Bull vs. Bear is a weekly feature where the VettaFi writers’ room takes opposite sides for a debate on controversial stocks, strategies, or market ideas — with plenty of discussion of ETF ideas to play either angle. For this edition of Bull vs. Bear, James Comtois and Elle Caruso debate if SMIDcap stocks provide access to the best opportunities in the current environment.

James Comtois, staff writer, VettaFi: Greetings, Elle! Having just attended VettaFi’s recent Equity Symposium, I’m eager to discuss the opportunities that are available through the small- and mid-cap, or “SMIDcap,” space. From what I’m seeing, SMIDcap stocks have the potential to offer significantly more value than their large-cap brethren.

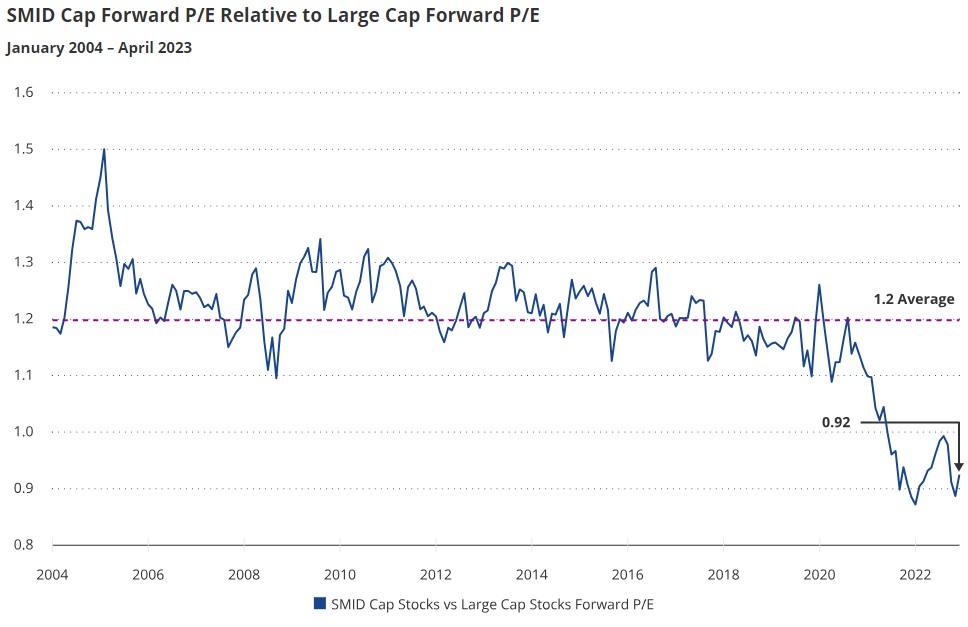

One of the reasons I’m so bullish on these smaller-cap stocks is that, relative to large-caps, valuations for these smaller stocks are becoming increasingly attractive.

Plus, check out this chart from VanEck showing the historical SMIDcap forward P/E relative to the large-cap forward P/E since 2004:

Source: Bloomberg via VanEck. SMID Cap Stocks represented by the Russell 2500 Index. Large Cap Stocks represented by the S&P 500 Index.

All of this suggests to me that smaller firms may have attractive valuations. But what say you, Elle? Is now the time to get a little smaller? Or should we continue to go big or go home?

Large-Caps Have Showed Strength in 2023

Elle Caruso, staff writer, VettaFi: Hi, James! You bring up some interesting points about SMIDcaps, but what stood out to me at last week’s Equity Symposium was actually the continued opportunities in large-caps. Large-caps have generated much of portfolios’ returns in the past year, something worth highlighting.

