Naomi Zimmermann, Product Analyst; Charl Malan, Senior Metals and Mining Analyst; Ammar James, Analyst, Natural Resources

The recent buzz around artificial intelligence (AI) has largely focused on its applications in consumer technology and e-commerce, but its potential reaches far beyond that.

Freeport-McMoRan Revolutionizes Green Metals Mining

Mining green metals efficiently is essential for transitioning to a more sustainable future, and AI is pivotal in achieving this goal. The mining company Freeport-McMoRan has been an early adopter of AI to revolutionize the detection and extraction of green metals.

Freeport-McMoRan utilizes a custom AI model at their copper mill in Bagdad, Arizona. By scanning and analyzing vast amounts of data, the AI model provides recommendations for operational changes that improve mining processes. As a result, Freeport-McMoRan witnessed a 10% increase in copper ore throughput. Copper is a critical metal for energy transition technologies, especially in electric vehicles (EVs) and renewable energy technologies.

Freeport’s use of the AI model at Bagdad demonstrates how mining companies can meet the rising demand for green metals as the resource transition accelerates to ensure a sustainable supply of these critical resources.

AI Model Recommendations Boost Copper Mine Production by 10%

Average Bagdad mine dry ore miller daily (thousand tons).

Source: Freeport-McMoRan, McKinsey.

SolarEdge Optimizes Renewable Energy

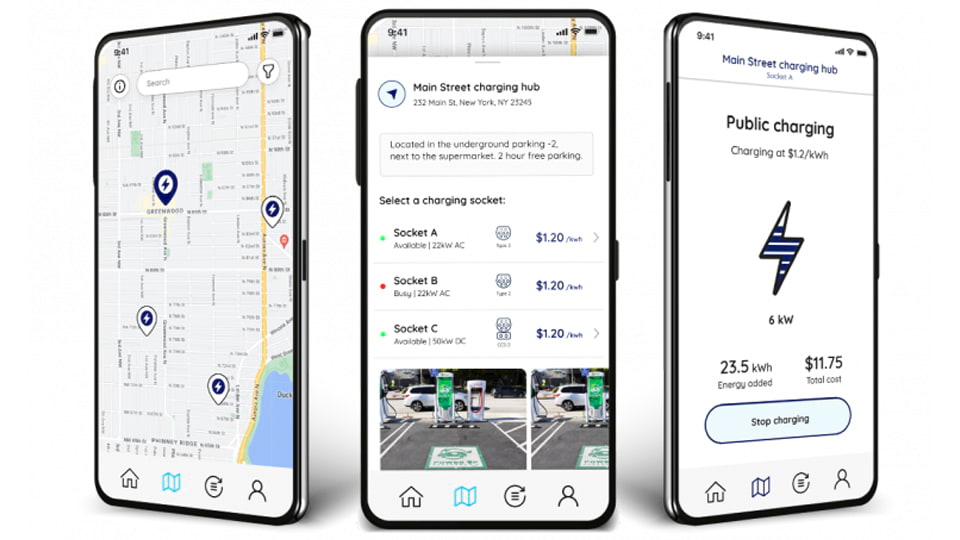

AI can also be leveraged to improve the deployment and management of renewable energy technologies. SolarEdge, a leading provider of solar inverters and battery energy storage, has developed an AI-powered EV charging platform. The platform employs algorithms and predictive analytics to enhance EV charging efficiency, particularly for projects involving multiple EVs. By incorporating real-time data on current solar production and electricity prices, SolarEdge’s AI model orchestrates and optimizes the charging process. This integration ensures that EV charging is efficient and takes advantage of renewable energy sources when supplying energy to the grid.

SolarEdge’s EV Charging Management Solution

Source: SolarEdge.

As the demand for EVs continues to soar, solar-attached EV charging facilities are increasingly important. SolarEdge’s AI model enables these facilities to operate intelligently, leveraging predictive algorithms to prioritize charging when solar generation is at its peak. This approach maximizes the utilization of renewable energy resources and contributes to a more efficient and sustainable EV charging infrastructure.

Corteva Enhances Resource Efficiency in Agriculture

Corteva, a prominent agricultural inputs company, offers AI solutions directly to farmers that enable them to make data-driven decisions, transform crop management practices and enhance resource efficiency.

