By David Semple, Portfolio Manager, Emerging Markets Equity

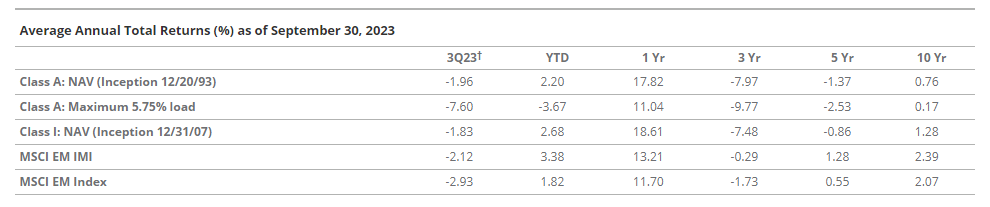

The VanEck Emerging Markets Fund (the “Fund”) slightly outperformed the MSCI Emerging Markets Investable Market Index (“MSCI EM IMI” or the “Index”) on the quarter-to-date basis ending September 30, 2023 (-1.96% for Fund vs -2.12% for Index). This outperformance was principally driven by allocation (weighting) and stock selection in Turkey, Georgia and Kazakhstan. After a strong first half of the year, the Fund’s overweight to Brazil contributed negatively to its performance last quarter.

Bank of Georgia, not held in the benchmark index (+21.1% quarterly return with an average Fund weight of 3.7%*), continues to be a standout performer. Kaspi.kz, a leading payments platform in Kazakhstan, also boosted relative performance (+23.7% quarterly return with an average Fund weight of 3.7%*), and is another name not held in the benchmark index.

Both of these examples underscore the Fund’s objective, which is to find long-term structural growth companies at a reasonable price (S-GARP). Our process is driven by stock selection conducted through rigorous due diligence with a focus on active management interaction and quality, governance and business models with visibility, innovation and low disruption risk.

The table presents past performance which is no guarantee of future results and which may be lower or higher than current performance. Returns reflect applicable fee waivers and/or expense reimbursements. Had the Fund incurred all expenses and fees, investment returns would have been reduced. Investment returns and Fund shares values will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at net asset value (NAV). Index returns assume that dividends of the Index constituents in the Index have been reinvested. Performance information current to the most recent month end is available by calling 800.826.2333 or by visiting vaneck.com.

Expenses: Class A: Gross 1.54%; Net 1.54%; Class I: Gross 1.19%; Net 1.01%. Expenses are capped contractually until 5/1/24 at 1.60% for Class A and 1.00% for Class I. Caps exclude acquired fund fees and expenses, interest, trading, dividends, interest payments of securities sold short, taxes and extraordinary expenses.

Market Review

The MSCI EM IMI returned -2.12% during the third quarter of 2023. Below we highlight the main developments that we believe affected the asset class:

Emerging Markets (“EM”) Equities Fell Slightly, but Outperformed Developed Markets (“DM”): The third quarter of 2023 saw negative performance from most of the large weights in the benchmark index. India and Turkey notched positive performance quarters, while Taiwan Region, South Korea and China contributed negatively. After a strong start to the year, Brazil fell in Q3, but Brazil’s performance remains decidedly up year-to-date.

EM Central Banks Have Begun Cutting Rates, with LatAm Leading: Although EM central banks are leading the rate cutting cycle, and reaping the benefits of falling core inflation, the current narrative of higher rates for longer in DM has been unhelpful for valuations and has spurred a dollar rally which is typically negative for EM. Chile and Brazil have already cut their benchmark rates, while Peru has indicated that cuts are possible. Keep in mind that LatAm countries usually lead in both ways – tightening and easing – so as we see the first LatAm countries begin to cut, we would expect other EM countries to follow suit but a little later than originally expected.

Macro Environment Supportive of Continued EM-DM Growth Differential: After falling sharply post-pandemic, the spread between EM and DM growth has rebounded sharply and is estimated to continue upwards. Historically, EM equities have performed well during cycles when GDP is rising and rates are easing. This could potentially set the stage for stronger EM performance going forward compared to DM. However, much depends on the ability of the Chinese economy to develop better momentum.

Valuation Differentials Point to Wide Historical Comparative Discount: Across multiple time-frames and metrics, EM valuations are comparatively cheap versus their domestic counterparts. When combined with the growth differentials highlighted above, this presents a compelling valuation-based case for investing in EM. One underappreciated facet is the increasing dividend payments coming from EM companies, which is expected to continue as balance sheets and free cash flow are all generally in very good shape.