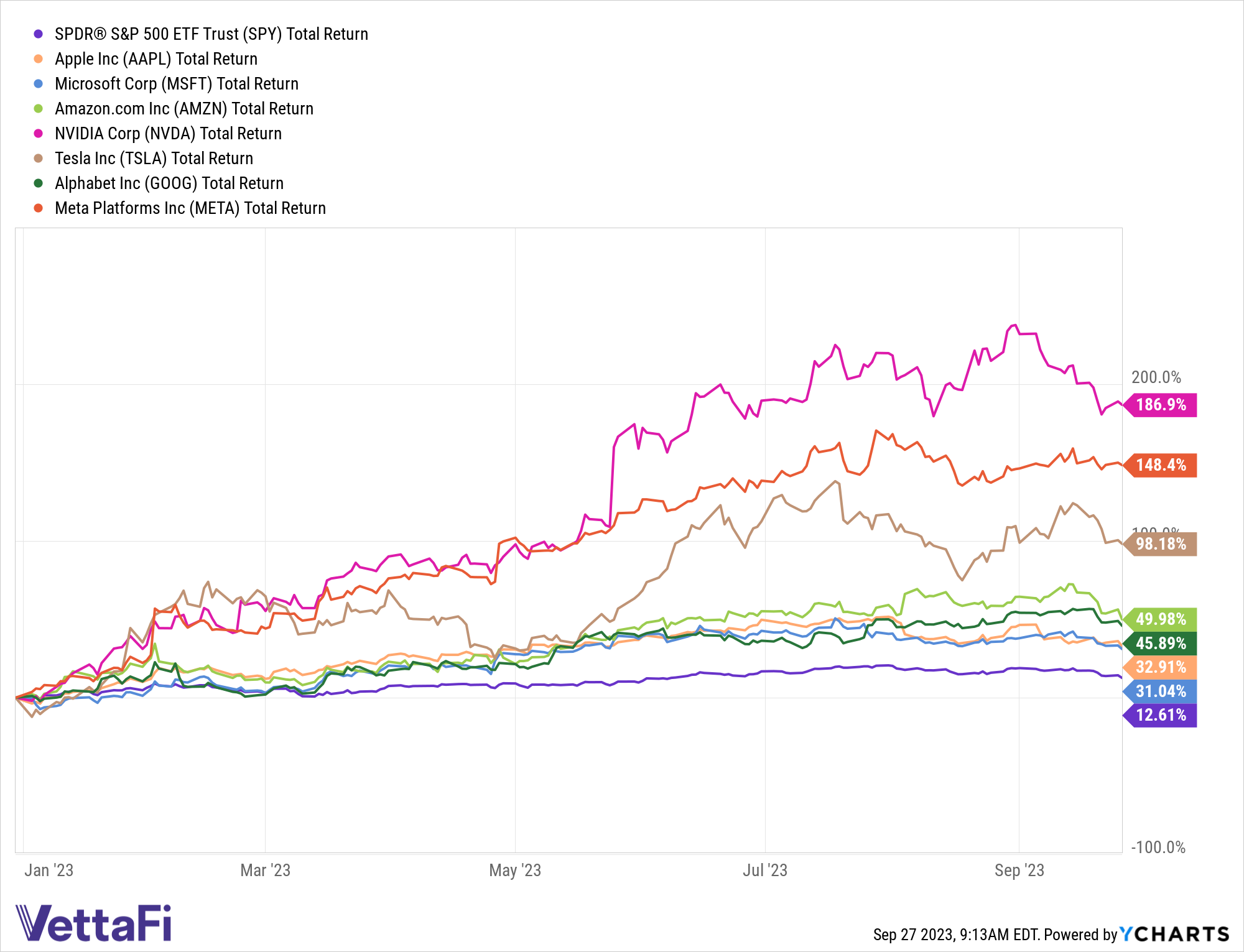

Equity performance this year has been driven almost single-handedly by the “Magnificent Seven,” the top seven names in the S&P 500 by weight.

See more: “Looking to Large-Caps: Where Do We Grow From Here?”

The Magnificent Seven makes up about one-fourth of the S&P 500 market cap but has gained more than 50% this year. Meanwhile, the other 493 stocks in the benchmark have collectively gained about 5%.

Large-cap equity performance has continuously surprised to the upside this year after a disappointing showing last year. Large-cap growth stocks struggled last year, dragging down the benchmark, leaving investors feeling very pessimistic about the asset class.

At the end of 2022, following the significant underperformance, many large-cap growth companies were forced to make a number of “difficult decisions,” Fidelity’s Sonu Kalra said during the symposium. These decisions resulted in a “right-sizing of the cost structure” that has led to better earnings estimates and performance this year.

Notably, when polled during the symposium, over 60% of respondents believed that equities will end the year in a bullish fashion. For investors looking to add exposure to large-caps, an active strategy such as the Fidelity Blue Chip Growth ETF (FBCG) may be worth consideration.

Untapped Opportunities

Comtois: Oh, that’s a very good point, Elle. Yes, large-caps have done surprisingly well this year. But there aren’t many hidden gems among the big players. Plus, many blue-chip companies are trading at jaw-droppingly high prices. Heck, Berkshire Hathaway (NYSE: BRK.A) was trading at more than $542,000 a share as of September 27!

Which reminds me of another point in SMIDcaps’ favor: With these great valuations come untapped opportunities.

