Everybody loves a comeback, but how will it actually last? Investors may find that out when it comes to value as the factor’s comeback may be starting to fizzle, according to the latest Quarterly Factor Report by FTSE Russell.

With the mad scramble to safe haven assets like bonds, precious metals and value-oriented equities in the summer, value may have just been a summertime fling for investors as September came to a close.

“The sharp rotation from Momentum to Value in September lost vigor by month-end and was not strong enough to overturn Quality, Profitability and Low Volatility leadership YTD,” the FTSE Russell report said.

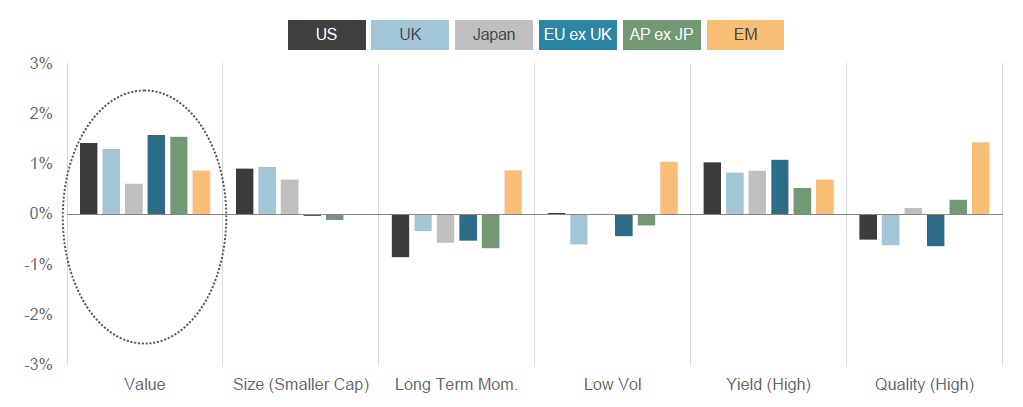

Among other factors like size, long-term momentum, low volatility, yield, and quality, value rose head and shoulders above the rest.

“In a dramatic trend reversal, Value snapped a long-running losing streak and defensive factors retreated in most markets in September, as synchronized central-bank easing and renewed trade optimism helped alleviate global growth fears,” the report noted.

The shift to value shows an apparent move to the defensive side as investors fret over global growth. Furthermore, more fears stemming from a protracted U.S.-China trade war and bond markets flashing a recession signal via inverted yield curves are also adding to the defensive shift.

“Several macroeconomic drivers have been fueling the strong outperformance of defensive stocks over their cyclical counterparts across the market cap spectrum,” said Alec Young, managing director, global markets research, FTSE Russell. ”The biggest has been widespread fears of slowing global growth, which has only been exacerbated by seemingly endless US-China trade tensions. This has led companies in defensive, counter-cyclical businesses to lead more economically sensitive stocks.”

“In addition, worries about the health of the global economy have driven interest rates to record lows around the world,” Young added. “Given that companies in defensive sectors like utilities, consumer goods, telecommunications and real estate generally sport higher dividend yields than their cyclical counterparts, falling interest rates have also helped drive defensive stock leadership.”

Can investors continue to count on value to carry them through the rest of the year? If the recent factor performance provides any clue, investors may also want to track what experts are saying regarding global growth and how interest rates will be addressed through the end of 2019.

“Investors looking for cues on better cyclical stock performance may want to focus on the outlook for global growth and the direction of long term interest rates,” Young said. “If confidence in a US-China trade breakthrough improves and interest rates head higher it’s logical to assume cyclical stock performance may become more competitive.”

For more market trends, visit ETF Trends.