![]()

“Sales below $500,000 dropped 21 percent on a year-over-year basis, while deals of $500,000 or more fell about 3 percent, marking the first annual decline for that price category in nearly two years,” said LePage. “Home sales of $1 million or more last month rose just a tad – less than 1 percent – from a year earlier following annual gains of between 5 percent and 21 percent over the prior year.”

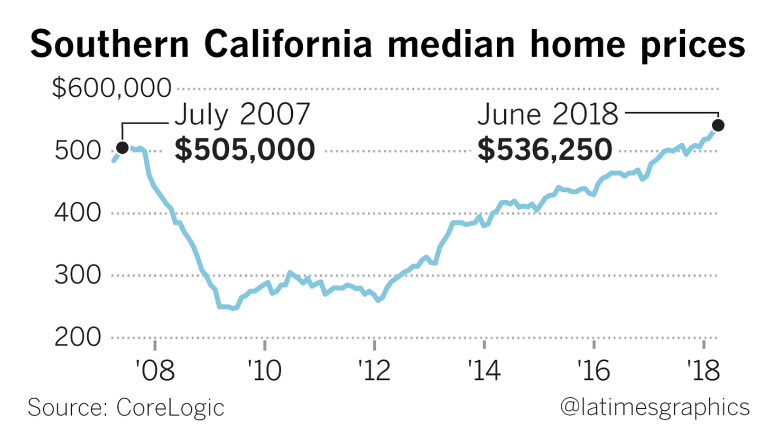

History shows that California, one of the largest housing markets in the United States, has been a reliable predictor of the nation’s housing market in general. As a result of a constriction in housing supply, home prices have been rising throughout the U.S. According to data from the National Association of Realtor, the supply of homes up for sale increased annually in June for the first time within the last three years.

Real Estate ETFs Decline

Meanwhile, if slumping sales in Southern California are indeed a barometer for real estate in general, then real ETFs responded accordingly. Three of the largest real estate ETFs with respect to total assets were down as of 2:30 p.m. ET–Vanguard Real Estate ETF (NYSEArca: VNQ) was down 0.61%, Schwab US REIT ETF (NYSEArca: SCHH) was down 0.72% and iShares US Real Estate ETF (NYSEArca: IYR) was down 0.59%.

For more ETF trends in the real estate sector, click here.