Last week, retail sales increased more than expected. It pointed to a resilient consumer despite the Fed’s efforts to temper inflation. Total retail sales increased 0.7% in July compared to June (up 3.2% year-over-year). While retail sales growth remains positive and somewhat strong, it is propped up by a few key areas. Areas like non-store retailers (e-commerce retailers). Although the broader consumer discretionary sector is still one of the highest-performing sectors, investors may be looking to pivot into more specific industries like e-commerce. This note discusses recent consumer spending habits and how investors can take advantage of these trends using ETFs.

2Q e-commerce sales outpaced retail sales, and July retail sales were higher due partly to Amazon Prime Day

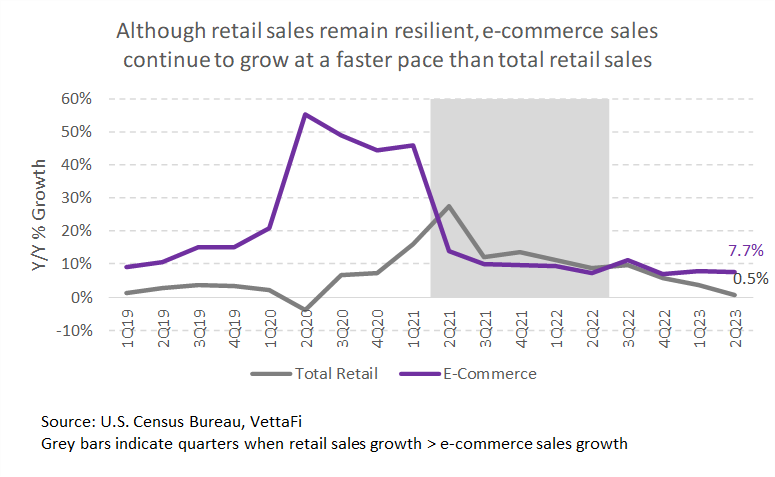

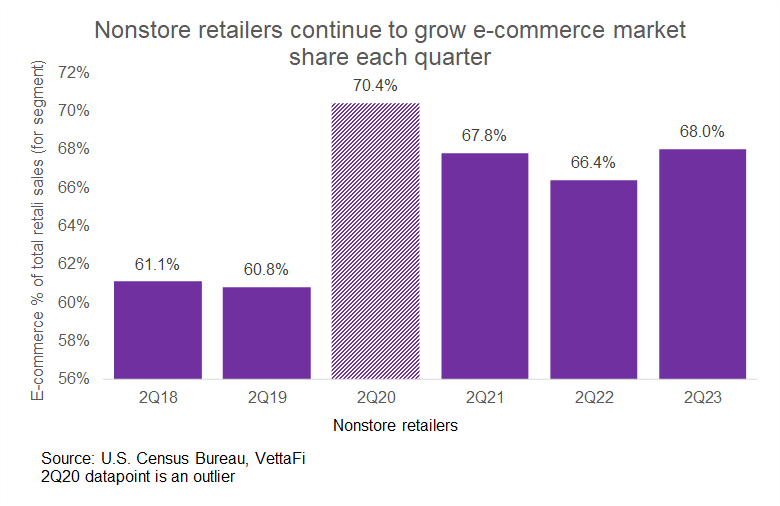

Just after July retail sales were released, and e-commerce sales results were also released for 2Q2023 (April through June). Adjusted e-commerce sales increased at an even faster pace than total retail sales (7.5% y/y vs. 0.5%) for the quarter. This continues the trend that we’ve seen pause only for a few quarters during the pandemic. That trend seems to have continued throughout the beginning of the third quarter since the nonstore retail sales segment was up the most in July month-over-month (+1.9%). A lot of those sales can be attributed to Amazon Prime Day which was on July 11 and 12. According to an Adobe Insights report, Amazon Prime Day sales increased 8.5% from last year to almost $12 billion. Additionally, during Amazon Prime Day, other companies have competing events, which also boosts total retail sales.

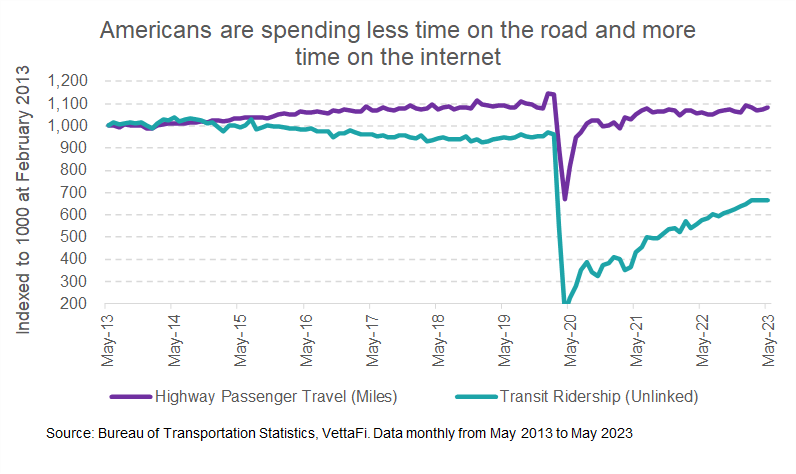

It is important to remember that high spending on Prime Day does not necessarily represent consumers’ willingness to spend. Consumers who have been affected by high prices all year may have been strategically planning for lower prices. So many consumers are waiting for key sales dates to spend — like Amazon Prime Day or Black Friday instead of spending throughout the year. This puts online retailers and other discount retailers at an advantage over traditional retailers as long as consumers are looking for ways to save. While this is a (hopefully) a short-term trend that will last until the economy normalizes, several long-term trends support e-commerce sales as a long-term trend in retail sales. These include remote work, less commuter traffic, greater internet access, and faster shipping speeds.

Bottom Line:

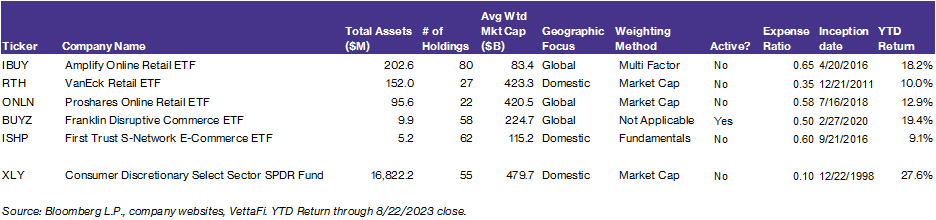

Overall, higher retail sales in July do not necessarily indicate a strong retail consumer. While consumers have remained resilient longer than most of us have predicted, consumers are looking for ways to save and are strategically planning to spend during sales days like Amazon Prime Day and Black Friday. Although the consumer discretionary sector and retail sales industries continue to perform well, online retail/e-commerce may be well-positioned going forward.

For more news, information, and analysis, visit the Beyond Basic Beta Channel.