A recent survey of advisors here at ETF Trends and ETF Database suggests that the traditional model of ETF distribution is changing quickly. The survey of nearly 700 advisors conducted in late 2019 asked questions about ETF buying behavior and research practices.

Key findings from the survey include:

- Advisors are more tech-savvy than most might expect. 83% of those sampled self-reported being sophisticated or very sophisticated in their use of technology.

- Few advisors rely on home-office supplied “approved lists,” however 81% use model portfolios for their clients, whether proprietary or provided by home offices, issuers, or ETF strategists.

- The average advisor spends a day a week on investment research.

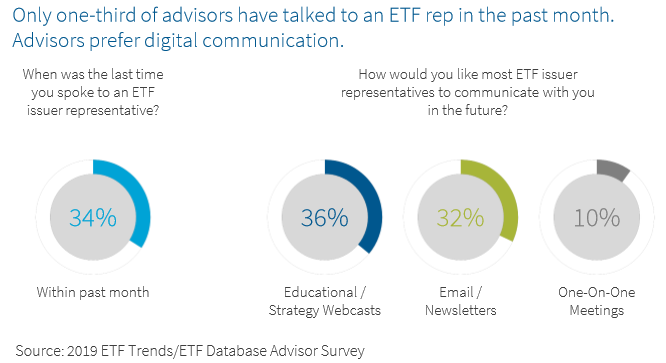

But perhaps the most surprising result was simply how much advisors don’t want to talk to issuer representatives:

Not only are advisors not taking the meetings, the one-on-one chat with a wholesaler is the single least favorite way of getting new information from issuers, with the most preferred method being educational webcasts.

Despite their desire to do their own research instead of being “sold”, there’s little question that ETFs are here to stay within the advisor community. More than half of those surveyed said that ETFs will be the target for new allocations in the coming year.

The full results of the survey, “How Financial Advisors Buy ETFs,” is available for free at http://etfdb.com/survey/.