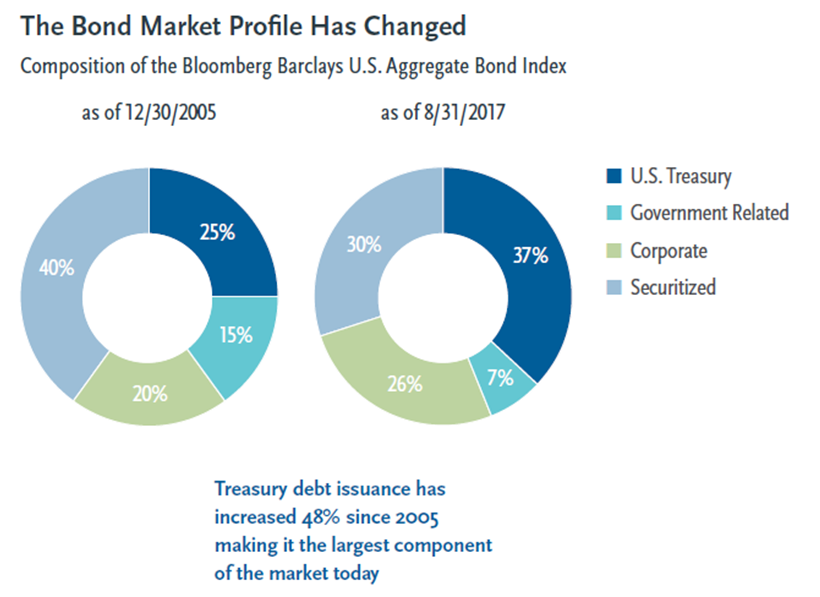

Many may not be aware that the benchmark Bloomberg Barclays U.S. Aggregate Bond Index, a primary benchmark for many bond investors and index funds, has become heavily weighted in low-yielding U.S. Treasury debt, grown less diversified and become exposed to greater interest rate risk.

Alternatively, investors may consider a growing number of smart beta or alternative index-based bond ETFs that eschew traditional market cap-weighting methodologies to provide potentially improved risk-adjusted returns.

Strategic beta ETFs are “designed to provide better risk/return profiles than market cap weighted benchmarks by assigning weights according to factors other than market cap,” Kremenstein said.

For instance, the NuShares Enhanced Yield 1-5 Year U.S. Aggregate Bond ETF (NYSEArac: NUSA) and the NuShares Enhanced Yield U.S. Aggregate Bond ETF (NYSEArca: NUAG) may help fixed-income investors take an alternative approach to bond investing.

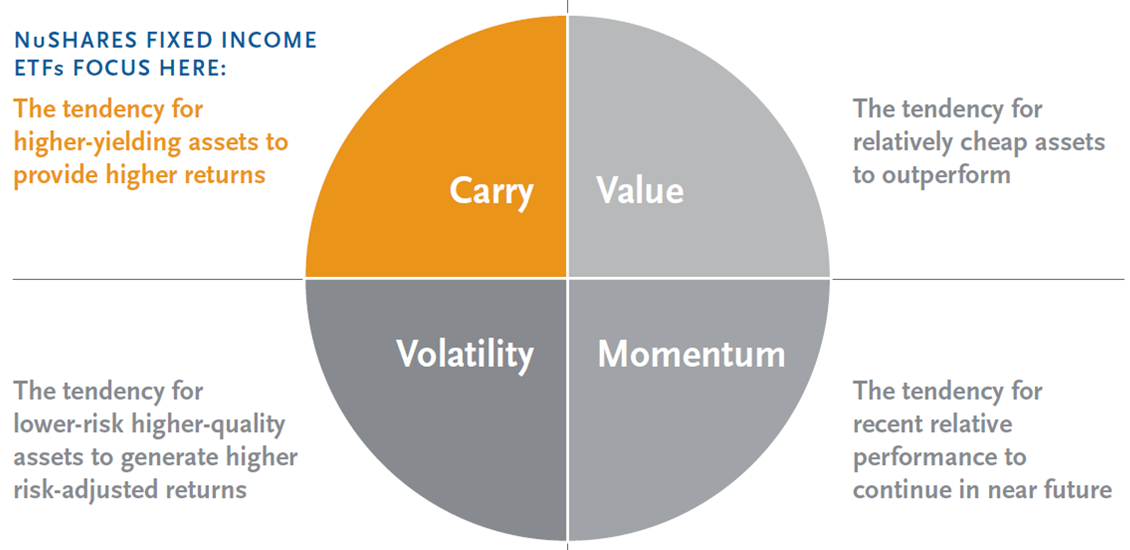

The smart beta bond ETFs weight constituents based on the tendency for higher yielding assets to provide higher returns, have the potential to provide better returns than underlying U.S. taxable investment-grade bond market with comparable levels of risk, and leverage the resources and expertise of Nuveen’s broad organization, including TIAA an experienced bond portfolio manager. Specifically, TIAA has identified four themes that may enhance risk-adjusted returns, including carry, volatility, value and momentum.

“Investors concerned with yield and credit quality can allocate to NUAG and potentially increase yield while maintaining a fully diversified investment grade bond portfolio,” Kremenstein said. “A transition from longer duration fixed income products to NUSA lowers interest rate risk while still providing a competitive yield. A 50/50 blend of NUAG and NUSA can be used to create an ‘improved’ core bond exposure.”

Financial advisors who are interested in learning more about factor and fixed-income investments can watch the webcast here on demand.