By Rob Bush, Deutsche Asset Management

One of the key differences between factor investing and other types of investing is that factors are not mutually exclusive. With equities, for example, a stock is either German, or French, or Japanese, but never all three. Within sector classifications, a stock can either be in the Information Technology sector, or in the Financial sector, but never in both. So, put simply, a stock’s geographic allocation, and its sector allocation, are completely distinct.

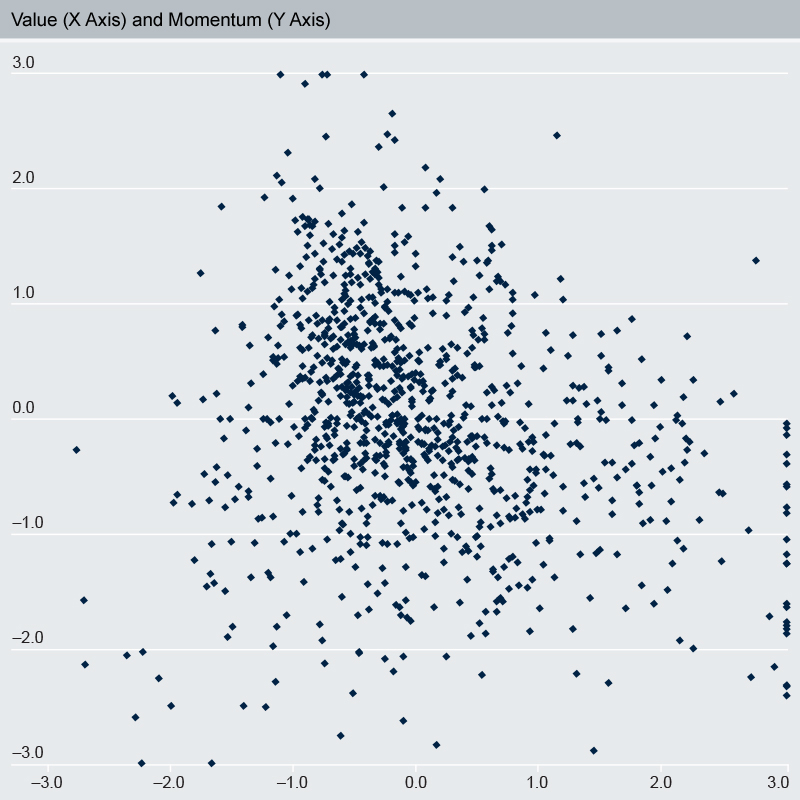

However, this is not true of factors. In the factor world, a stock can exhibit both value and momentum; or it can exhibit quality and low volatility and size. Just because it has one characteristic doesn’t necessarily preclude it from having another (though there are limitations – sometimes one factor is defined as the opposite of another – for example value and growth – and now of course, the ability to belong to both categories is lost).

But the fact remains that, with many factors, which define stocks across suitably different parameters, stocks can have multiple features. Investors can, if they so desire, both have their cake and eat it too (i.e. both have their value and their momentum – eating them is inadvisable).

Given this distinction therefore, here is a suggested three-step framework for determining the “right” number of factors (“right” is in quotation marks because it is ultimately a subjective decision):

- Identify those factors that you believe in, and to which you want exposure.

- Satisfy yourself that they are complementary (i.e. not philosophical or definitional opposites that might net off, like value and growth), and that pairs amongst them are not so highly correlated that including both would be unnecessary.

- Think hard about the methodology for combining them.

In past blogs we have discussed the first and last parts of this framework and will feature more on the subject in future blogs so, for now, let’s focus on the un-correlated nature of various factors.

Five well known, empirically-tested, factors with strong heritage are; value, size, momentum, quality and low volatility. To get a sense of how stocks can look across each pair of these factors (ten permutations), we did the following. First, we took the Z-score for each factor that FTSE Russell assigned to each stock in the Russell 1000. This is just the standardized raw score for each factor, so the higher the better. Then, we simply produced scatter plots of each pair-wise combination of these scores. Two of the resulting charts are shown below.