By Natalia Gurushina, Chief Economist, Emerging Markets Fixed Income

Case for EM Bonds

Emerging markets (EM) central banks’ independence and early (credible) responses to the post-pandemic inflation spike boosted EM real yields and carry, supporting the fundamental case for EM bonds and helping to shield them from recent market turbulence in developed markets (DM). EM’s disinflation progress keeps the pivot hopes alive, but for now most central banks prefer to stay vigilant. And often this means an extended pause – like in the case of the Chilean central bank yesterday (higher rates for longer), or Poland’s national bank this morning.

EM Disinflation

The latest inflation prints in Mexico, Colombia and the Philippines show why many central banks are cautious – even though headline inflation has clearly peaked, core price pressures are much more persistent. Mexico’s core inflation slowed less than expected in March – staying above 8% year-on-year – and services inflation continued to accelerate. Core inflation in Colombia and the Philippines was also in “lift-off” mode – the latter reached a new high since March 1999, leaving room for a small “farewell” rate hike. The market expects to have more clarity on these issues in three to six months, which explains the timing of priced-in “inaugural” EM rate cuts. A comment from Poland’s central bank Governor Adam Glapinski also drew attention to the disinflationary impact of stronger EM currencies, which might help to bring easing forward in some countries.

Global Growth Outlook

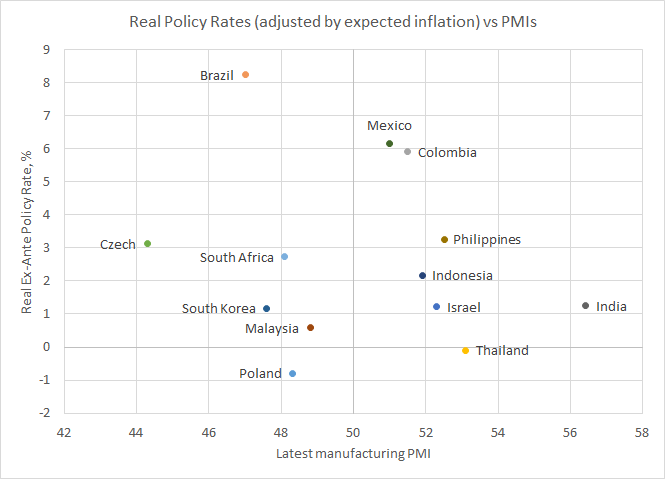

As more EMs are exiting their tightening cycle, the attention is shifting to the impact of high real interest rates on growth. The chart below plots real policy rates against the latest activity gauges – and it shows that bringing inflation down can come at a price, as domestic demand slows. The updated World Economic Outlook – released by the IMF this morning – reminded that there are additional considerations here, such as the increasingly complicated global backdrop. The report talks about the impact of geopolitical tensions and geo-economic fragmentations, which can “reshape the geography of foreign direct investments”, especially in strategic sectors. Some EMs will be winners in this brave new world – but some can become more vulnerable. Stay tuned!

Chart at a Glance: EM Rate Hikes and Domestic Activity Gauges

Source: Bloomberg LP.

Originally published 05 April 2023.

For more news, information, and analysis, visit the Beyond Basic Beta Channel.

PMI – Purchasing Managers’ Index: economic indicators derived from monthly surveys of private sector companies. A reading above 50 indicates expansion, and a reading below 50 indicates contraction; ISM – Institute for Supply Management PMI: ISM releases an index based on more than 400 purchasing and supply managers surveys; both in the manufacturing and non-manufacturing industries; CPI – Consumer Price Index: an index of the variation in prices paid by typical consumers for retail goods and other items; PPI – Producer Price Index: a family of indexes that measures the average change in selling prices received by domestic producers of goods and services over time; PCE inflation – Personal Consumption Expenditures Price Index: one measure of U.S. inflation, tracking the change in prices of goods and services purchased by consumers throughout the economy; MSCI – Morgan Stanley Capital International: an American provider of equity, fixed income, hedge fund stock market indexes, and equity portfolio analysis tools; VIX – CBOE Volatility Index: an index created by the Chicago Board Options Exchange (CBOE), which shows the market’s expectation of 30-day volatility. It is constructed using the implied volatilities on S&P 500 index options.; GBI-EM – JP Morgan’s Government Bond Index – Emerging Markets: comprehensive emerging market debt benchmarks that track local currency bonds issued by Emerging market governments; EMBI – JP Morgan’s Emerging Market Bond Index: JP Morgan’s index of dollar-denominated sovereign bonds issued by a selection of emerging market countries; EMBIG – JP Morgan’s Emerging Market Bond Index Global: tracks total returns for traded external debt instruments in emerging markets.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities mentioned herein. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Certain information may be provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as the date of this communication and are subject to change. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

Investing in international markets carries risks such as currency fluctuation, regulatory risks, economic and political instability. Emerging markets involve heightened risks related to the same factors as well as increased volatility, lower trading volume, and less liquidity. Emerging markets can have greater custodial and operational risks, and less developed legal and accounting systems than developed markets.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.