ETF Trends caught up with Linda Zhang, CEO/CIO of Purview Investment, to discuss the latest happenings in ESG investing.

1. Why do you think ESG ETFs Tested Well Against the Market During the Recent Volatility?

Environmental Social and Governance focused ETFs have attracted more attention this year for both asset growth and their performance. Based on the ESG ETF database compiled by Purview Investments, the total AUM for US listed products has grown to $27.5 billion, as of May 19, 2020, a 60% growth YTD. The largest ESG product has gathered over $6 billion, with eight products each over $1 billion. This is far from the beginning of 2019, when there was only a single $1 billion product. The performance of this category has shown resilience. Both MSCI and S&P have reported that their suite of ESG indices have outperformed their traditional counterparts. According a recent study by Morningstar, over 70% of the sustainable funds in US equities are in top two quartile of all US equity funds.

The pandemic crisis has in many ways pushed ESG issues to the front and center. For example, carbon intense industries such as airline and cruise lines took a direct hit as global travels were brought to a halt. Environmental damaging energy and coals industry also saw demand destruction from a pause on economic activities.Investors also took notice how firms handle employee’s safety and job security.

Overall, ESG ETFs tend to avoid companies with high exposure to environmental, regulatory, operational risks and controversies. These attributes offer companies a competitive edge in the long run, and were critical in weathering extreme storms in the capital markets as well. The broad benefit of ESG can be seen a Morningstar study that attributed the outperformance of sustainable funds to the security selection across sectors, rather than underweighting the energy sector.

2. Why Do You Think Active Management Matters for Differentiation in ESG Investments?

Currently, the largest ESG ETFs are mostly passive in nature, tracking similar ESG indices. They offer little product differentiation. Most of these indices are designed to track the performance of non-ESG counterpart by staying close on sector exposure, risk and return characteristics, while having better ESG characteristics. These ESG products typically have large number of holdings. Some products include highly polluting fossil fuel and material firms, in order to ensure close tracking to the performance of non-ESG counterpart.

This leaves room for an actively managed product that can really focus on both ESG impact and investment performance. I applaud the efforts by many ESG research firms such as MSCI, S&P Global, Sustainalytics, ISS, to name a few. They deepen our understanding of materiality of ESG issues to company performance. These firms may differ in their ESG ratings for the same company. In my view, that is perfectly normal, just as sell-side firms often disagree on price targets for the same company. In an actively managed product, ESG ratings is just a starting point of investment analysis, not the end decision point for investment choices. It would be beneficial to blend passive products with active ones in one’s portfolio for potential enhanced ESG impact and investment approach diversification.

3. Are ESG products for ESG conscious investors only?

I have to say this is a big misconception. ESG product is not just for ESG conscious investors at all. ESG investing is about investing after all. It is about incorporating perspectives and information previously thought irrelevant or unattainable. It can be a good fit for any investor, ESG inclined or not, who look for managers with a differentiated approach to investing. The last thing one wants to see in his or her portfolio is that every manager has the same approach and same return patterns. Manager diversification is just as important as portfolio diversification.

4. What are the long-term themes in ESG are you most excited about?

We have identified many key industry transition trends reflective of ESG movements, such as alternative energy, efficient usage of energy and resources, efficient transportation, reduced needs for transportation by getting goods online and services via streaming, work/life balance through work from anywhere, healthy living with plant based and less meat based food, equitable workplace and society, to name a few. Let me elaborate on a few such long-term trends and investment thesis.

Corporate culture of work from anywhere. The global pandemic has expedited a shift in corporate culture of flexible work hour. The work from home is likely to stay in some forms even after the pandemic. In fact, Twitter and Square just announced permanent WFH policy. This trend is consistent with a move in the corporate culture towards a better work/life balance, operational efficiency, less road congestion and less pollution. Companies providing the enabling technology are likely to benefit from this long-term trend

E-commerce and streaming services. The global pandemic also pushed the trends of consumption of good and services online vs in stores and facilities. We anticipate more people will form and keep the habits of ordering goods online, streaming movies, play e-sports, practice yoga, take cycling classes right at home beyond the pandemic, and for years to come. Companies specialize or with large presence in e-commerce, contents streaming will likely to benefit in the long run.

Three Revolutions in transportation industry. Auto industry has been experiencing three stages of revolutions: Electrification, Ride sharing, autonomous driving. Companies who are early adopters and leaders in these transitions are likely to win in the long run.

Alternative energy. There have been global shifts away from fossil fuels to much cleaner solar, wind and other alternative energy. Oil and coal companies are facing high regulatory risks, investor backlash, declining demand, stranded asset risk and risk of share mispricing. Solar and other alternative energy continue to grow in its adoption with competitive pricing. Alternative energy firms have shown resilience and it is likely to continue for the long run.

5. TrueMark launched ECOZ on March 2, sub advised by your firm Purview Investments, what makes it unique and why do you think it’s well positioned?

I am excited for Purview to collaborate with TrueMark Investments on offering a differentiated product on many fronts. ECOZ is a rare transparent active ETF. ECOZ is a more concentrated portfolio around 75 names for bigger impact and performance differentiation, while remain sector balanced.

