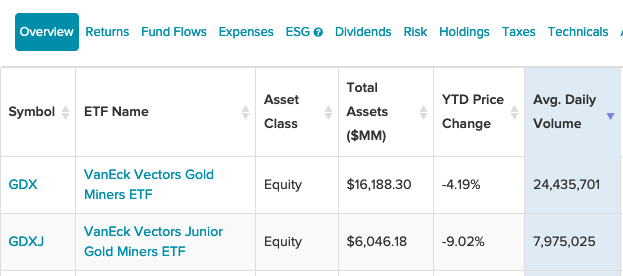

A confluence of factors are affecting gold prices, including Bitcoin’s upward run, rising Treasury yields, and a stronger dollar. This is feeding into heavy daily volume for the VanEck Vectors Gold Miners ETF (GDX) and VanEck Vectors Junior Gold Miners ETF (GDXJ).

“Bouts of dollar strength and the uptick in U.S. yields have triggered short-term corrections,” said Standard Chartered Analyst Suki Cooper in a CNBC article. “The gold market is caught between longer-term buying on the back of rising inflation expectations given stimulus measures, but selling as the dollar has bounced and concern over QE tapering materialised.”

GDX seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the NYSE® Arca Gold Miners Index®. The index is a modified market-capitalization weighted index primarily comprised of publicly traded companies involved in the mining for gold and silver.

GDXJ seeks to replicate as closely as possible the price and yield performance of the MVIS® Global Junior Gold Miners Index. The index includes companies that generate at least 50% of their revenues from gold and/or silver mining/royalties/streaming or have mining projects with the potential to generate at least 50% of their revenues from gold and/or silver when developed.

The Case For Gold Miners

ETF investors who weren’t able to get in on the gold action due to rising prices in 2020 are looking for a value opportunity. Rather than bank on a future recovery of gold prices, investors can opt for miners, which have proven their mettle in bull market runs.

“Gold is highly revered for its great returns and resilience during economic downturns, but during gold bull markets there’s something that regularly provides even greater returns: the ownership of gold mining stocks,” a Visual Capitalist article points out. “Over the past 20 years, gold mining stocks have outperformed the price of gold bullion in bull markets, offering what can be seen as a leveraged play on gold’s price appreciation.”

That performance of miners relative to gold prices was apparent as gold’s run higher from April to the middle of summer last year saw miners outperform. Even as prices started to downtrend, miners were less affected by the selling pressure.

One reason for this disparity in performance is a gold miner’s ability to sell the precious metal before the market reacts to prices.

“As a gold mining company mines and produces gold, the gold is sold on the market fairly quickly to avoid the risk of gold’s price depreciating,” the article noted further. “When the price of gold rises, miners immediately start to see greater profits from selling their ounces on the market. While the costs to mine gold also rise in bull markets, they rise less and at a slower rate.”

For more news and information, visit the Tactical Allocation Channel.