Blockchain, cannabis, and dividend yields are a few of the top-performing sectors in the actively-managed space from ETF providers Amplify and Cambria.

Blockchain Tops the List

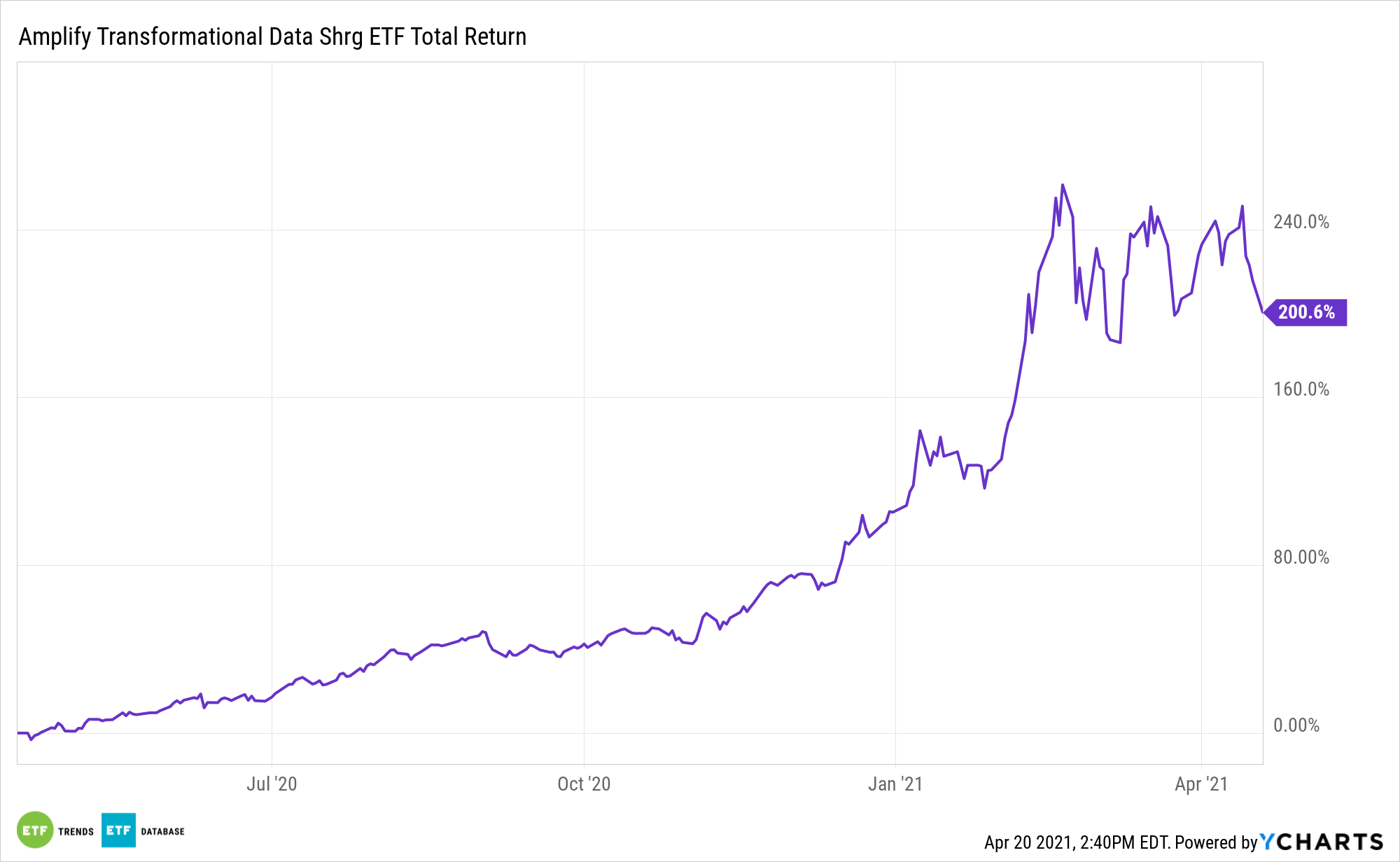

As cryptocurrencies continue to see interest from investors large and small, institutional and non-institutional, so are their underlying technologies: blockchain. This is helping active funds like the Amplify Transformational Data Sharing ETF (BLOK).

BLOK seeks to provide total return by investing at least 80% of its net assets (including investment borrowings) in the equity securities of companies actively involved in the development and utilization of transformational data sharing technologies. It may invest in non-U.S. equity securities, including depositary receipts.

“Instead of investing directly in volatile digital currencies, BLOK looks for companies that are involved in the development and utilization of blockchain technology,” an ETF Database analysis said. “BLOK’s portfolio includes well-known U.S. stocks like Microsoft, Google-parent Alphabet, and IBM, alongside Japanese internet firm GMO Internet and Chinese online retailer JD.com.”