Global Investors are Under-Positioned in EM: Compared to historical weightings, global investors are currently under-positioned in their allocations to EM exposure. In particular, managers in aggregate are very underweighted in China. While EM countries represent just over 10% of the MSCI ACWI Index, global investors hold only 6% of their weights positioned in EM. This indicates that there is money on the sidelines for this asset class, and could also indicate favorable timing from a contrarian investor perspective.

Fund Review

On a sector level, Consumer Staples, Financials and Health Care contributed to relative performance, while Materials, Consumer Discretionary and Industrials detracted. On a country level, Turkey, Georgia and Kazakhstan contributed to relative performance, while India, Brazil and South Korea detracted.

Top Contributors

Top contributors to return on an absolute basis during the quarter:

- MLP Saglik Hizmetleri AS Class B (“MLP”) (2.3% of Fund net assets*) is the largest private hospital group in Turkey. The group also has a sizable medical tourism business to capitalize on the high-quality and cost-competitive care offered by its hospitals. This business line has shown very strong performance in 2022 and year to date, driven by growing international demand and increasing MLP’s foreign currency revenues against a weakening Turkish lira. Management’s successful efforts to deleverage and strengthen its balance sheet have also positioned MLP very favorably for further inorganic expansion and share buybacks. After very strong share price performance in 2022, the company continued to show solid operational performance this year. We continue to be excited about the growth outlook for MLP and the upcoming expansion plans within Turkey as well as its recent foray into select international markets. The company is well positioned to potentially be the consolidator of Turkey’s private healthcare market.

- Kaspi.kz JSC (4.0% of Fund net assets*) is the leading payments, marketplace and fintech platform in Kazakhstan. Kaspi’s business model is highly profitable and leverages a well-integrated ecosystem that supports growth across all three of its business segments. The company has consistently beaten market expectations since its listing a few years ago and continues to demonstrate an impressive ability to leverage its scale and ecosystem to find new avenues for growth including online grocery and travel, which maintains our excitement about the prospects of the company.

- Bank of Georgia Group Plc (3.9% of Fund net assets*) is one of the two largest banks, dominating the Georgian banking system, with more than 33% market share. During the quarter, the bank outperformed on the back of stronger than expected earnings delivered in the first half of 2023 on top of an already strong base in 2022, with return on equity remaining well above 25%. Bank of Georgia’s management has undergone significant digitization efforts, resulting in higher efficiency and a superior customer experience.

Top Detractors

Top detractors to return on an absolute basis during the quarter:

- Taiwan Semiconductor Manufacturing Co (“TSMC”) (6.2% of Fund net assets*) is the largest and global leader in integrated circuit (IC) manufacturing. As a build-to-order foundry, it provides a wide range of value-add activities: IC manufacturing, mask-making, IC design services, turnkey solutions and process development. We attribute its success to its proven, winning business model, unparalleled scale advantage, optimized execution and technology scope and depth. Our investment thesis believes that ongoing growth in mobile, rise of artificial intelligence (AI) and proliferation of Internet of Things (IoT) should result in a sustainable upside in aggregate computing power globally. TSMC, as the leading contract manufacturer of semiconductor chips, is in a good position to capitalize. Current share price weakness can be attributed, we believe, to a slightly stretched valuation as well as some negative news about capital expenditure plans and slower opening of its new foundries in the U.S.

- Vamos Locacao de Caminhoes, Maquinas e Equipamentos SA (“Vamos”) (2.7% of Fund net assets*) is the leader in the truck, machinery and equipment rental in Brazil. They offer customized solutions to clients with long term contracts. Vamos is the largest player with 70% market share and operate in a very underpenetrated market. The primary reason for the disappointing results has been a more challenging macro scenario that has forced the company to focus from accelerating its fleet allocation to be more selective in providing contracts. The company will continue growing, but not at the pace it did in the past. However, we see a more consistent pace going forward. On the other hand, the dealership division has been very weak, due primarily to a delay by the government to provide the subsidies to farmers (“Plano Safra”) to buy trucks. That disbursement usually occurs in May/June, and farmers wait for the subsidies to buy their trucks, but this year it didn’t occur until the end of August. This is a temporary impact, as there was a big rebound in September, and the business should normalize in the next quarter. We believe the issues that Vamos is experiencing are not structural and are mostly temporary. Vamos will continue to remain the consolidators on a very low penetrated truck rental market, grabbing most of the incremental market due to its competitive advantages on truck purchase and scale. We expect a recovery in Q4 23 with a positive year in 2025.

