In the current low rate environment, fixed income investors don’t have time for any monkey business. When it comes to seeking income sources, one promising place to look is business development companies (BDCs) via the VanEck Vectors BDC Income ETF (BIZD).

BIZD gets down to business by seeking to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS® US Business Development Companies Index. The fund normally invests at least 80% of its total assets in securities that comprise the fund’s benchmark index.

The index is comprised of BDCs. BDCs are vehicles whose principal business is to invest in, lend capital to, or provide services to privately-held companies or thinly traded U.S. public companies. Getting financing nowadays can be tough through traditional means like big banks. BDCs help fill the gap.

BIZD gives investors:

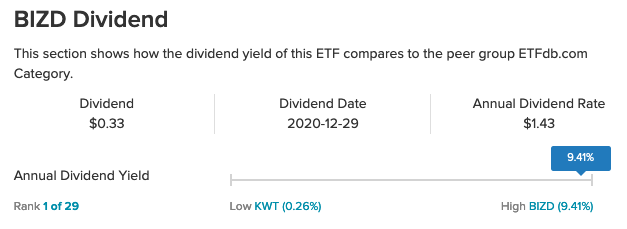

- High Income Potential: Business Development Companies (BDCs) have proven an attractive alternative income source historically

- Exposure to Private Credit: Privately-held U.S. companies and thinly traded U.S. public companies are generally difficult to access

- Lending to Middle-Market Companies: BDCs generate income by lending to and investing in private companies that tend to be below investment grade or not rated

- Strong Performance: BIZD is up 24% the last six months

Is ‘BIZD’ the Place to Be in 2021?

As mentioned, BDCs help provide struggling companies with loans they aren’t able to get via traditional means. As the global economy continues to heal amid a vaccine rollout, companies will need to get funding to continue the healing process and inject capital back into their businesses.

“Business development companies (BDC) could be the place to be in 2021,” a Kiplinger’s article said. “These financiers of small- and midsized businesses struggled throughout most of last year, but Raymond James is among the analyst outfits looking for a snapback this year.”

“Though BDCs are quickly coming back to pre-COVID valuations, the rate environment today could present a different context in which BDCs are valued as they currently deliver a premium income multiple versus the major indices,” writes Robert Dodd of Raymond James. “We believe the premium income yield of the BDC space compared to the broader market could present a favorable tailwind to BDC performance in the near-to-mid term.”

For more news and information, visit the Tactical Allocation Channel.