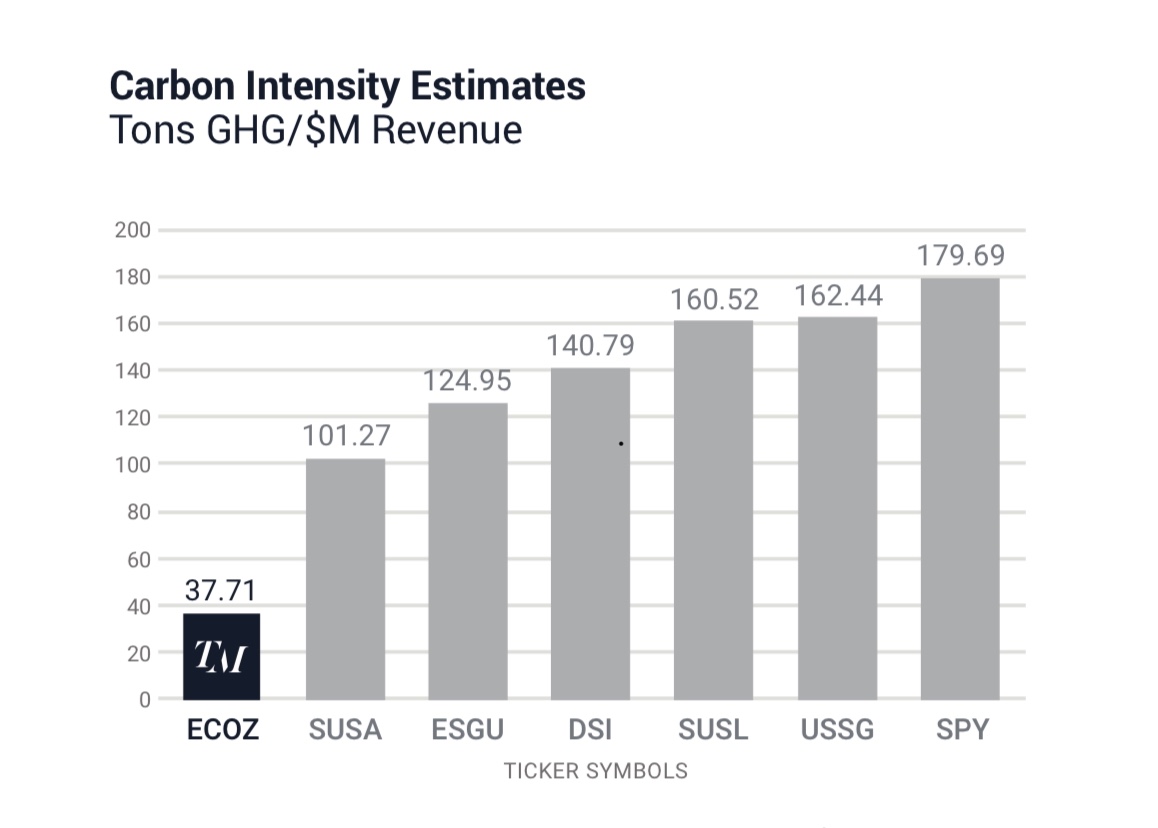

A key differentiator is the environmental resilience. ECOZ drastically lowers the portfolio carbon footprint. Its carbon intensity is at 37 tons per million-dollar revenue, a nearly 80% reduction compared to a broad market index ETF, SPY and much lower than leading US equity ESG ETFs. (See chart below and more details on subject from my white paper published on https://www.true-shares.com/resource)

Since carbon intensity is a key selection criterion, fossil fuel firms such as oil and coal companies, airlines and cruise lines don’t make to ECOZ. It is likely to remain the case unless fossil fuel companies take radical measures to either change their revenue mix, and airline and cruise lines drastically improve fuel efficiency and participate in carbon neutral programs.

Data source: Bloomberg and TrueMark, as of March 31, 2020, based on most recently available data.

Data shown reflects weighted-average data for underlying portfolio holdings.

Our ESG investment framework is unique. We start with identifying key industry transitions toward a low-carbonized economy and other ESG consistent trends, as mentioned previously. We analyze key opportunities and risks in those transitions, focusing on ESG issues unique and material to that industry. We dive deep into companies to seek champions and likely champions in those industry transitions. A firm may have good ESG ratings. Yet if it lags in key industry transitions, it might not make it to our portfolio.

Furthermore, we also go through investment profile assessment. A firm with a fine ESG appeal might not necessarily make to ECOZ due to a weak investment prospect. This is a clear departure from leading ESG ETFs, where ESG considerations are the only criteria.

ESG perspective and information are relatively new and less explored in the asset management investment community. I believe that ECOZ’s approach to active research with ESG narratives, combined with investment analysis, offers a staying power of differentiation.

Disclosure: Linda Zhang is CEO/CIO, Purview Investments, a company specialized in low-carbon and ESG investing. Purview is a subadvisor for ECOZ, TrueMark ESG Active Opportunities, launched on March 2, 2020. Purview also offers global multi-asset strategies to clients using low-carbon and ESG ETFs. The views expressed here do not serve as investment advice, and are merely for research and public education purposes.