- LG Chem Ltd. (“LG”) (1.3% of Fund net assets*) is an integrated chemical manufacturer based in Korea. Its main business domains include petrochemicals, advanced materials and energy solutions (batteries). Our investment case centers on the long-term developing strength in EV batteries, where LG’s customers include most of the major global EV original equipment manufacturers (OEMs). LG’s rapid capacity expansion in both South Korea and North America is expected to further build on its leadership position in non-China produced battery and cathode solutions. We anticipate growth vectors of customer and consumer transition to EVs and fast-growing demand in large scale energy storage solutions – especially for renewable energy generation needs. The shares came under pressure this quarter following some savage price cuts by the Chinese manufacturers and concerns about LG’s decision to supply cathodes only to Tesla.

Top Buys & Sells

During the period, we established new positions in the following:

- Jio Financial Services (JFS) (0.6% of Fund net assets*) is a spinoff from Reliance Industries. The fund was allocated shares pro rata to its position in Reliance. JFS is a new digital consumer financial services company. Given regulatory requirements in India, JFS was required to be separately listed and we are excited to be shareholders. The business model is to lend small sums to customers to finance purchases of items such as electronics, vehicles and furniture. Right now, the business is in its infancy but we estimate considerable value creation over time. JFS is set to benefit from customer access of the Reliance Group – over 500mm customers in the Jio Cellular Network and several hundred million customers of Reliance Retail and Reliance Media. The newly assembled management bench is known to our research team, access to capital is clear and we believe this business will scale quickly with attractive margins.

- Baidu (0.5% of Fund net assets*) is a leading search engine and information feed application in China; a similar business model to Google in the USA. Baidu provides several other services including autonomous driving taxis and IQ, a short video app – a kind of YouTube/Netflix mashup in China. Our investment thesis focuses on 3 components. First is their enterprise Cloud, and AI foundational model/data solutions, which has now been officially approved for use in China, and consequently, puts Baidu in a position of category leadership to all >500mm customers. The second value driver is iQiyi, the short video app that has recently turned profitable. It is positioned to grow strongly and is no longer a margin drag on the core search business. The third point in the investment case is our proprietary modeling of forecast growth and share price multiples. We are confident in higher numeric values as compared to what the share price currently implies.

During the period, we exited the following positions:

- Humansoft (not held by Fund at end of period) is a leading higher education company in Kuwait. During the quarter, we exited our position. While the company continues to show solid execution and high profitability, we are seeing signs that growth in slowing down and the story is shifting from growth to capital return, and as a result, we prefer to reallocate capital to higher structural growth stories that better fit our strategy.

- Ming Yang (not held by Fund at end of period) is a Chinese company which mainly designs and produces wind turbines, both offshore and onshore. Our concern about heightened competition, particularly in the onshore category, as well as the elevated prices of some components, led us to anticipate weaker margins than originally forecasted. Having sold down the position, the remaining portion was sold.

- Shandong Head (not held by Fund at end of period) is an international cellulose ether manufacturer. The two main divisions of the business were not performing as had been expected. Vegetarian capsules which are used in pill and vitamin manufacture, saw poor volume numbers. The other division, cellulose ether, is used in a variety of industries, but the building sector is a prominent user. Given the ongoing issues in the property sector, which is constraining building activity, the short-term outlook does not appear positive.

- Westwing (not held by Fund at end of period) is a Brazilian marketplace specializing in the home and decoration segment with a differentiated sales format. Although they have niche positioning, the market where they operate has been very challenging, with a difficult demand scenario and inflation impacting Selling, General and Administrative Expenses. They have also been impacted by higher rates. We had a small position and the stock is very illiquid, so given the change in the outlook, we decided to exit the name.

Outlook

We remain grounded by our investment process and our positioning reflects our convictions from a bottom-up basis heading into the last quarter of the year. Our process has created some positioning differentials versus the benchmark. Brazil remains overweight to start the fourth quarter (14% Fund weight versus 5% Index weight), as does Georgia (5% Fund weight versus 0% Index weight).

