As ETFs get longer in the tooth, more investors are understanding how certain strategies work, especially when it comes to smart beta funds—as evidenced by the latest data by ETFGI that these products gathered $9.72 billion in assets globally during the month of November.

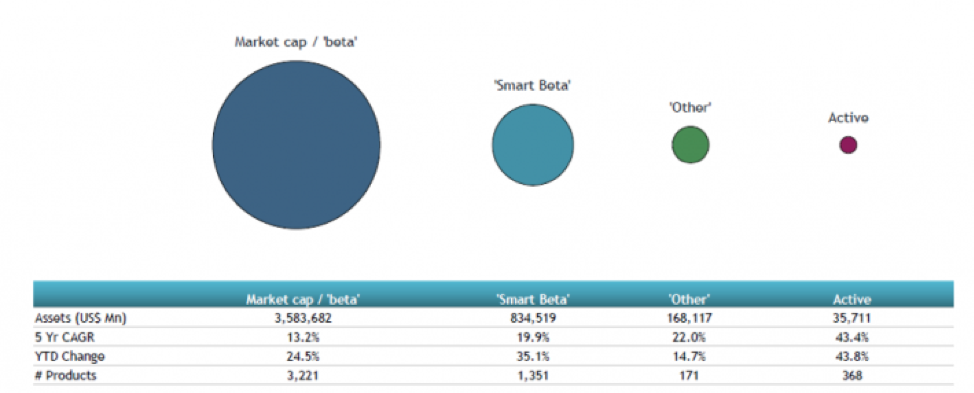

“ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that equity-based Smart Beta ETFs and ETPs listed globally gathered net inflows of US$9.72 billion during November,” a Nasdaq report noted. “Year-to-date through to the end of November 2019, Smart Beta Equity ETF/ETP assets have increased by 35.1% from US$618 billion to US$835 billion, with a 5-year CAGR of 19.9%, according to ETFGI’s November 2019 ETFs and ETPs Smart Beta industry landscape insights report, an annual paid-for research subscription service.”

“At the end of November 2019, there were 1,351 smart beta equity ETFs/ETPs, with 2,530 listings, assets of $835 billion, from 167 providers on 41 exchanges in 33 countries,” the report added. “Following net inflows of $9.72 billion and market moves during the month, assets invested in Smart Beta ETFs/ETPs listed globally increased by 4%, from $803 billion at the end of October 2019 to $835 billion.”

Lower Fees, More Education Can Bolster Smart Products

Smart beta is gaining more traction in the capital markets and in order for that to continue, it will have to be a two-punch combination of lower fees and education that will drive more awareness moving forward.

“There are probably several drivers behind increased adoption, but I think the elephant in the room is lower fees,” said Bernie Nelson, chief research advisor at Style Analytics, in Pensions & Investments. “Most smart beta and factor products are being positioned between traditional active and very low-cost, nondiscretionary passive, in terms of fees as well as active risk. From a fiduciary perspective, there has to be an obligation to examine whether a lower-fee product could provide an appropriate investment solution.”

Fees, alone, don’t represent the sole driver for smart beta adoption. More education on these smart beta strategies is making investors more aware of what their uses in a portfolio.

“If you go back 20 years, the strategies that are today called risk premia or alternative beta strategies were the inherent ingredients of a hedge fund,” said Oliver Schupp, Head of Investor Relations, North America at Capital Fund Management (CFM). “It could be long/short value and momentum investing in equities, it could be merger arb, it could be trend following, or it could be harvesting volatility. Those were hedge fund strategies for which investors happily paid 2 and 20. What I think happened is that these strategies have been researched well and therefore made essentially public. That’s my rationale for why these strategies have been repriced so dramatically, as they have been. “

For more market trends, visit ETF Trends.