However, A-Shares aren’t necessarily the primary choice for most foreign investors. Much of the focus appears to instead be on H-Shares companies listed in Hong Kong but incorporated in mainland China—or N-Shares—which are incorporated in China but are listed on the NYSE, even though these make up far less of the overall China pie.

Why are investors overlooking A-shares?

Part of the reason is accessibility. China A-shares trade in Renminbi while other share classes trade in the local currency—which includes dollars in some cases. Meanwhile, Chinese nationals and Qualified Foreign Institutional Investors (QFII) are the only investors allowed to buy A-Shares; the other classes do not suffer the same restrictions. Another aspect to consider is that H-Shares and N-shares can often contain some of the few household names, providing an element of comfort to foreign investors.

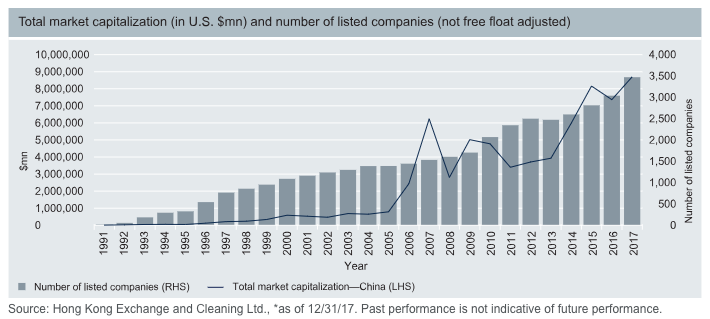

However, recent changes have opened up this once-closed off market. China is slowly increasing the quota of A-shares available to foreign investors. And as it has become easier to tap into these stocks, we are seeing notable growth in terms of both market capitalization and the number of listed companies.

![]()

This may just be the tip of the iceberg, as China looks poised to continue its economic liberalization, potentially signaling even easier A-share access in the future. Furthermore, with the growth we’ve already seen in the A-shares market, it is becoming increasingly difficult to deny their importance in obtaining complete China exposure. MSCI and other index companies are looking to either include Chinese A-shares in their benchmarks or boost the percentage that this class makes up in indexes. That is likely to increase demand by institutional and index-based investors as more capital is allocated to this market by passive investors.

Bottom Line

China is a unique market. Its myriad of share classes can be quite intimidating to the average investor, but there are several reasons to focus on A-shares right now. The growth in this historically restricted corner of the market has been tremendous. Not only is interest rising as the market opens up and grows, but A-shares help to complete the puzzle that is China investing, offering exposure to mainland companies that are simply not included in other China-centric benchmarks. So, if investors are looking for China exposure, there is no sense in limiting oneself to half the market anymore; A-shares can’t be ignored if one wants to see the complete China investing picture.

Now that you have the basics, make sure to check out my colleague Rob Bush’s article on Advanced China ETF Investing.