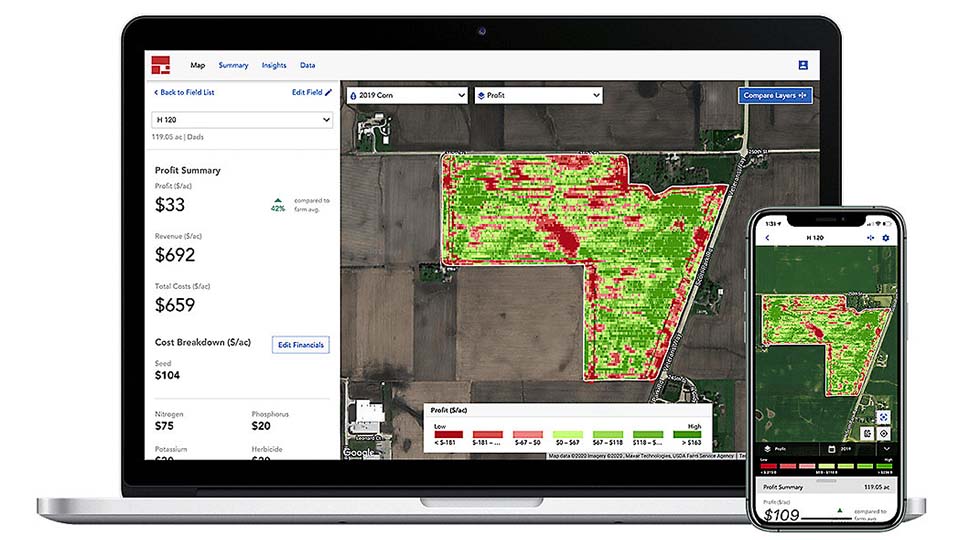

One of Corteva’s notable AI tools, Granular Insights, harnesses the power of AI to compile and analyze data from various sources, including field and crop sensors, drones, and satellites. By integrating and processing this diverse data, Granular Insights provides farmers with valuable insights and recommendations for optimizing their farm management practices.

For instance, Granular Insights analyzes agricultural machinery data, satellite imagery, and financial information regarding crop prices to calculate profitability on a field-by-field basis, allowing farmers to strategically adjust their practices to maximize crop yields and minimize resource costs. These insights also help farmers make precise decisions about water usage, pesticide application, and fertilizer allocation, therefore, reducing their environmental impact and fostering long-term sustainability.

Corteva’s Granular Insights Tool

Source: Corteva.

AI is poised to maximize synergies, minimize risks, and capture upside in the natural resource sectors. Whether mining green metals, deploying renewable energy technologies, or managing agricultural practices, AI has the potential to revolutionize sectors and thereby accelerate the energy transition.

To receive more Natural Resources and Sustainable Investing insights, sign up in our subscription center.

Originally published 14 June 2023.

For more news, information, and analysis, visit the Beyond Basic Beta Channel.

Disclosures

Please note that VanEck may offer investment products that invest in the asset class(es) or industries included in this commentary.

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities, financial instruments or digital assets mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, tax advice, or any call to action. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results, are for illustrative purposes only, are valid as of the date of this communication, and are subject to change without notice. Actual future performance of any assets or industries mentioned are unknown. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data. The information herein represents the opinion of the author(s), but not necessarily those of VanEck or its other employees.

Sustainable Investing Considerations: Sustainable investing strategies aim to consider and in some instances integrate the analysis of environmental, social and governance (ESG) factors into the investment process and portfolio. Strategies across geographies and styles approach ESG analysis and incorporate the findings in a variety of ways. Incorporating ESG factors or Sustainable Investing Considerations may inhibit the portfolio manager’s ability to participate in certain investment opportunities that otherwise would be consistent with its investment objective and other principal investment strategies.

ESG investing is qualitative and subjective by nature, and there is no guarantee that the factors utilized by VanEck or any judgment exercised by VanEck will reflect the opinions of any particular investor. Information regarding responsible practices is obtained through voluntary or third-party reporting, which may not be accurate or complete, and VanEck is dependent on such information to evaluate a company’s commitment to, or implementation of, responsible practices. Socially responsible norms differ by region. There is no assurance that the socially responsible investing strategy and techniques employed will be successful. An investment strategy may hold securities of issuers that are not aligned with ESG principles.

Hard assets investments are subject to risks associated with real estate, precious metals, natural resources and commodities and events related to these industries, foreign investments, illiquidity, credit, interest rate fluctuations, inflation, leverage, and non-diversification.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

© 2023 Van Eck Securities Corporation, Distributor, a wholly owned subsidiary of Van Eck Associates Corporation.