China and Taiwan Region are significantly underweighted versus the benchmark, which does not reflect a bearish macro view on the region, but is a reflection of the opportunities we see. Currently, approximately one third of the portfolio is allocated to China and Taiwan Region, focused specifically on those companies which pass our due diligence process.

The Fund also is also significantly underweighted versus the benchmark in South Korea, Saudia Arabia and South Africa.

The Fund’s objective is to find long-term structural growth companies at a reasonable price (S-GARP). Country weightings are driven by the analysis of individual companies: our process is driven by stock selection conducted through rigorous due diligence with a focus on active management interaction and quality, governance and business models with visibility, innovation and low disruption risk.

Download Commentary PDF with Fund specific information and performance.

To receive more Emerging Markets Equity insights, sign up in our subscription center.

Disclosures

† Quarterly returns are not annualized.

* All country and company weightings are as of September 30, 2023. Any mention of an individual security is not a recommendation to buy or to sell the security. Fund securities and holdings may vary.

All indices listed are unmanaged indices and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. Certain indices may take into account withholding taxes. An index’s performance is not illustrative of the Fund’s performance. Indices are not securities in which investments can be made.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of emerging markets countries. The MSCI Emerging Markets Investable Market Index (IMI) is a free float-adjusted market capitalization index that is designed to capture large-, mid-and small-cap representation across emerging markets countries.

MSCI Emerging Markets Investable Market Index (IMI) captures large, mid, small-cap cap representation across emerging markets (EM) countries. The index covers approximately 99% of the free float-adjusted market capitalization in each country.

The MSCI All Country World Index (ACWI) tracks broad global equity-market performance.

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities, financial instruments or digital assets mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, tax advice, or any call to action. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results, are for illustrative purposes only, are valid as of the date of this communication, and are subject to change without notice. Actual future performance of any assets or industries mentioned are unknown. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data. The information herein represents the opinion of the author(s), but not necessarily those of VanEck or its other employees.

You can lose money by investing in the Fund. Any investment in the Fund should be part of an overall investment program, not a complete program. The Fund is subject to risks which may include, but are not limited to, risks associated with active management, consumer discretionary sector, direct investments, emerging market issuers, ESG investing strategy, financials sector, foreign currency, foreign securities, industrials sector, information technology sector, market, operational, restricted securities, investing in other funds, small- and medium-capitalization companies, special purpose acquisition companies, special risk considerations of investing in Chinese, Indian, and Latin American issuers, and Stock Connect risks, all of which may adversely affect the Fund. Emerging market issuers and foreign securities may be subject to securities markets, political and economic, investment and repatriation restrictions, different rules and regulations, less publicly available financial information, foreign currency and exchange rates, operational and settlement, and corporate and securities laws risks. Small- and medium-capitalization companies may be subject to elevated risks. Investments in Chinese issuers may entail additional risks that include, among others, lack of liquidity and price volatility, currency devaluations and exchange rate fluctuations, intervention by the Chinese government, nationalization or expropriation, limitations on the use of brokers, and trade limitations.

ESG integration is the practice of incorporating material environmental, social and governance (ESG) information or insights alongside traditional measures into the investment decision process to improve long term financial outcomes of portfolios. Unless otherwise stated within an active investment strategy’s investment objective, inclusion of this statement does not imply that an active investment strategy has an ESG-aligned investment objective, but rather describes how ESG information may be integrated into the overall investment process.

ESG investing is qualitative and subjective by nature, and there is no guarantee that the factors utilized by VanEck or any judgment exercised by VanEck will reflect the opinions of any particular investor. Information regarding responsible practices is obtained through voluntary or third-party reporting, which may not be accurate or complete, and VanEck is dependent on such information to evaluate a company’s commitment to, or implementation of, responsible practices. Socially responsible norms differ by region. There is no assurance that the socially responsible investing strategy and techniques employed will be successful. An investment strategy may hold securities of issuers that are not aligned with ESG principles.

Investing involves substantial risk and high volatility, including possible loss of principal. Bonds and bond funds will decrease in value as interest rates rise. An investor should consider the investment objective, risks, charges and expenses of a fund carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.

© Van Eck Securities Corporation, Distributor, a wholly owned subsidiary of Van Eck Associates Corporation.

Originally published 18 October 2023.

For more news, information, and analysis, visit the Beyond Basic Beta Channel.