consensus estimates of $1.03 per share on $2.51 billion in sales.

Big-Box & Wholesale Retailers

Walmart easily beat earnings estimates with adjusted earnings of $1.80 per share on $173.4 billion in sales, versus the consensus numbers of $1.65 per share on $170.7 billion in revenue. The big-box retailer has thus far been one of the big winners of the high inflation we’ve seen over the last year or so as consumers turned to its everyday low prices to meet their needs.

Target reported $2.98 per share in earnings on $31.9 billion in sales, versus the consensus estimates of $2.42 per share on $31.8 billion in revenue. The retailer struggled in 2023 due to its dependence on a larger share of discretionary items versus Walmart’s sales mix. However, Target stock popped following the latest release due to improving profits.

On the other hand, Costco was one of a relatively small number of retailers to disappoint on sales during the holiday quarter, although it did beat expectations for profits. The wholesale/retail chain posted earnings of $3.92 per share on $58.4 billion in revenue, versus the consensus estimates of $3.62 per share in earnings on $59.2 billion in sales. Despite the revenue disappointment, Costco reported a 5.6% year-over-year increase in comparable-store sales globally.

Department Stores

Moving onto the few department stores that remain, Macy’s reported another quarter of tumbling sales as it tried to resume growth. The retailer reported adjusted earnings of $2.45 per share on $8.12 billion in sales, versus the consensus numbers of $1.96 per share on $8.15 billion in revenue.

On a net basis, Macy’s swung to a loss, posting net losses of 26 cents per share or $71 billion, down from a net profit of $1.83 per share or $508 million a year ago. Unfortunately, Macy’s e-commerce sales fell 4% year over year, another big concern for the department store operator. Traditional brick-and-mortar retailers like Walmart have been able to grow their overall sales significantly by focusing on online sales alongside their in-store sales.

Kohl’s missed expectations by a wide margin, reporting a sizable loss of $2.49 per share, versus expectations of a 98-cent-per-share profit. Revenue also missed, coming in at $5.78 billion versus the expected $5.99 billion. Same-store sales plunged 6.6% during the holiday, contributing to the disappointments as Kohl’s as management blamed it on inflation.

Retail-Focused ETFs

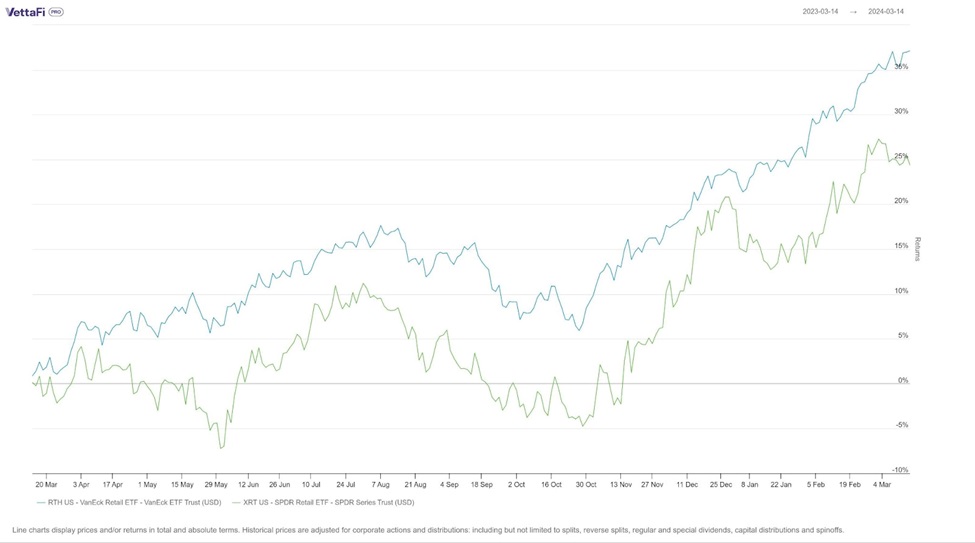

Chart via VettaFi PRO (formerly the LOGICLY platform)

So far, 2024 has largely been a solid year for retail stocks, with noteworthy gains in most names. As such, funds like the SPDR S&P Retail ETF (XRT) and the VanEck Retail ETF (RTH) are holding their own, with the former up 4.6% year to date and the latter gaining an impressive 10.2% as of Friday.

With a net asset value of $399.6 million, XRT tracks a modified, equal-weighted version of the S&P Retail Select Industry Index, and its top holdings are Carvana, Abercrombie + Fitch, and Advance Auto Parts.

Meanwhile, RTH has total net assets of $191.8 million and tracks the MVIS U.S.-listed Retail 25 Index. Its top holdings are Amazon, Home Depot, and Costco.

For more news, information, and analysis, visit the Beyond Basic Beta Channel.