Once again in 2019, growth stocks are outperforming value stocks to the tune of 7.6% year-to-date. However, this trend of outperformance for growth investors may not be sustainable if history repeats itself. This blog examines the 1, 3, 5, and 10-year excess performance of the Russell 1000 GrowthRussell 1000 GrowthRussell 1000 Growth over the Russell 1000 ValueRussell 1000 Value Total Return Indexes when the relative valuation of growth versus value reached current levels in the past.

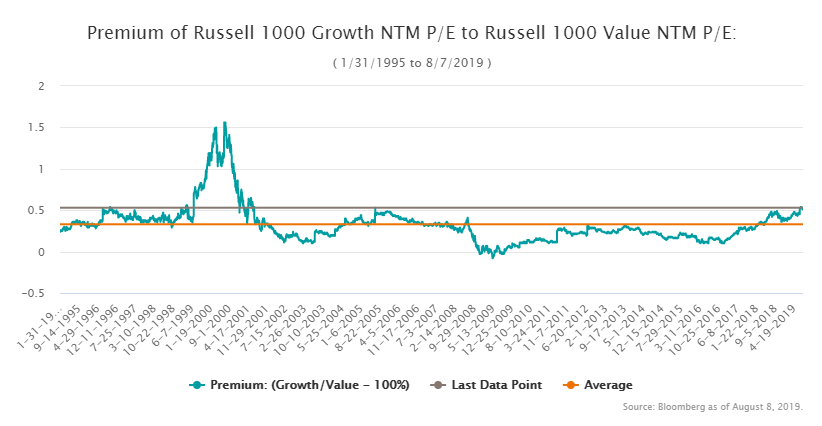

Right now, the growth to value premium stands at roughly 52.9%. This is a high number by historical standards and is more than 20% above its 25-year average. In fact, the growth/value premium only reached or exceeded its current level relatively few times since early 1995, and not once in the past decade.

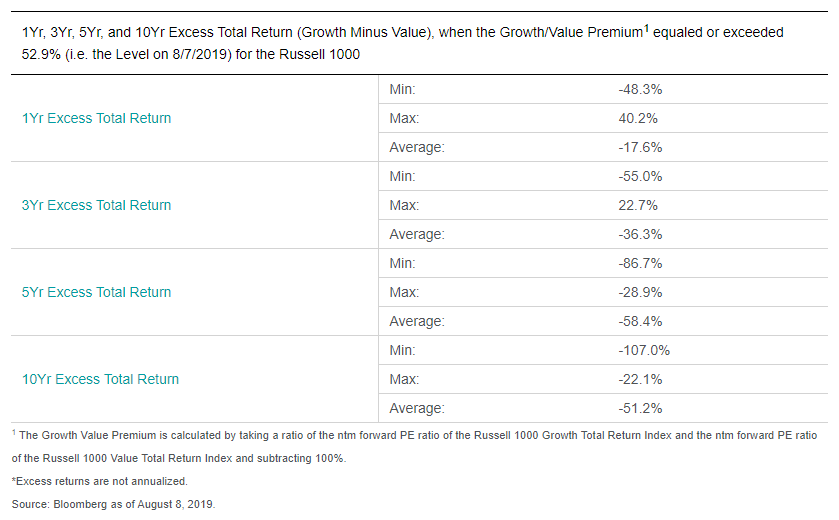

Historically, when the premium exceeded today’s level, subsequent excess total returns (i.e. Russell 1000 Growth Total Return Index minus Russell 1000 Value Total Return Index) have always been negative on average on a 1, 3, 5 and 10-year basis.

It is difficult to predict when a bubble will burst, and expensive stocks can get more expensive. In fact, our analysis shows that there have been situations where investors have bought growth at this level and still managed to make an additional 40% on a one-year rolling basis in the period 1/31/95 to 8/7/19. However, those investors would have needed to get out fast because this 40% was merely the maximum return seen within a short, one-year investment horizon, while the average return over the same period was -18% and the minimum was a loss of -48%. Over longer time frames, the historical figures look even worse. Investors that held growth for 5 and 10 year periods, after the growth value premium reached current levels, always experienced significant cumulative negative excess returns in growth stocks relative to value stocks on average.

In conclusion, when the growth value premium breached current levels, historical evidence suggests that some investors were able to capitalize on the current trend by favoring growth over value in specific, well-timed, short-term investment horizons. However, on an average basis, and also over the long term, such an investment strategy has typically led to losses.