As of Wednesday, gold is on an eight-day losing streak, its longest such skid in six years. Not surprisingly, gold miners are feeling the pain, too. For example, the VanEck Gold Miners ETF (GDX), the largest ETF in this category, is off 14.7% over the past month. While there’s no sugar-coating price action like that, investors should stay focused on the forest through the trees. in this case, the forest is gold miners’ robust free cash flow.

Why Are Gold Prices Falling?

Gold’s falling price likely has to do with the Federal Open Market Committee’s (FOMC) July meeting. The minutes indicate the Fed hasn’t eliminated the idea of additional interest rate hikes later this year. That’s a negative for gold, which doesn’t pay interest or dividends.

Additionally, more rate hikes could firm up the U.S. dollar, in turn punishing dollar-denominated commodities, like gold.

When gold prices fall, that inherently impacts miners’ profit potential. Falling gold prices can impact which mines are operate or shutter, even which new projects break ground.

Free Cash Flow Provides Clues To Gold Miners Long-Term Health

When it comes to stocks, many investors focus on short-term events, such as earnings reports. Nothing wrong with that. After all, earnings are vital tells about a company’s financial health. However, as VanEck portfolio manager Imaru Casanova points out in a recent blog, forecasting gold miners’ earnings isn’t as easy as it is in other industries.

“The fact that these companies are issuing forecasts based on only estimates of the properties of the gold deposits they are mining,” she notes.

“Clearly, we expect that these estimates are a good representation of the gold deposit over the life of the mine. Quarter-over-quarter, it is also very reasonable to expect variations from those estimates that could certainly impact earnings, while generally having no material impact in the net asset value of the mine or the company.”

Rather than getting hung up on miners’ earnings, investors should consider instead the free cash flow-generating capabilities of gold miners, including the constituent stocks of GDX.

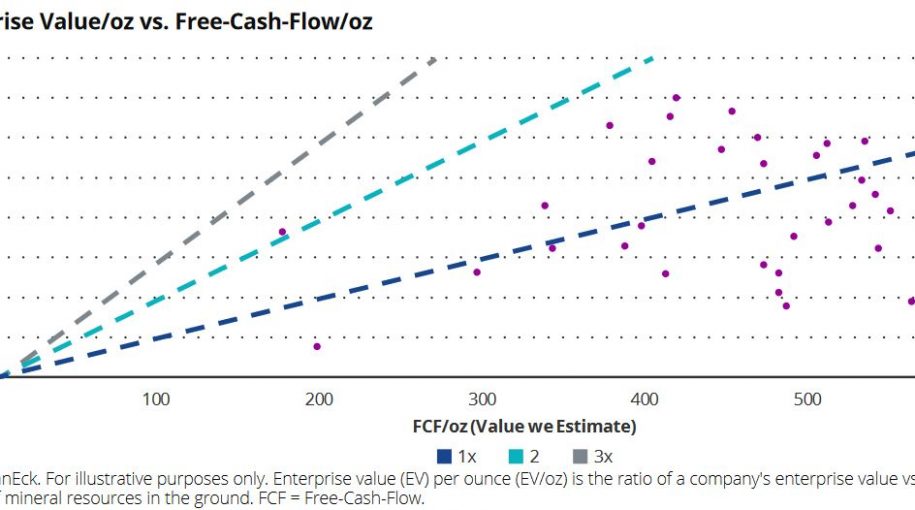

For example, Casanova points to a methodology known as “free cash flow per ounce,” which VanEck uses to better understand miners’ ability to generate free cash flow over the long haul. Free cash flow per ounce is the total free cash flow a miner generates in a given period, divided by all the gold it will mine over that same period.

“It is a simple, yet transparent measure that allows us to assess the relative valuations of the companies in our universe,” she writes.

The free cash flow/oz for most of the companies in the GDX portfolio remains very strong:

Source: Imaru Casanova, VanEck.com

“Gold Not Mined (Or Sold) This Quarter Is Not Lost”

Regardless of industry, prolific free cash flow generators usually deliver superior long-term returns for investors. These stocks may offer shareholder rewards, such as buybacks and dividends, without straining balance sheets.

“We believe gold equity investors should demand that companies deliver against their operational targets, while focusing less on quarterly earnings and more on the outlook for good old free cash over the next decade or two,” concludes Casanova.

“It is also helpful to remember that any gold not mined (or sold) this quarter is not lost, it will still be there the next quarter or year, ready to meet the world’s historical need for the shiny metal, potentially at even higher prices.”

For more news, information, and analysis, visit the Beyond Basic Beta Channel.