Cannabis and Dividend Yields

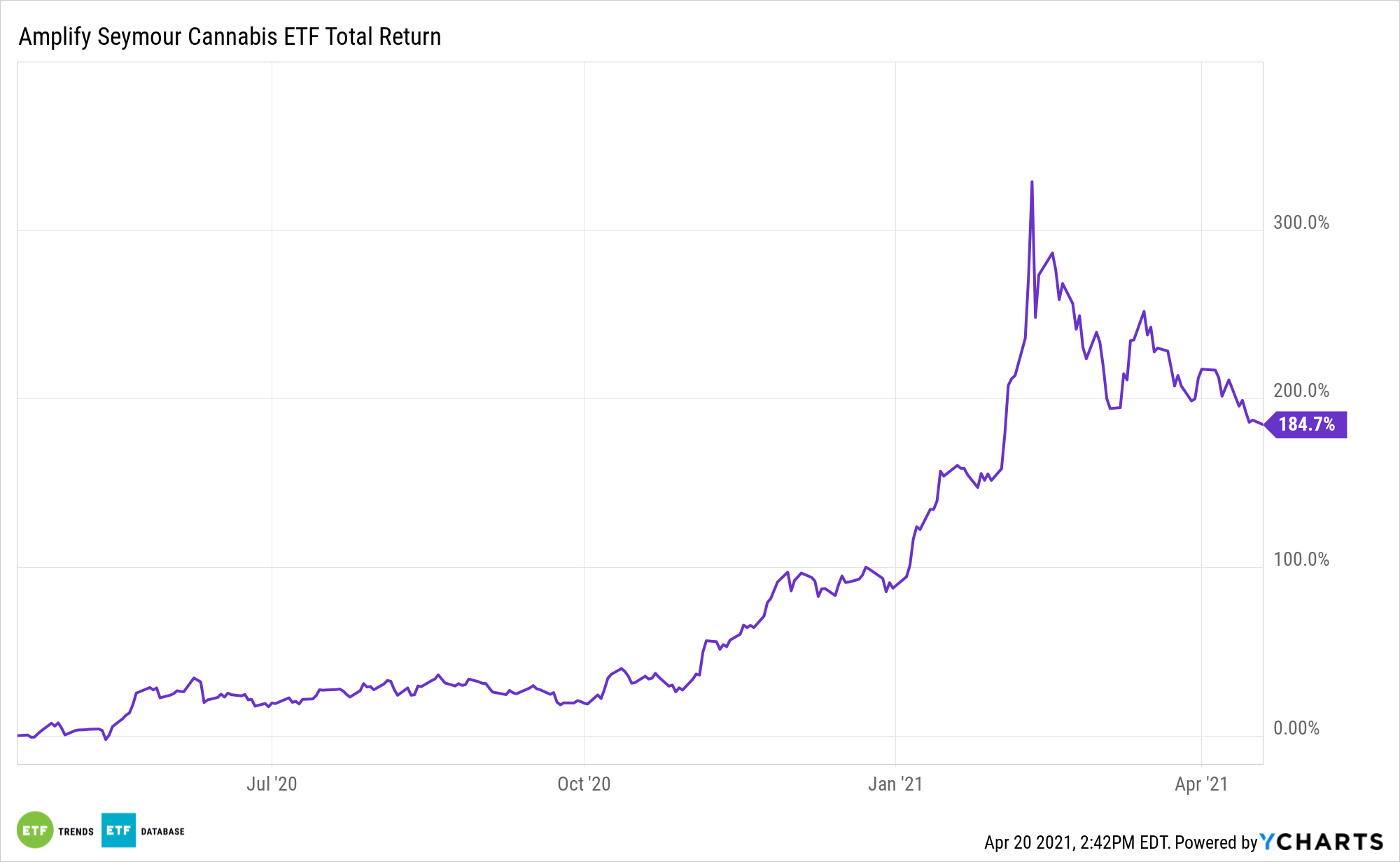

Cannabis is not too far behind blockchain with the Amplify Seymour Cannabis ETF (CNBS). CNBS seeks to provide investment exposure to global companies principally engaged in the emerging cannabis and hemp ecosystem across one of three classifications.

CNBS capitalizes on:

- Consumer Demand: Worldwide consumer spending on legal cannabis was $21.3 billion in 2020, up 48% (from $14.4 billion) in 2019.

- Legalization: Currently legal in some form in 47 US states and 21 countries, with more anticipated to come.

- Medical Use: Over 100 naturally occurring compounds – cannabinoids – are found in the cannabis plant. Currently three FDA-approved drugs exist that incorporate cannabis compounds; however, research into other use and application cases is dramatically increasing.