A white paper from AllianceBernstein noted that these opportunities come from SMIDcaps’ research inefficiencies and pure-play nature. And there are opportunities for both growth and value managers.

Growth managers are trying to determine whether a company will live up to market expectations. Since growth stocks are generally priced at a premium, companies that disappoint tend to take a beating. Those that fare well or exceed expectations, meanwhile, can see their values soar.

For value managers, the opportunities lie in companies in hot water due to some sort of controversy. They’re looking to find out whether doubts about the company’s earnings potential are valid.

Now, granted, trying to find the right SMIDcaps can be akin to finding a couple of profitable needles in a giant haystack. Fortunately, there are a number of ETFs that do that work for the investor. So, for anyone wanting some SMIDcap exposure, might I suggest looking into the VanEck Morningstar SMID Moat ETF (SMOT) or the First Trust SMID Cap Rising Dividend Achievers ETF (SDVY)?

How Market Uncertainty Affects Large-Caps

Caruso: Something we haven’t discussed yet, James, is the continued uncertainty in markets.

There are a lot of ongoing factors for investors to consider. These include interest rates, inflation, recessionary fears, rising commodity prices, and upcoming third-quarter earnings. Also consider geopolitical risk and U.S.-China tensions, as well as tech concentration, and it leads to heightened uncertainty and market volatility.

It’s because of large-caps’ outsized nature that they are worth considering when it comes to increasing your exposure as the U.S. undergoes a recessionary period. Large-cap companies, particularly the magnificent seven I discussed earlier, are too big to fail.

These companies offer solid business models with long-established performance histories through a variety of economic cycles, often providing a more predictable rate of returns in times when many equities feel the squeeze of economic downturn.

The stability of mega-cap names is highly attractive during periods of market uncertainty. Looking at the Vanguard Mega Cap ETF (MGC), MGC was able to continue to generate income for investors during past economic drawdowns and recessions.

During the last two recessionary periods (the COVID-19 crash in 2020 and the great financial crisis of 2007-2008), the Vanguard fund provided stable dividends to shareholders.

This stability during economic turndowns can’t typically be found in the SMIDcap space, which is why large-caps are well-positioned in the current uncertain environment.

SMIDcaps Can Diversify an Overconcentrated Portfolio

Comtois: Yet another point in large-caps’ favor that I can neither refute nor ignore: Yes, large-cap stocks come with a higher degree of stability that the SMIDS may not be able to provide. But before we decide to super-size our portfolios, there’s an issue with these big stocks: overconcentration.

Large-caps are at record concentration levels. As our colleague Nick Peters-Golden recently noted, there were just 10 firms responsible for more than 80% of the S&P 500’s appreciation this year. And since SMIDcaps don’t have the same concentration risk, they could serve as a good — dare I say, great? — diversifier for an equity investor’s portfolio.

As that AB white paper noted, SMIDcaps offer “the diversification and return potential of small-cap stocks but with less volatility and fewer of the constraints associated with small-cap-only investing.”

But Can SMIDcaps Capitalize on AI Revolution?

Caruso: Finally, large-caps are best positioned to benefit from the adoption of AI. During the symposium, Kalra said generative AI is the fourth technology transition that we’re seeing after the internet, smartphones, and cloud capabilities. Generative AI tools such as ChatGPT have demonstrated the potential of the technology.

Notably, the current AI performance boost has been limited to a handful of large-cap stocks.

Companies like Nvidia are integral drivers in allowing efficient scaling of AI. They produce hardware evolutions. On the other hand, companies like Microsoft and Amazon are hyper-scalers, meaning they focus on the buildout of the infrastructure of AI through the cloud. Notably, these companies are poised to remain the core infrastructure players in the future.

As AI has been a large driver of returns this year, SMIDcap stocks are underperforming the S&P 500. As you mentioned, small-caps’ P/E ratios are near historic lows right now. The low valuations could be an attractive buy-in opportunity, but it also could be a flashing warning signal — particularly with the complex current economic environment.

You brought up some compelling points for investing in SMIDcaps, James. However, I’m still fascinated by the ongoing opportunities and stability in large-caps.

Comtois: As always, Elle, you’ve given me a lot to think about. Large-caps do indeed offer a high level of security. But I think they’ve sucked all the oxygen out of the room. So, I think SMIDcaps’ low prices, potential for strong outperformance, and ability to diversify make them worth looking at.

Until next time, Elle!

For more news, information, and analysis, visit the Beyond Basic Beta Channel.