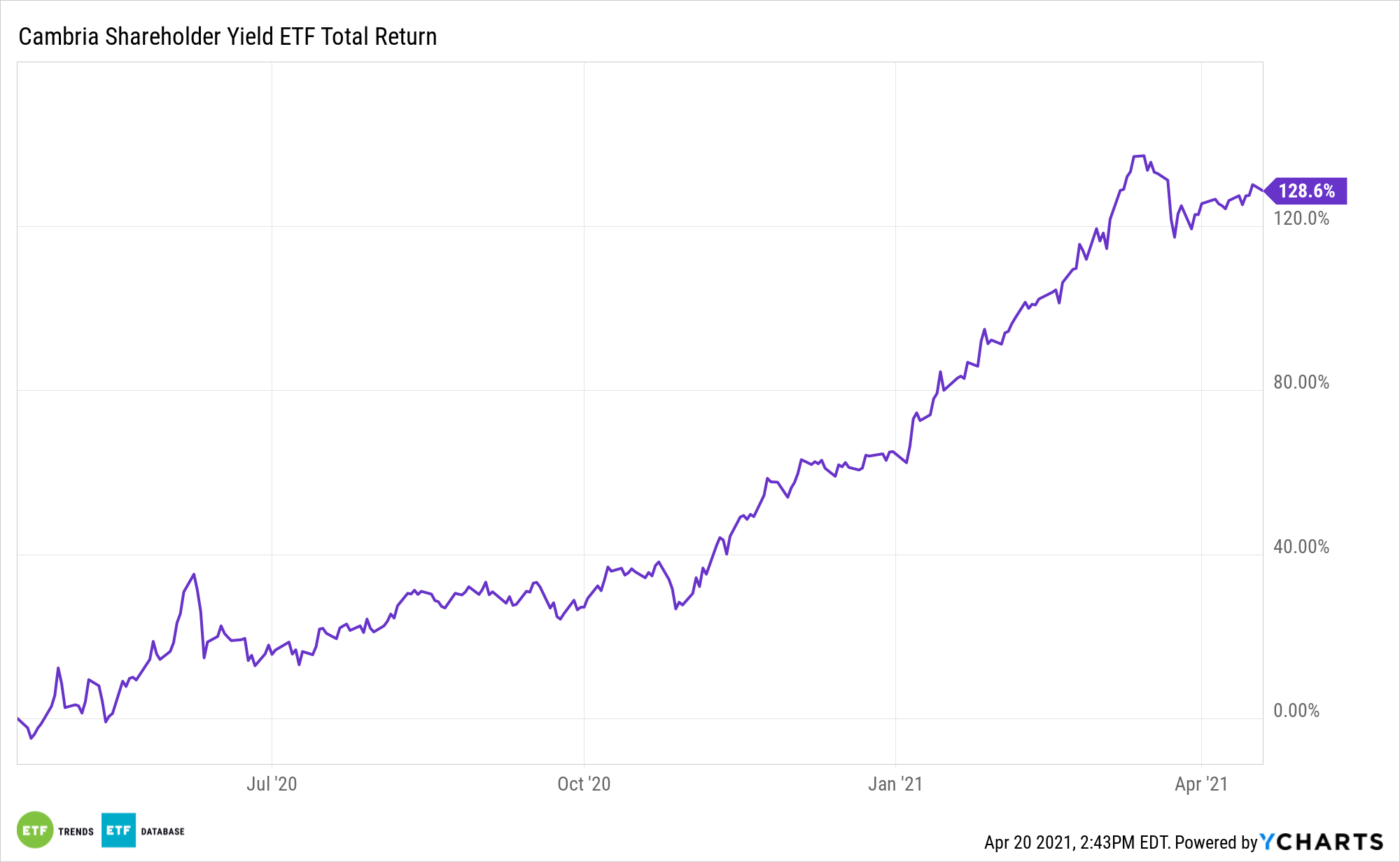

Lastly, the Cambria Shareholder Yield ETF (SYLD) seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its total assets in equity securities, including common stock, issued by U.S.-based publicly listed companies that provide high “shareholder yield.” Its investment adviser, Cambria Investment Management, L.P., defines “shareholder yield” as the totality of returns realized by an investor from a company’s cash payments for dividends, buybacks, and debt paydowns.

SYLD utilizes a quantitative approach to invest in U.S. equities with high cash distribution characteristics. The initial screening universe includes stocks in the United States with marketing capitalizations over $200 million.

The ETF is comprised of the 100 companies with the best combined rank of dividend payments and net stock buybacks, which are the key components of shareholder yield. The ETF also screens for value and quality factors, including low financial leverage.

For more news and information, visit the Smart Beta Channel.